Are you looking for an easy way to determine your long-term rate of return? Average Annual Return (AAR) is a great tool to help you gain an understanding of what you can expect from your investments over time. AAR measures the average yearly return of an investment over a certain period of time, allowing you to compare different investments and make informed decisions. In this article, we’ll discuss what AAR is, how it’s calculated, and how you can use it to make better investment decisions.

What Factors Should I Consider When Calculating Average Annual Return (AAR)?

When it comes to calculating your Average Annual Return (AAR), there are several important factors to consider. First, you’ll want to take into account the amount of time that you’re investing for. This can be a short-term or long-term venture, and you’ll want to make sure that the returns you’re anticipating are in line with the amount of time you’re investing. Second, you’ll want to look at the risk versus reward of your investments. This means looking at the potential for gains versus the potential for losses, and making sure that you’re comfortable with both scenarios. Lastly, you’ll want to look into the historical performance of your investments. This means researching past returns over a given period of time, and using this data to help inform your decision-making. By taking these factors into account, you can get a better sense of what kind of Average Annual Return (AAR) you should be expecting.

Understanding the Different Types of Average Annual Return (AAR)

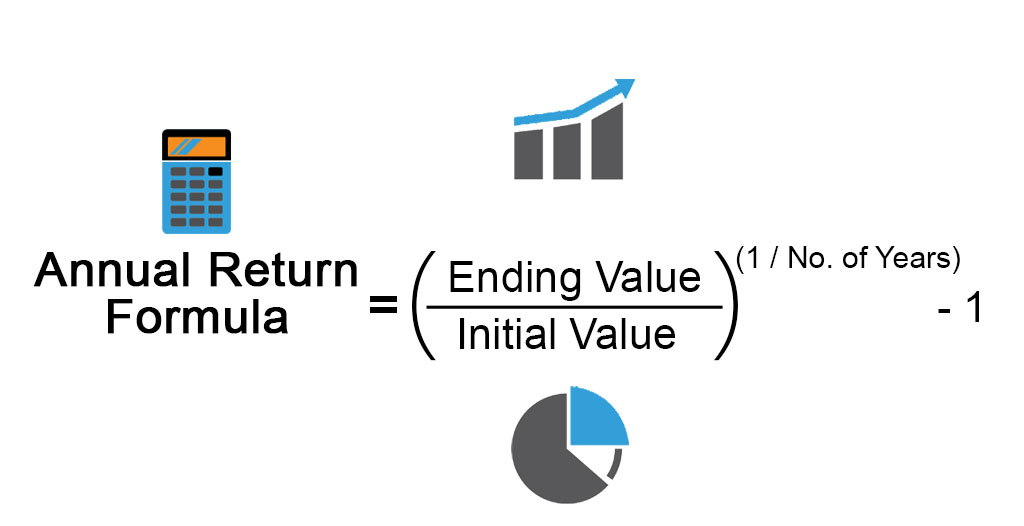

When it comes to understanding the different types of Average Annual Return (AAR), there are a few key points to consider. First, it is important to understand that AAR is a measure of the average annual rate of return on an investment. It is calculated by taking the total return for a period of time, such as one or five years, and dividing it by the number of years in the period. The result is the average annual rate of return for the period. Additionally, the AAR measures the average annual return of an investment over the entire holding period. This means that the AAR is not affected by short-term market fluctuations, and is a much more reliable measure of the long-term performance of an investment. Finally, when looking at the AAR of an investment, it is important to remember that past performance does not guarantee future returns. While the AAR can be a useful measure for evaluating an investment, it is only one tool among many that investors should use when making financial decisions.

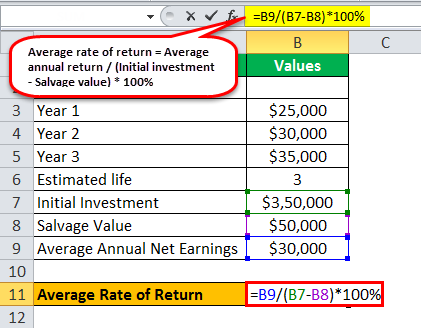

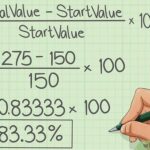

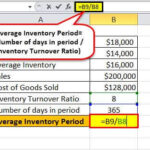

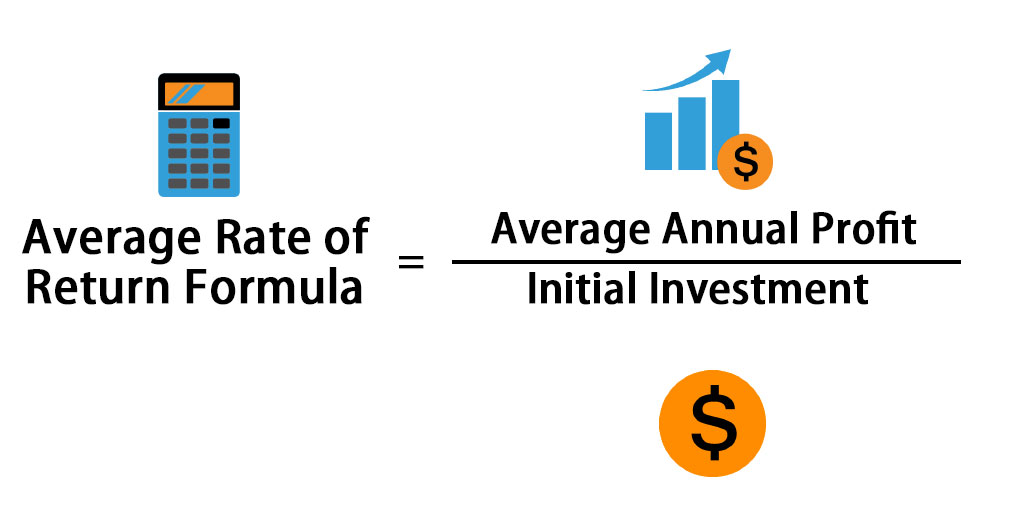

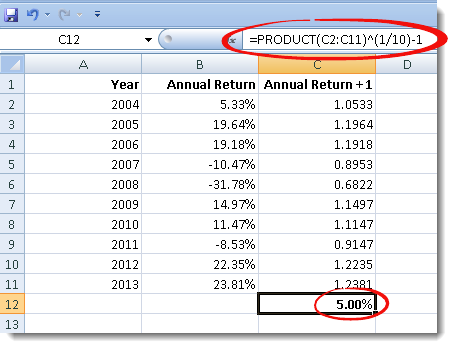

How to Calculate Average Annual Return (AAR)

Calculating your Average Annual Return (AAR) is a great way to measure the performance of your investments over time. AAR is a simple calculation that takes the total return of your investments over a certain period and divides it by the number of years in that period. This can help you get an idea of how your investments are doing and if they are meeting your expectations. To calculate AAR, start by adding up all of your investment returns over the period in question. Then divide that total by the number of years in that period. This will give you the Average Annual Return (AAR). This can help you determine how your investments are performing compared to other investments and the overall market. It can also help you decide whether you need to adjust your investment strategy or make changes to your portfolio.

Benefits of Calculating Average Annual Return (AAR)

Calculating your Average Annual Return (AAR) is one of the most important things you can do as an investor. AAR measures the compounded rate of return you receive from your investments over a period of time. By calculating your AAR, you can get an accurate view of how your investments have performed in the past and what kind of returns you can expect in the future. This can help you make informed decisions when it comes to investing and choosing investments that are right for you and your goals. Additionally, calculating your AAR can help you determine how much you need to invest in order to reach your financial goals, and it can also help you stay on track with your investment objectives. Calculating your AAR can be a great way to stay organized and ensure you are making the most of your investments.

Risks of Investing With Average Annual Return (AAR)

Investing in the stock market can be tricky, and it’s important to understand the risks of investing with Average Annual Return (AAR). AAR is a metric used to measure the average yearly return of an investment over a period of time. It’s important to be aware that AAR isn’t a guarantee of returns, and there are a variety of factors that can impact the success of an investment. AAR also doesn’t consider the volatility of the market or the potential for a sudden downturn. It’s important to understand that investing with AAR involves risk and you should be sure to do your research and consult a financial professional if you’re unsure about investing. With the right strategy and a willingness to take calculated risks, you could achieve great success in the stock market.