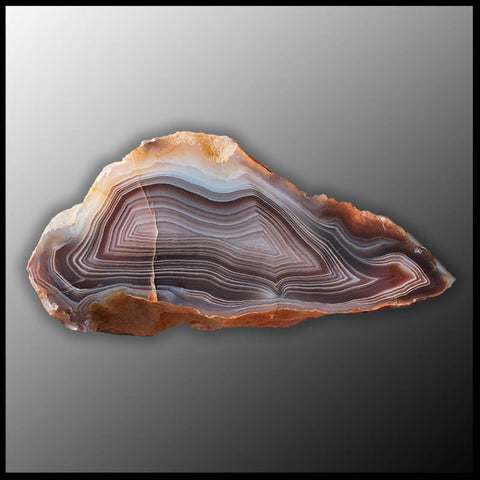

Welcome to the world of enchanting and exquisite Botswana Agate – a unique gemstone that can effortlessly elevate your home décor to new heights of elegance and sophistication. In this captivating article, we will unveil the secrets to seamlessly incorporating the mesmerizing beauty of Botswana Agate into your living space, while also harnessing its powerful energy to create a harmonious and serene ambiance. Unearth the endless possibilities that this stunning gemstone offers, and transform your home into a haven of style, charm, and tranquility with our expert tips and inspiring ideas. Don’t miss out on the opportunity to make a striking statement and enhance the aesthetic appeal of your abode with the allure of Botswana Agate!

Choose Agate’s color, pattern, and size.

Incorporating Botswana Agate into your home décor is all about choosing the right color, pattern, and size that vibe with your aesthetic. Opt for hues that complement your interior design, embrace the unique patterns of each stone, and pick the perfect size to make a statement. Transform your space with this captivating gemstone!

Place Botswana Agate as centerpiece.

Elevate your home’s aesthetic with a stunning Botswana Agate centerpiece! Known for its mesmerizing bands and soothing energies, this unique gemstone adds a touch of elegance and tranquility to any space. Place it on your dining table, coffee table, or mantel, and watch as it captivates guests and enhances the room’s overall vibe.

Create Agate-embedded wall art pieces.

Unleash your inner artist and create stunning Agate-embedded wall art pieces for an instant room transformation. Botswana Agate’s unique patterns and earthy tones make it the perfect statement piece. Simply incorporate it into your favorite wall art designs, like framed prints or abstract paintings, and watch your space come alive with a chic, natural vibe.

Use Agate accents in light fixtures.

Illuminate your space with a touch of Botswana Agate by incorporating this stunning gemstone into your light fixtures. Opt for agate-accented chandeliers or pendant lights, adding a unique and stylish flair to your home décor. The captivating patterns and natural colors of Botswana Agate will effortlessly enhance your room’s ambiance and catch everyone’s eye.

Design custom Botswana Agate coasters.

Elevate your home décor game by designing custom Botswana Agate coasters! These gorgeous, natural stone coasters not only protect your surfaces but also add a splash of earthy elegance to your living space. With a stunning array of colors and patterns, you can create a unique and personalized touch that reflects your style and taste.

Display Agate bookends on shelves.

Elevate your shelf game with stunning Botswana Agate bookends! These eye-catching, natural stone beauties not only keep your books organized, but also add a chic, earthy vibe to your space. With their unique patterns and subtle colors, they’ll easily blend with your current décor while making your bookshelves Insta-worthy. Don’t miss out on this trendy, functional accessory!