Saving money is a great way to prepare for your future. Whether you’re a student, recent graduate, or someone just starting out in life, there are plenty of tips and tricks that can help you build a strong financial future. From budgeting to understanding different types of investments, this post will provide you with all the information you need to start saving money and building a secure financial future.

Track spending and budget.

As a young adult, it’s important to track your spending and budget accordingly. I use a budgeting app to keep track of how much money I’m spending daily and how much I’m saving. It helps me to stay on track with my finances and set realistic goals for the future. Staying organized and setting a budget is key to saving money and building a strong financial future.

Automate savings deposits.

As a student, automating my savings deposits is one of the best ways to ensure I stay on track with my financial goals. Setting up automatic transfers from my checking account to my savings account is a quick and easy way to guarantee that I’m continually adding money to my savings. I’m able to set up these transfers in a few simple steps, and now I don’t even have to think about it; the money just transfers automatically and helps me build my financial future!

Cut non-essential costs.

As a student, I’m always trying to find ways to save money, especially when it comes to cutting costs. One of the best ways to do this is to limit non-essential expenses. I’m talking about things like eating out, buying coffee, and ordering takeout. By making a budget and sticking to it, I can save a lot of money while still having some fun!

Negotiate bills and fees.

I’m just starting out, so it’s really important for me to learn how to save money. One way I’ve found to save is to negotiate my bills and fees. It’s not always easy, but it’s worth it to take the time to call companies and see if they can discount my services. Every bit counts and it can add up over time.

Invest in low-cost funds.

As a young adult, it’s important to start thinking about investing in low-cost funds as soon as possible. There are a lot of tools available to help you get started, like robo-advisors and index funds, which offer an easy and affordable way to start slowly building a financial future. Investing in low-cost funds can help you save money, while also giving you the opportunity to make more money in the long run.

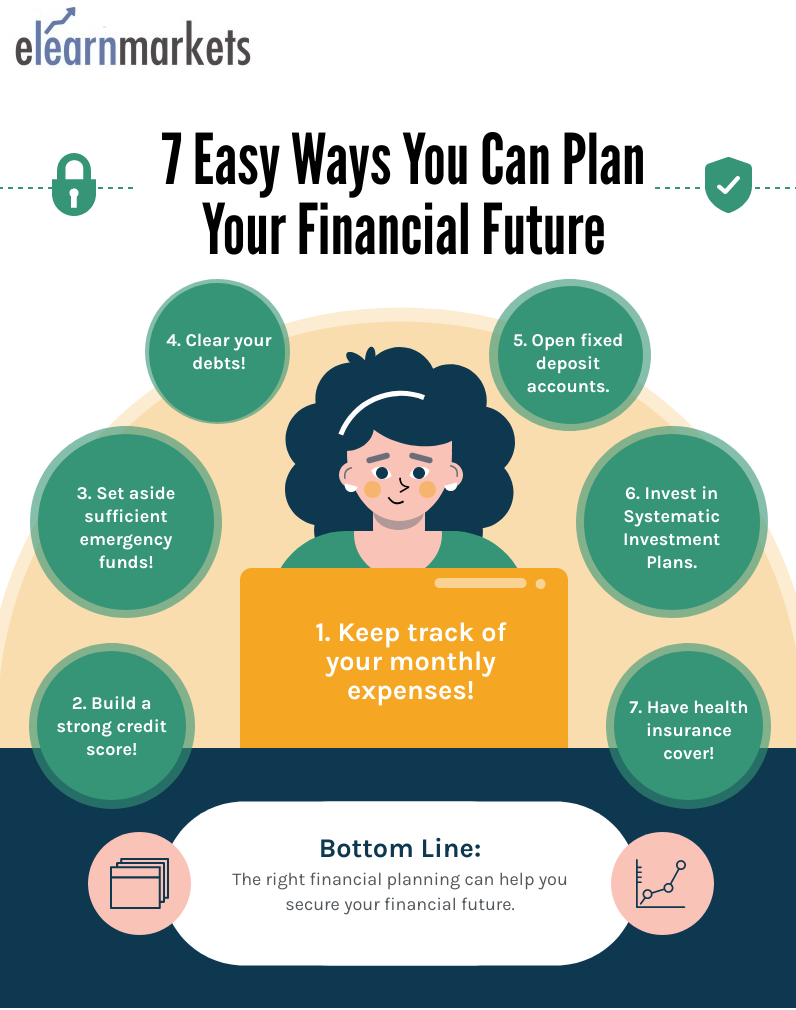

Make a financial plan.

Making a financial plan is essential to saving money and building a strong financial future. It’s never too early to start, and as a 18 year old I’ve found it helpful to make a budget and set long-term goals. Knowing my income and expenses, as well as how much I can save each month, has been key to staying on track and making smart financial decisions. It’s also important to review my plan regularly to make sure it’s still on track.