Are you curious about Average Daily Trading Volume (ADTV)? ADTV is an important metric used by investors to measure the liquidity of a stock, ETF, or other security. It helps investors gauge the level of interest in any given security and provides insight into the trading activity in a security. In this article, we’ll explore what Average Daily Trading Volume (ADTV) is, how it is calculated, and why it is important to investors. Read on to learn more about this valuable metric.

Understanding Average Daily Trading Volume (ADTV)

Average daily trading volume (ADTV) is a measure of the number of shares traded over a given period of time, usually a single day. ADTV is often used to measure the liquidity and volatility of a stock or other security. It can also be used to compare the trading activity of different stocks. There are a few different ways to calculate ADTV, but the most common is to simply take the total number of shares traded in a day, divide it by the total number of shares outstanding, and then multiply by the number of trading days in the period. This gives you the average daily trading volume for that period. Knowing the average daily trading volume can help investors understand how active the market is for a particular stock and how easily they can buy and sell it. It’s also a good tool for investors to use when deciding which stocks to buy and sell.

Common Uses of Average Daily Trading Volume (ADTV)

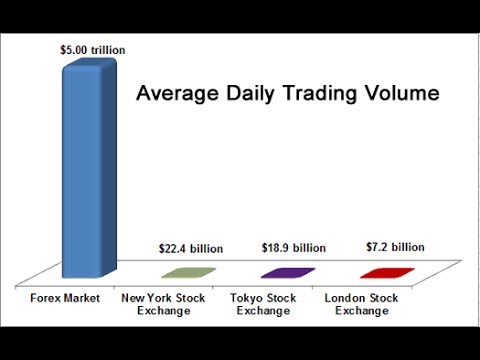

Average Daily Trading Volume (ADTV) has become an important metric for traders to understand and evaluate. As its name suggests, ADTV is the average amount of shares traded each day over a certain period of time. This can be used to measure the liquidity of a stock, as well as the amount of interest in a stock. Common uses of ADTV include assessing overall market sentiment, understanding the investor base, and gauging potential trading opportunities. ADTV can also be used to compare stocks against one another, as well as to identify potential entry and exit points. By understanding ADTV, traders can make informed decisions when it comes to buying and selling securities.

Factors Affecting Average Daily Trading Volume (ADTV)

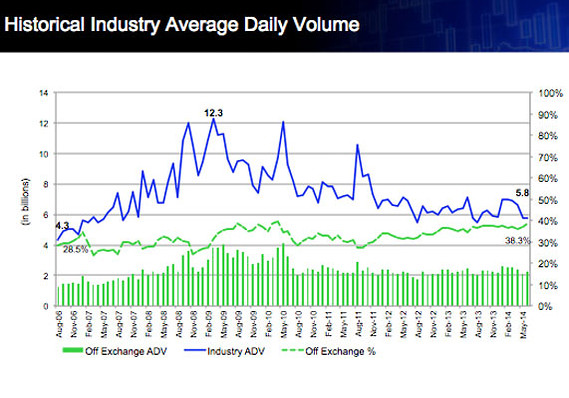

ADTV is an important metric for investors to pay attention to, as it can give an indication of how active a stock is in the market. Factors that affect ADTV are the stock’s liquidity, volatility, price, and news. Liquidity is how many shares are available to buy and sell, which can be affected by the number of investors in the stock. Volatility is how much the stock price fluctuates, which is affected by market trends and news. Price is how much the stock is worth, which can be affected by market competition and investors’ perceptions of the stock. News can also affect ADTV, as news events can increase or decrease the level of activity in a stock. By understanding how these factors affect ADTV, investors can make more informed decisions when it comes to trading.

Benefits of Monitoring Average Daily Trading Volume (ADTV)

Monitoring Average Daily Trading Volume (ADTV) is a great way to stay on top of the market. With ADTV, you can identify the liquidity and volatility of a stock, allowing you to make more informed decisions. Knowing the ADTV of a stock, you can quickly spot any unusual activity and react accordingly. This can give you a leg up when it comes to trading, providing you with an opportunity to capitalize on any potential profits. Additionally, ADTV can help you determine the best time to enter or exit a position. By understanding the trading volume of a stock, you can identify the optimal time to buy and sell, which can be incredibly beneficial for your trading strategy.

How to Calculate Average Daily Trading Volume (ADTV)

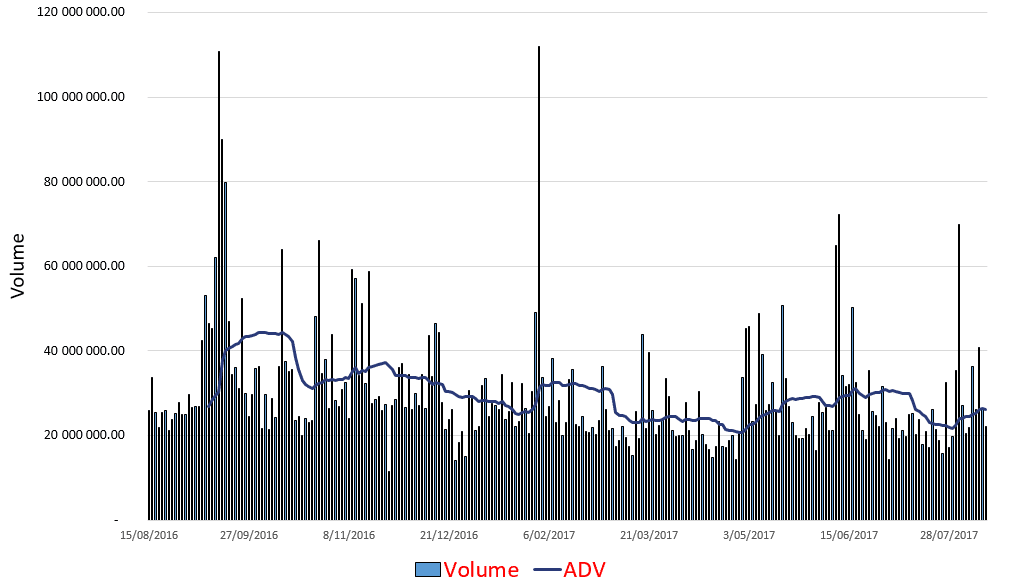

Calculating Average Daily Trading Volume (ADTV) is an important metric for stock market investors as it can provide insight into the activity level of a security. ADTV can be calculated by taking the total amount of shares traded in a given day and dividing it by the total number of days in the period. This can be done for any period of time, from a single day to several months. The result of this calculation is the Average Daily Trading Volume. ADTV is a useful tool for investors to assess the liquidity of a stock, as well as its popularity among traders. Additionally, it can be used to determine the volatility of a security, which can be beneficial when trying to gauge risk. Understanding ADTV can be a powerful tool for investors, and calculating it can be done quickly and easily.