If you’re a student like me, you’re probably always looking for ways to save money and make the most of your budget. One great way to do this is by negotiating your bills and reducing your monthly expenses. In this article, I’m going to share my tips and tricks on how to negotiate your bills and save money on your monthly expenses. I’ll show you how to talk to service providers, what questions to ask, and how to stay on top of your finances. Read on to learn how to stay on top of your monthly expenses and save money!

Assess current expenses.

Having a budget is the best way to start saving money, and assessing my current expenses is the first step. I’m basically 18 years old and I recently moved out and started to pay for things like rent, groceries, utilities, and phone bills. I realized I had to start cutting back, so I took a look at how much I was spending each month and saw where I could save some money. This was a big help in figuring out how to negotiate my bills and save money each month.

Identify potential savings.

As a student, it’s important to make sure you’re getting the best value for the money you’re spending. To save money on your monthly expenses, identify potential savings by analyzing your bills and seeing if there are any areas where you can reduce your spending. Look for discounts and offers, and negotiate with service providers to get the best deal. It’s all about being savvy and finding the best way to save money!

Research alternatives.

If you’re looking for ways to save money on your monthly expenses, researching alternatives is an important step. Do your research and compare different providers, plans and packages to find the one that best fits your needs. Make sure to read the fine print and know the details of each offer before signing up. It’s also wise to check online reviews to get an idea of the customer service you can expect. Don’t forget to negotiate with your current provider to get the best deal possible.

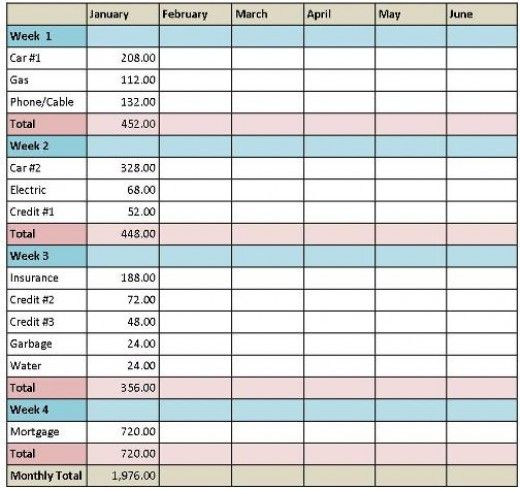

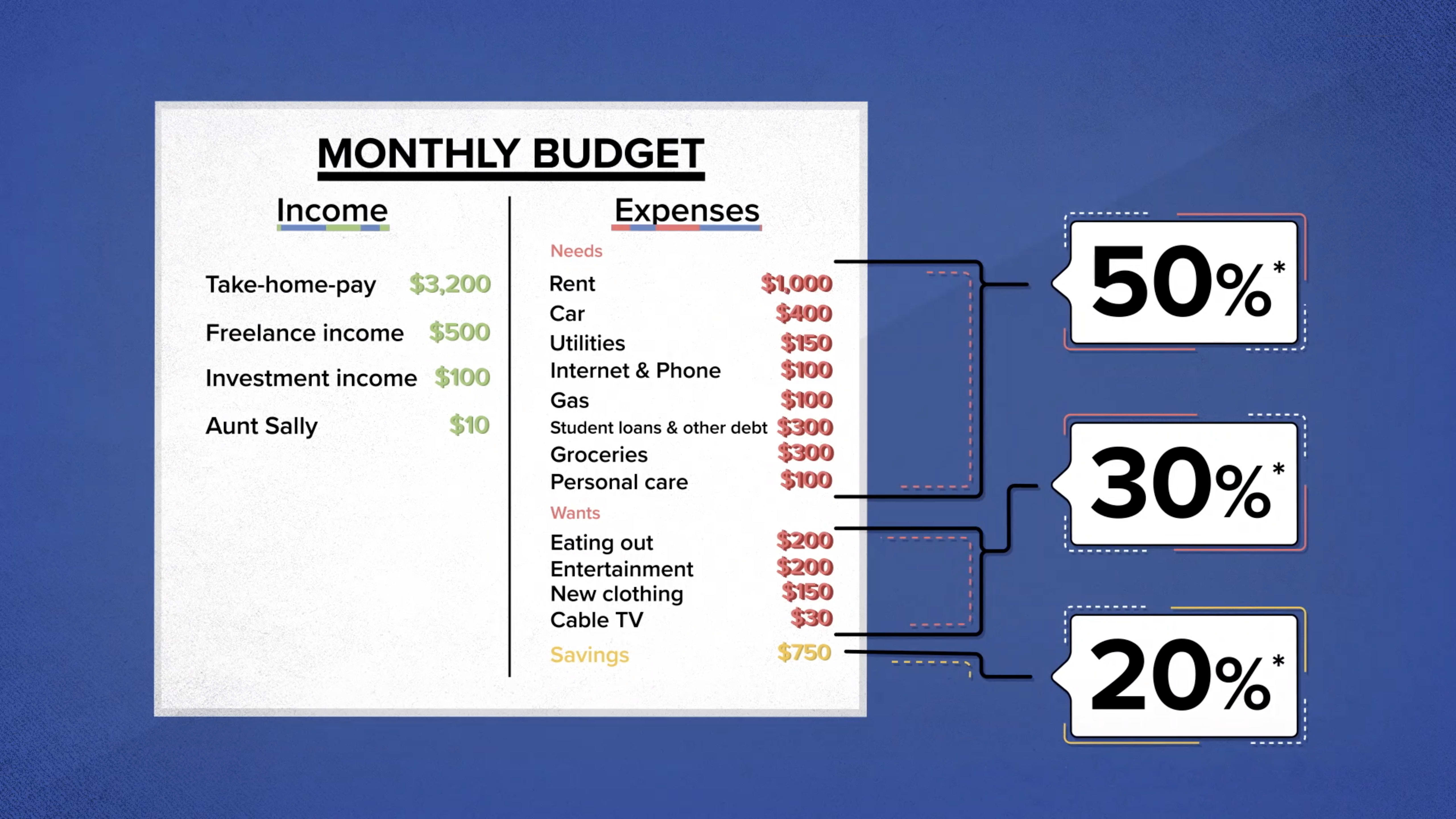

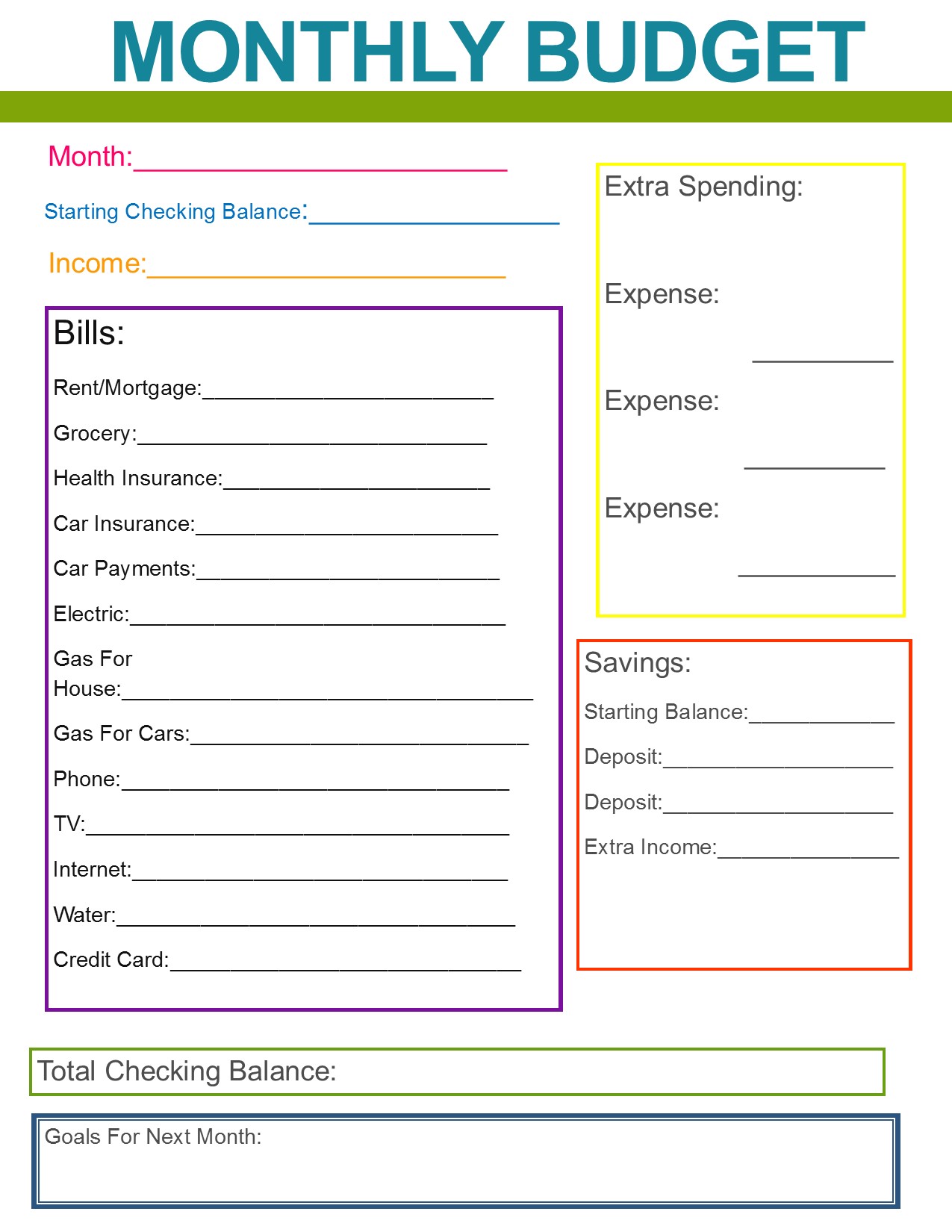

Make a budget.

When it comes to budgeting, I find it’s so important to make a budget and stick to it. This helps me to identify where I’m spending too much and where I can cut back. It’s also a great way to prioritize my expenses and make sure I’m saving for the things that really matter to me. With a budget, I can easily track my spending, understand my finances better, and save money each month.

Negotiate with providers.

Negotiating with providers is a great way to save money on monthly expenses. I’ve been able to lower my phone bill, internet bill, and even my student loan payments by asking for discounts. It’s easy – all you have to do is call up your provider and explain your situation. Make sure you know what other companies are offering and be prepared to ask for a better deal. You might be surprised at how much you can save!

Track savings.

I’m all about tracking my spending and savings – it’s so helpful in understanding where my money is going and how I can save. I use budgeting apps and write down all of my expenses, so I can keep track of where I’m saving money on bills and other monthly expenses. It’s a great way to make sure I’m on top of my budget and stay on track with my savings goals.