Are you trying to figure out which financial software is the best for your needs? You’ve come to the right place! Evaluating the different options available can be overwhelming, but with the right steps, you can choose the best financial software for you. In this article, I’ll be taking you through the process of evaluating and selecting the financial software that meets your needs. Let’s get started!

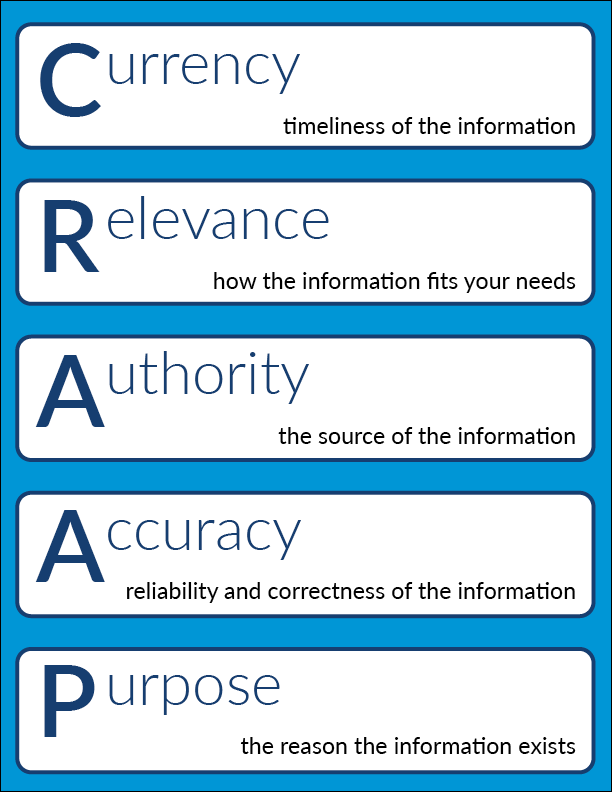

Research software options.

If you’re looking for the best financial software for your needs, research is key! Check out reviews from trusted sources, read user experiences, and compare pricing and features to find the best option for you. Ask questions and read up on more technical specifications to ensure the software you choose is the perfect fit.

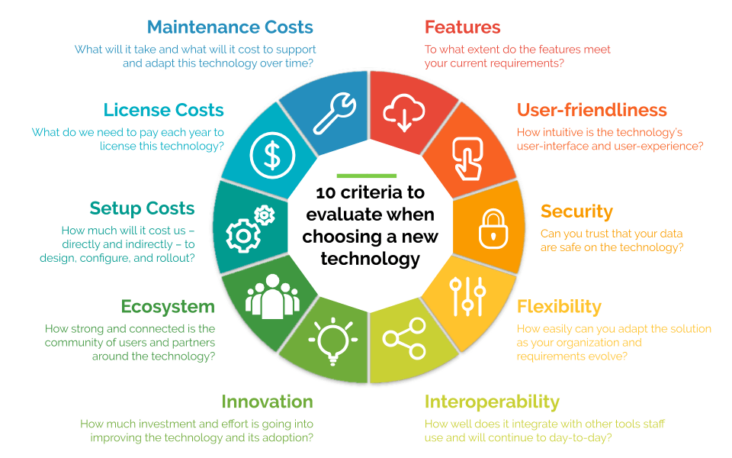

Compare features & costs.

When looking for the best financial software, it’s important to compare features and costs to make sure you get the best solution for your needs. I personally like to look at what features are included, the cost of the software, and any discounts or deals that are available. Additionally, I often research customer reviews to get a real-life opinion of the software before making my final decision.

Assess support & reviews.

When assessing different financial software, it’s important to consider the support and reviews available. I recommend looking for customer reviews on trustable websites like Capterra and G2. Also, make sure to ask about support options, like phone, email and chat, to ensure that you have access to the help you need.

Consider customization needs.

Choosing the right financial software for your needs can be overwhelming. When evaluating different options, it is important to consider customization needs. For example, some software may offer more features that can be tailored to your individual needs, such as budgeting, tracking expenses, and more. Also, look for software with custom reporting features, so you can get the most out of your data. Make sure to choose a financial software that fits your specific goals and objectives.

Calculate ROI potential.

![]()

Figuring out the return on investment (ROI) potential of a financial software is essential to making sure it’s the right fit for your needs. To calculate the ROI, you need to consider the cost of the software, any implementation fees, and the time you’ll save. Compare this to the potential revenue it could generate, and you’ll have a better idea of whether it’s worth it or not.

Make final decision.

Finally, it’s time to make your decision. When choosing the financial software that best fits your needs, make sure to consider your budget, the features the software offers, and its user reviews. Also, double-check the customer support team to make sure you feel comfortable with their help if you need it. At the end of the day, you want a software that is secure, reliable, and affordable.