Discover the secrets to unlocking financial success with Exchange-Traded Funds (ETFs) in our comprehensive guide on how to make money in ETFs. Learn the ins and outs of this lucrative investment strategy as we delve into the world of ETFs, exploring the various types available and the top strategies for maximizing your returns. Your journey to financial freedom starts here as we equip you with the knowledge and tools needed to turn your investment portfolio into a profit-generating powerhouse. Don’t miss out on this opportunity to capitalize on the growing popularity of ETFs and secure your financial future today!

Long-term investing: One of the simplest ways to make money with ETFs is through long-term investing

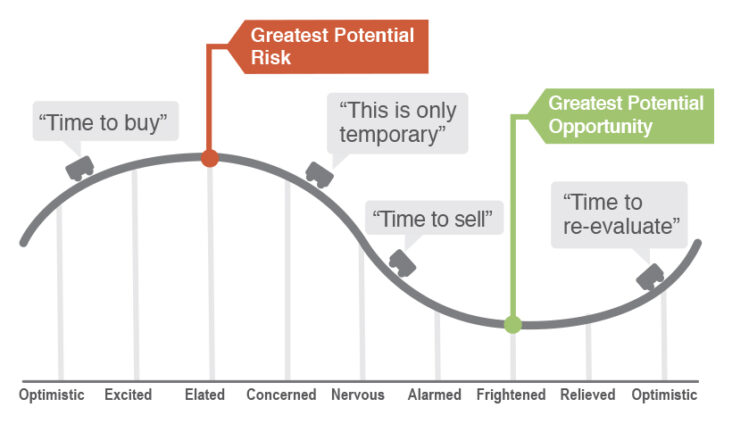

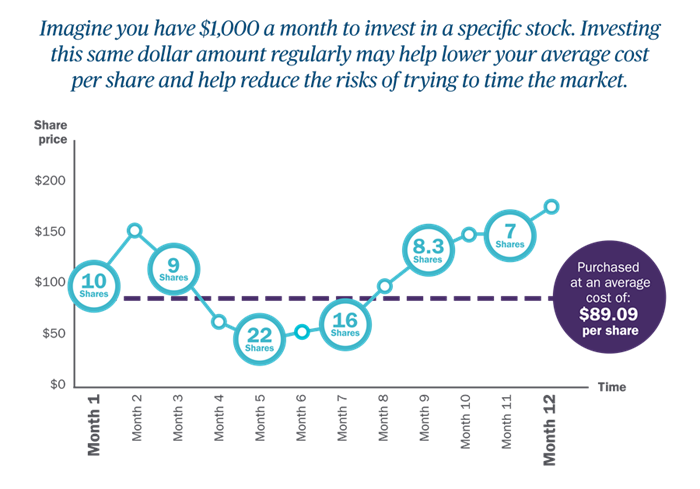

Long-term investing in ETFs is a proven strategy for generating wealth over time, as it allows investors to benefit from the power of compounding returns and reduced risks. By selecting a diversified mix of ETFs that track different sectors, geographical regions, or asset classes, investors can achieve steady growth and minimize market volatility. Additionally, long-term investing enables individuals to take advantage of dollar-cost averaging, which involves consistently investing a fixed amount of money over time, irrespective of market fluctuations. This approach not only simplifies decision-making, but also helps in accumulating more units when prices are low, ultimately leading to higher gains when markets recover. Embrace a patient, disciplined approach to ETF investing to reap the rewards of consistent, long-term growth.

By selecting a well-diversified ETF that tracks a broad market index, you can potentially earn a return on your investment over time as the market grows

By strategically choosing a well-diversified ETF that closely tracks a broad market index, investors can potentially reap the benefits of market growth over time. A diversified ETF minimizes risk by spreading investments across multiple sectors and industries, ensuring that a single stock’s poor performance does not significantly impact the overall portfolio. This approach aligns with the time-tested principle of “buy and hold,” where investors can capitalize on long-term market expansion without constantly monitoring individual stocks. By targeting a wide-ranging index, such as the S&P 500, these ETFs provide an optimal avenue for investors to generate passive income and steadily grow their wealth.

This approach is ideal for those who are not interested in actively trading and want to minimize risk.

This passive investment strategy is perfect for individuals seeking a hands-off approach to making money in ETFs, while effectively reducing risk. By focusing on long-term growth and diversification, you can capitalize on the potential of various market sectors, without worrying about day-to-day market fluctuations. Opting for low-cost, broad-based ETFs that track major indices can further contribute to steady returns, while keeping expenses at a minimum. Additionally, implementing a dollar-cost averaging method by consistently investing a fixed amount over time can help mitigate the impact of market volatility and enhance your overall portfolio performance. Embrace this efficient, stress-free approach to ETF investing and watch your wealth accumulate over time.

Trading ETFs: Active traders can make money by buying and selling ETF shares on a short-term basis

Active traders can capitalize on the potential to generate profits through short-term buying and selling of ETF shares. This trading strategy, often referred to as “swing trading,” can help traders take advantage of market fluctuations and price movements in specific sectors or industries. By carefully analyzing market trends, technical indicators, and economic data, traders can identify lucrative entry and exit points for various ETFs. This approach requires constant monitoring and a disciplined mindset, but it can yield significant returns if executed correctly. Additionally, the inherent diversity of ETFs can provide traders with exposure to a broad range of investment options, reducing the risk associated with individual stocks.

This can involve identifying trends and using technical analysis to predict price movements

One effective approach to generating income through ETFs is by recognizing market trends and leveraging technical analysis to forecast price fluctuations. By meticulously examining historical price data, trading volume, and various technical indicators, you can identify emerging patterns and make informed decisions about when to enter or exit positions. This analytical method is particularly useful for investors focusing on short-term trading strategies, such as swing trading or day trading. By honing your technical analysis skills and staying abreast of market trends, you can potentially capitalize on lucrative opportunities in the ETF landscape, ultimately boosting your overall investment returns.

Trading ETFs allows you to profit from both rising and falling markets, as you can buy (go long) on an ETF you expect to appreciate in value, or sell (short) an ETF you

Trading ETFs provides a lucrative opportunity for investors to profit in diverse market conditions, whether they’re rising or falling. By strategically buying (going long) on an ETF that’s anticipated to increase in value, or selling (shorting) an ETF that’s expected to decline, investors can maximize their earnings. This versatile approach offers flexibility and adaptability, as it allows for adjustments in response to market fluctuations. Additionally, trading ETFs reduces the risk of losses, as it diversifies your investment portfolio across various sectors and industries. In essence, incorporating ETFs into your trading strategy can enhance overall profitability while mitigating potential risks.