Are you wondering what Average Life means? It’s a term used to describe the length of time it takes for an investment or debt to be paid in full. It’s a key factor in determining the profitability of a business or investment. Average Life is an important concept to understand when it comes to managing your finances and planning for the future. In this article, we’ll explain what Average Life is and how it works, so you can make the most of your investments.

What is the Average Life of Financial Assets?

When it comes to financial assets, the average life of them can be an important part of understanding the overall success of your investments. The average life of a financial asset is a measure of how long it will take to get back the money you put into the asset. This includes things like stocks, bonds, mutual funds, and other investments. Knowing how long it will take to get back the money you put in can help you make smart decisions when it comes to investing and managing your portfolio. It’s important to remember that the average life of a financial asset doesn’t tell you the exact time you’ll get your money back, but it does help you understand the general timeline of your investment. With this knowledge, you can make educated decisions about the investments you make and ensure your money is working for you.

How to Calculate the Average Life of Financial Assets?

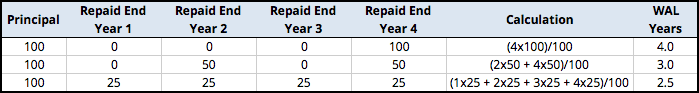

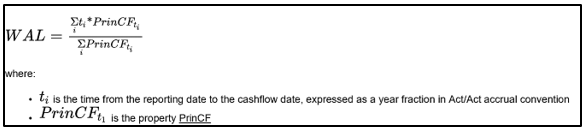

Calculating the average life of financial assets can seem daunting. However, with a few simple steps, you can easily determine the average life of your investments. To start, identify the total remaining payments or cash flows that you expect to receive from the asset. Then, sum up all of the payments or cash flows that you expect to receive over the life of the asset. Finally, divide that number by the total number of payments or cash flows that you expect to receive. This will give you the average life of the asset. Knowing the average life of your financial assets can be helpful to ensure that you are getting the most out of your investments. It is important to stay on top of your investments and make sure that the average life of the financial assets is in line with expected returns.

The Benefits of Knowing Your Average Life Financial Assets

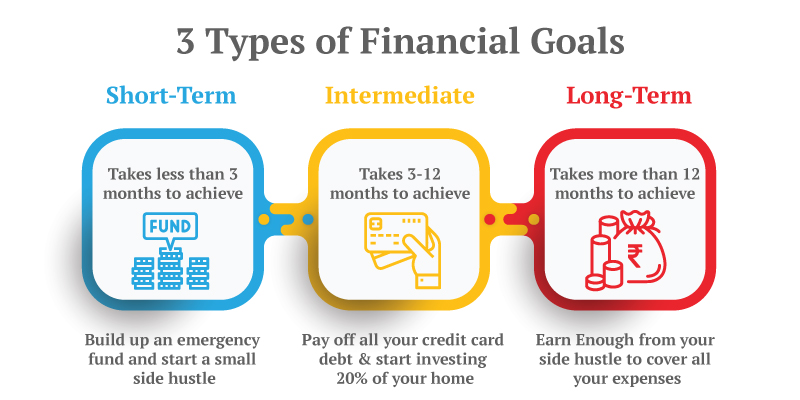

Knowing your average life financial assets can be incredibly beneficial. Being aware of how much you have saved, how much you’re earning, and how much you’re spending can help you make decisions that will pay off in the long run. It’s important to understand how you’re managing your finances so you can make the best possible decisions for your future. With the right plan in place, you can make sure you’re always making the most of your current financial situation, and being able to spot potential problems in the future. Investing in yourself is one of the best ways to ensure you have a secure financial future. Knowing your average life financial assets can help you do just that.

The Dangers of Not Understanding Your Average Life Financial Assets

Being aware of your average life financial assets is essential if you want to make sure your money is being used properly. Not understanding the ins and outs of your average life financial assets can be dangerous and can cause you to miss out on opportunities to grow your wealth. Not knowing the basics of average life financial assets can lead to making bad decisions and putting yourself at risk of losing out on potential gains. It’s important to take the time to educate yourself on the fundamentals of average life financial assets so you can make informed decisions and maximize your investments. Knowing the basics can help you protect your assets and open up new opportunities to increase your financial health. Make sure to stay up to date with changes in the market and educate yourself on the different strategies to optimize your average life financial assets.

Strategies to Help You Avoid Plagiarism When Discussing Average Life Financial Assets

.When it comes to discussing Average Life Financial Assets, it can be tricky to avoid plagiarism. To ensure your content is original and up to the standards of modern SEO, here are some strategies to help you out. First, make sure to do your research. Gather information from reliable sources and be sure to cite them properly. Second, use your own words to explain the concepts you’re discussing. While it’s important to use accurate terminology, don’t be afraid to express your own insights and make the content your own. Lastly, use tools such as Copyscape to check your content for plagiarism before you publish. By following these strategies, you can make sure your content is unique and informative.