If you’re like me and you’re 18 years old and trying to get out of financial trouble, you know how hard it can be to manage your debt. You might feel overwhelmed and like you don’t know where to start. Don’t worry – I’m here to help! In this article, I’ll share some tips and tricks for how to manage your debt and get out of financial trouble. You’ll be on your way to a debt-free future in no time!

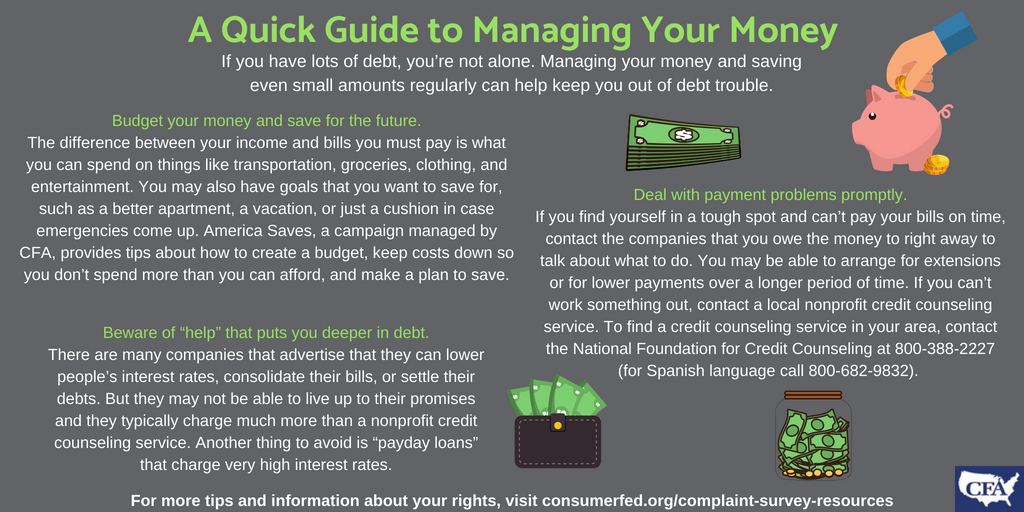

Make budget plan.

Making a budget plan is key to getting out of financial trouble. Start by tracking your income and expenses. Once you have that data, you can create a plan to prioritize your payments and build an emergency fund. Don’t be afraid to get creative: consider side hustles, cutting costs, and speaking to a financial advisor to help you with the plan. With a budget plan, you can take control of your finances and get yourself out of debt!

Track spending habits.

Tracking my spending habits was scary at first, but totally worth it. I started writing down every single expense, from my coffee to my rent, and I could finally see how much I was spending and where I could cut back. With this info, I was able to create a budget and see where I could save money by cutting back on unnecessary expenses. It was a huge help in getting out of financial trouble!

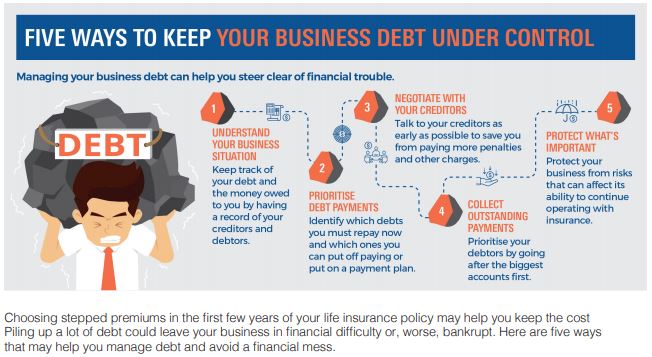

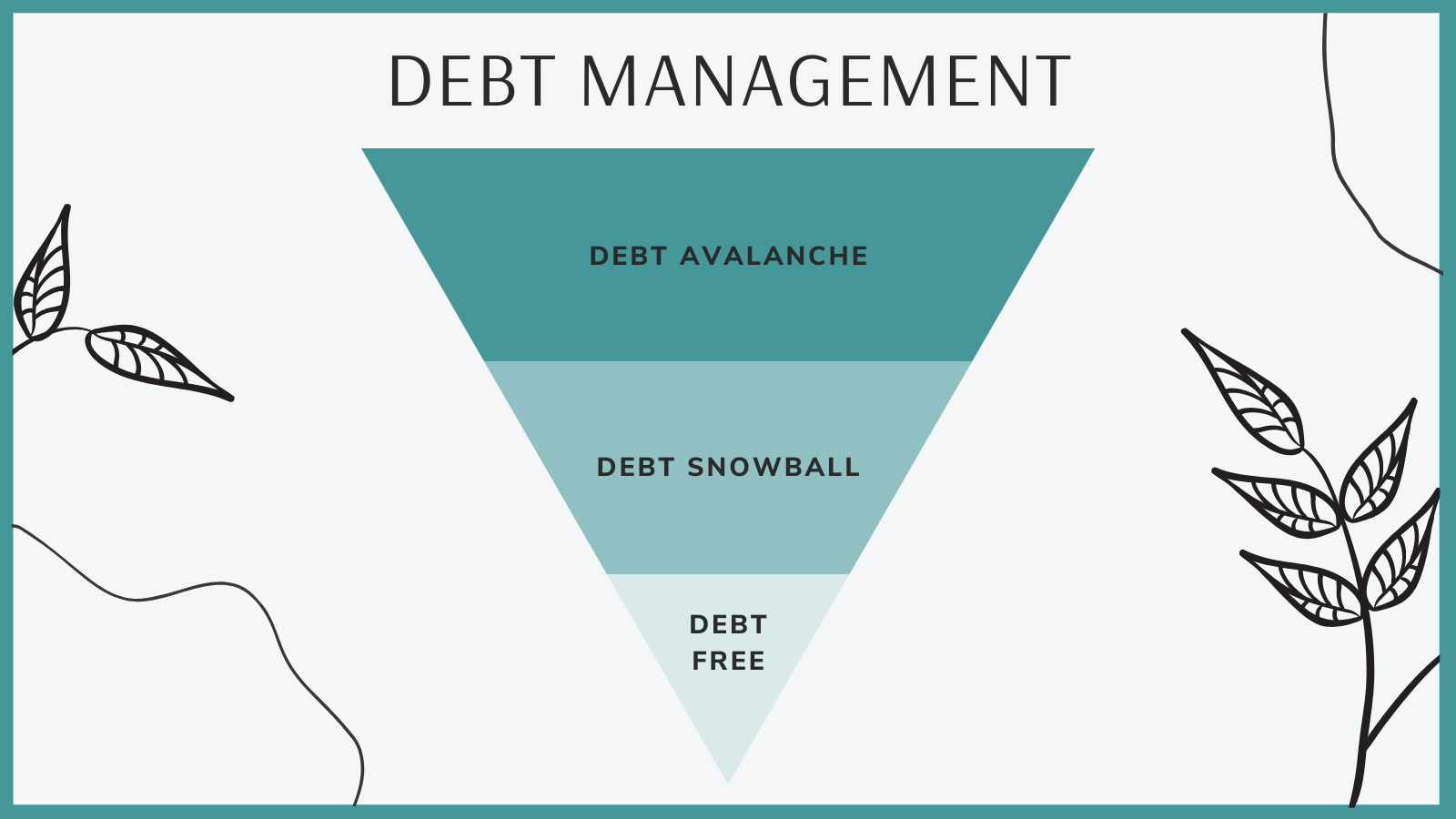

Prioritize payments.

When it comes to getting out of financial trouble, it’s important to prioritize payments. Make sure you pay off any debt with high interest rates, such as credit cards, first. Then focus on debts that are more manageable, like student loans. If possible, make more than the minimum payment on each debt to pay it off faster. Don’t forget to create a budget so you can stay on track with your payments.

Look for extra income.

I’m a student and like many of us, I’m always looking for ways to make a little extra money. Whether it’s through part-time jobs, freelance opportunities, or side hustles, it’s important to look for extra income when managing debt and getting out of financial trouble. It may not be easy, but with a little effort, you can find new ways to make money and start rebuilding your financial security.

Seek professional help.

If you’re in serious financial trouble, it’s wise to seek help from a professional. Many companies offer debt management advice, budgeting tools, and credit counselors who can look at your current situation and help you figure out the best way to get out of debt. Don’t be embarrassed or ashamed to seek help. It could be the best decision you ever make.

Avoid future debt.

I’m 18, and I’ve already started to understand the importance of managing my debt and avoiding future debt. I’m learning to budget and save as much as I can, and I’m trying to make smart financial decisions. I’m also working hard to pay off any existing debt so I can start fresh and stay out of financial trouble. I’m getting better at understanding my financial situation and making sure I’m always in control of my money.