The Average Directional Index (ADX) is a technical indicator used by financial analysts and investors to measure the strength of a trend. This index is used to assess the momentum of price movements and identify potential trading opportunities. It is a simple yet powerful tool that can help traders identify when a strong trend is forming, so they can make informed decisions about their investments. By understanding how ADX works, investors can get an edge in the markets and maximize their returns.

What is Average Directional Index (ADX)?

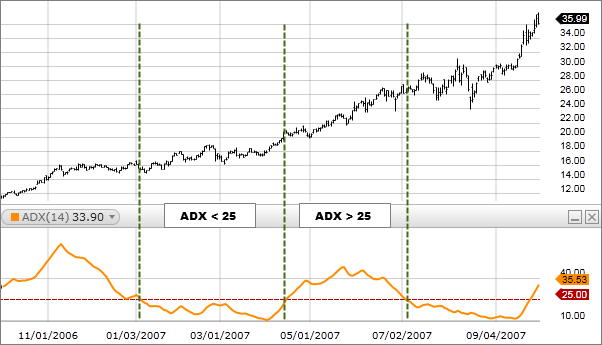

Average Directional Index (ADX) is an indicator used in technical analysis that measures the strength of a trend. It is calculated using a combination of three different lines: the positive directional indicator (+DI), the negative directional indicator (-DI), and the ADX line. ADX can range from 0 to 100, with values above 25 typically indicating a strong trend. The higher the ADX reading, the stronger the trend is considered to be. ADX can be used to identify whether a trend is emerging, or whether it is weakening. It can also be used to determine whether a trend is bullish or bearish. Traders can use ADX to identify entry and exit points in a trend, as well as when to enter and exit the market. ADX is a great tool for any trader looking to maximize their profits and minimize their losses.

How to Calculate the Average Directional Index (ADX)

The Average Directional Index (ADX) is a popular indicator used by financial traders to measure the strength of a trend. To calculate the ADX, you’ll need to first calculate the positive directional indicator (+DI) and the negative directional indicator (-DI). Then, you’ll take the average of both of these values and combine them with the directional movement index (DMI). This will give you the ADX value which will be a figure between 0 and 100. If the ADX is below 25, then it’s likely that the market is in a range-bound or sideways trend. If the ADX is above 25, then it’s likely that the market is in a strong trend. By having the ADX indicator on your chart, you can easily spot when to enter or exit a trade based on the strength of a trend. Additionally, the ADX can help you identify false breakouts, so you know when to stay out of the market. Knowing how to calculate the ADX is a great tool to have in your trading arsenal, so you can be sure to maximize your profits and minimize your losses.

Benefits of Using the Average Directional Index (ADX)

The Average Directional Index (ADX) is a great tool for any investor looking to get a better read on their investments. The ADX gives investors a better understanding of the strength of a trend in a security’s price and provides traders with a way to measure the potential of a market trend. By taking into account the direction and strength of a trend, traders can better understand the potential of a security. This can help them make more informed decisions when trading. The benefits of using the Average Directional Index (ADX) are numerous. Firstly, it can help traders identify the strength of a trend and determine the potential of a trade. Secondly, it can be used to confirm a trend as well as provide an indication of when a trend may be ending. Lastly, traders can use the ADX to determine entry and exit points for a trade. All in all, the Average Directional Index (ADX) is a great tool for any investor looking to gain more insight into their investments.

Tips for Maximizing the Potential of Average Directional Index (ADX)

If you want to maximize the potential of Average Directional Index (ADX) trading, then it’s important to understand the components of the indicator. First, you need to identify the trend direction and strength, which is based on the positive and negative directional movement (plus and minus DM). You should also pay attention to the directional movement indicator (DMI) which is the difference between the plus and minus DM, as this can help you to identify the trend direction. Finally, you need to watch the ADX line, which is a measure of the trend strength, and should be combined with the DMI to get a better trading signal. By understanding the components of the ADX indicator, and combining them with other technical indicators, you can improve your trading decisions and maximize your potential with this powerful trading tool.

Common Mistakes to Avoid with Average Directional Index (ADX)

When it comes to Average Directional Index (ADX), there are a few common mistakes to be aware of. The first mistake is to rely too heavily on the ADX as the only indicator when making trading decisions. While the ADX is a useful tool, it should not be used as the only indicator when trading. It is important to take into account other factors, such as price action and other indicators, when making decisions. Additionally, it’s important to remember that while the ADX can indicate a strong trend, it is not always guaranteed to be right. Finally, another mistake to avoid is to make decisions without considering the time frame. The ADX is only useful if it is used in the correct time frame. Taking all of these factors into account will help ensure that you make the best decisions when trading.