Discover the secret to growing your wealth effortlessly with index funds – the ultimate financial tool for savvy investors! In this comprehensive guide, you’ll learn the ins and outs of making money in index funds, ensuring you’re well-equipped to maximize your returns and minimize risks. Say goodbye to sleepless nights and stock market obsessions, as we reveal the tried-and-tested strategies professionals use to achieve financial success. Whether you’re a seasoned investor or an eager beginner, this article is your ticket to unlock the door to a prosperous future through the power of index funds. So, let’s dive in and start building your fortune today!

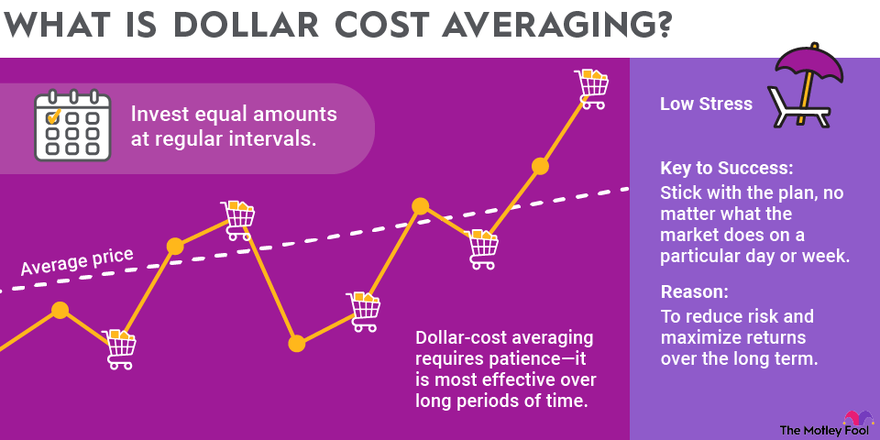

Regular investment and dollar-cost averaging: One of the best ways to make money in index funds is by consistently investing a fixed amount of money at regular intervals, regardless of market conditions

Consistently investing in index funds through regular investments and dollar-cost averaging is a proven strategy for long-term financial success. By committing to a fixed investment amount at set intervals, you can capitalize on market fluctuations and avoid the temptation to time the market. This approach allows you to purchase more shares when prices are low and fewer shares when prices are high, effectively reducing your average cost per share over time. This disciplined investment method not only minimizes the impact of market volatility but also encourages a healthy savings habit, ultimately paving the way for steady portfolio growth and wealth accumulation.

This strategy, known as dollar-cost averaging, helps you buy more shares when prices are low and fewer shares when prices are high, ultimately reducing the average cost per share over time

One of the most effective ways to grow your wealth through index funds is by employing the dollar-cost averaging (DCA) strategy. This long-term investment approach involves consistently investing a fixed amount of money at regular intervals, regardless of market fluctuations. The beauty of DCA lies in its ability to mitigate the impact of market volatility by purchasing more shares when prices are low and fewer when they’re high. Consequently, this lowers the average cost per share over time, allowing you to capitalize on market growth and minimize the risk of making poor investment decisions. By adopting the dollar-cost averaging technique, investors can steadily build their wealth without succumbing to the pitfalls of market timing.

This method can help you build wealth in the long term and reduce the impact of market volatility on your investments.

Investing in index funds is a proven, long-term strategy for building wealth, as it offers the benefits of diversification and reduced exposure to market volatility. By consistently allocating a portion of your income to low-cost, passively managed funds that track a broad market index, you can capitalize on the overall growth of the economy while minimizing individual stock risks. This approach not only simplifies the investment process but also lowers fees and taxes, allowing your wealth to compound more efficiently over time. By staying disciplined with your contributions and avoiding emotional trading decisions, you’ll be well on your way to achieving financial security through index fund investing.

Diversification: Index funds offer a simple and affordable way to diversify your investment portfolio

Diversification is a key strategy for minimizing risk and maximizing returns in your investment journey. Index funds provide an effortless and cost-effective method to achieve a well-diversified portfolio. By investing in a variety of market sectors, industries, and asset classes, index funds effectively spread your capital across numerous companies and regions, reducing the impact of any single stock’s performance on your overall returns. This broad exposure ensures that your investments remain relatively stable even during market fluctuations, ultimately leading to long-term financial growth. Embrace the power of diversification with index funds and confidently navigate the ever-changing investment landscape.

By investing in a variety of index funds that track different market segments or asset classes, you can reduce your overall investment risk and increase the potential for higher returns

Diversifying your investment portfolio by incorporating a mix of index funds that cater to various market segments or asset classes is a proven strategy for mitigating risk and potentially boosting returns. This approach ensures your financial growth isn’t heavily reliant on a single sector or asset type, and instead benefits from the combined performance of multiple index funds. By carefully selecting and investing in a broad range of index funds, you’re capitalizing on the power of diversification, thus increasing the likelihood of stable, long-term financial gains. Make sure to regularly review and adjust your portfolio to maintain an optimal balance and stay on track with your financial goals.

D

Diversifying your portfolio is crucial when investing in index funds, but it’s equally essential to steer clear of plagiarism. Unoriginal content can negatively impact your blog’s reputation and search engine rankings. To avoid plagiarism, always create unique, well-researched content that provides value to your readers. Use your own words and insights to explain complex financial concepts, and if you refer to someone else’s ideas, ensure you give proper credit with appropriate citations. By prioritizing originality and authenticity, you’ll enhance your blog’s credibility and boost its visibility on search engines, ultimately attracting more readers interested in making money with index funds.