Creating a will and estate plan can be intimidating, especially if you’re just starting out and don’t know where to begin. For any 18-year-old student, understanding how to protect your legacy and plan for the future is a great place to start. This article will provide you with an overview of how to create a will and estate plan, as well as how to make sure that your wishes are honored after you’re gone. It will also cover the importance of getting professional help, such as an estate planning lawyer, to ensure that your estate plan is done properly. By the end of this article, you’ll have the knowledge you need to create a comprehensive will and estate plan to protect your legacy and ensure that your wishes are respected.

Research current laws

If you want to create a will and estate plan, it’s important to research the current laws in your state. I’m 18 and I recently did some research on this topic. I found out that laws vary from state to state so it’s important to make sure you’re getting the right information. Doing research on the current laws can help ensure that your wishes are followed and your legacy is protected.

Choose executor/attorney

If you’re 18 and want to protect your legacy, you should choose an executor or attorney to help you create a will and estate plan. Make sure they are experienced and trustworthy, so you can feel confident your wishes will be carried out correctly. It’s important to do your research and take your time when making this decision, as it will have a lasting impact on your legacy.

List assets/debts

If you’re 18 and want to protect your legacy, create a will and estate plan. Start by listing all your assets and debts. This includes real estate, investments, vehicles, cash, bank accounts, loans, and credit cards. Be sure to include online accounts, too. This will help you and your family know exactly what you own and what you owe, so your wishes are carried out and your legacy is protected.

Determine beneficiaries

Creating a will and estate plan requires you to decide who will receive your assets after you pass away. It’s important to take the time to determine who you want your beneficiaries to be, whether that be family, friends, or charitable organizations. Make sure you update your beneficiaries list as life events occur to ensure your legacy is preserved and distributed to the people you want.

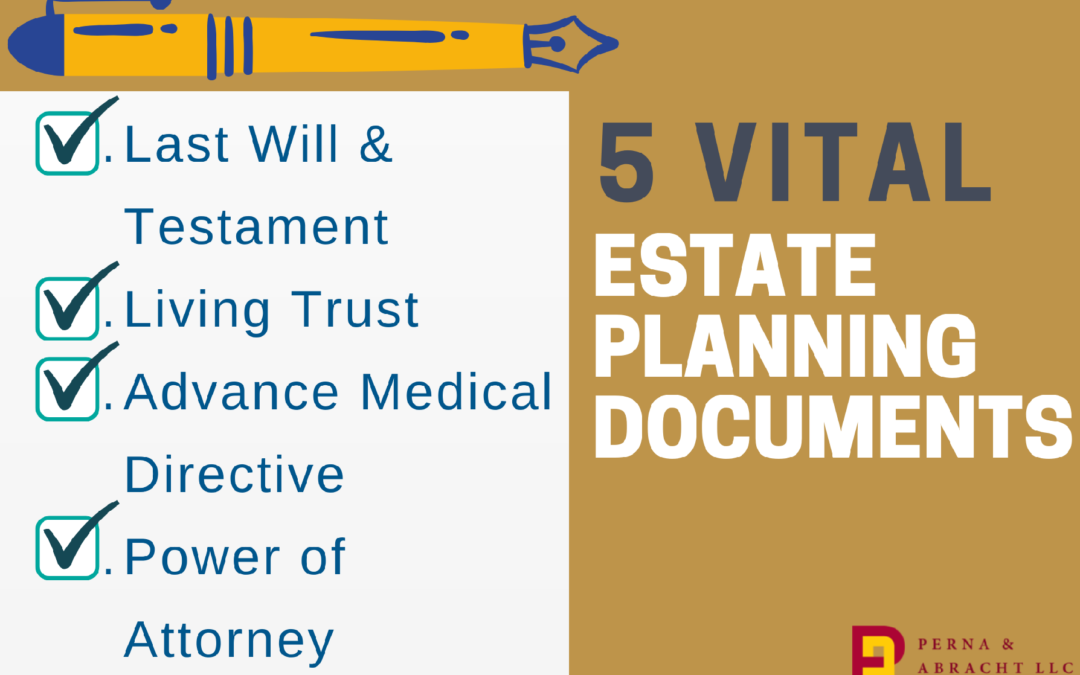

Create will/trusts

Creating a will and estate plan is an important step in protecting your legacy. As a young adult, it’s never too early to start thinking about estate planning. A will or trust is a legal document that allows you to designate how your assets will be distributed upon your death. It’s a great way to ensure that your loved ones are taken care of and your wishes are honored. Plus, it’s easier to do than you might think.

Finalize plan/documents

Finalizing your will and estate plan can be daunting, but it is essential to protecting your legacy. Make sure to review all documents carefully and get appropriate legal advice if needed. Make sure to sign off on all documents and store them in a safe place. It is also important to keep your family members informed of your plan and where to find it. This way, they can easily access it when the time comes.