Are you 18 and feeling overwhelmed by your finances? Don’t worry, budgeting doesn’t have to be complicated! Creating a personal budget is the key to managing your finances properly and taking control of your money. In this article, I’ll show you a step-by-step guide to creating a personal budget that works for you, so you can get your financial life in order and start living your best life!

Gather financial info.

As a college student, it’s important to take control of your finances and that starts with creating a personal budget. Gathering your financial info is the starting point for this process. I keep track of my bank account and credit card statements as well as any other financial commitments like rent and loan payments. Having all this info in one place helps me to understand where my money is going and how I can save.

Track all expenses.

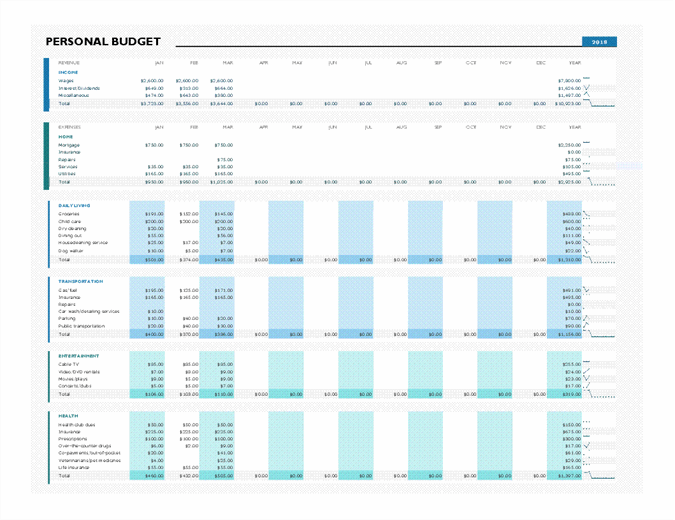

Tracking all my expenses has been a game changer for me. It’s really helped me stay on top of my finances and budget better. I use a spreadsheet to log everything I spend money on, from my rent and bills to my shopping and eating out. It’s so easy to do and it’s really helped me stay on top of my budget!

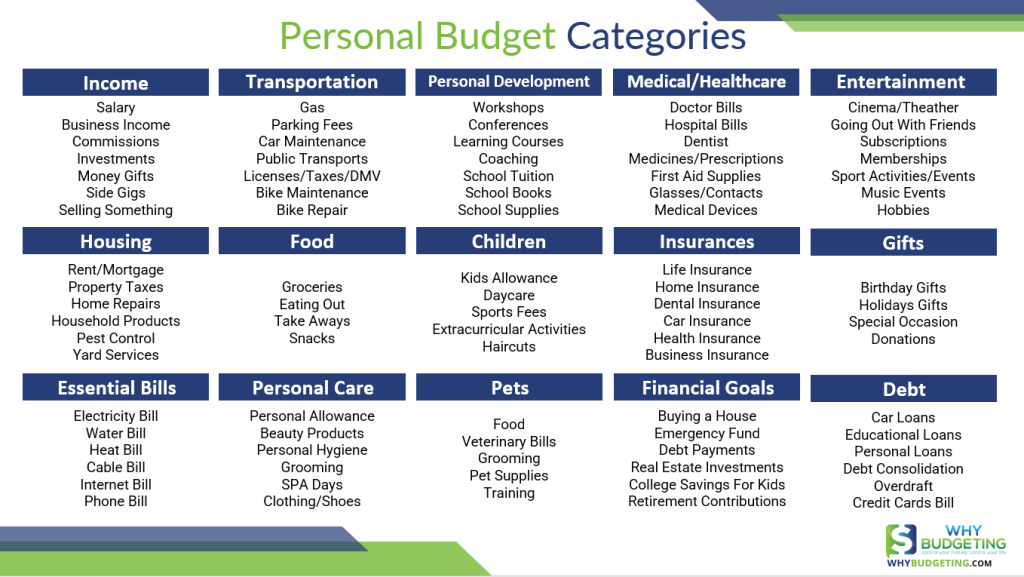

Identify needs/wants.

Creating a budget can be intimidating, but it doesn’t have to be. Start by identifying needs and wants. Needs are essential expenses such as rent, food and transportation. Wants, on the other hand, are nice-to-haves like a new pair of shoes or take-out. Knowing the difference between needs and wants helps you understand how to prioritize your spending and allocate your funds.

Set financial goals.

As a student, it’s essential for me to set financial goals to ensure that I’m able to manage my finances responsibly. By creating goals such as saving X amount of money each month or reducing my spending in certain areas, I’m able to create a budget that works for me and my lifestyle. Setting financial goals helps me stay on track and stay within my budget.

Create budget plan.

Creating a budget plan can feel daunting, especially if you are a student who is just starting out. But don’t worry! It doesn’t have to be intimidating. Follow these simple steps to make a budget plan that will help you manage your finances and reach your financial goals. First, identify your sources of income and list your expenses. Then, set a budget and track your spending. Finally, review your budget regularly and make adjustments when needed. With a little practice, you’ll be budgeting like a pro in no time.

Monitor and adjust.

Monitoring and adjusting your budget is an essential step to ensure that you stay on track with your finances. It’s important to check in with yourself every month to make sure you’re sticking to your budget and adjust accordingly. This can help you stay organized and make sure that you’re able to save and spend money responsibly. Checking in with yourself regularly will help you stay on top of your finances and make sure that you’re always in control of your finances.