Are you looking to understand Average Annual Growth Rate (AAGR) and its implications for your investments? AAGR is an important metric used by investors to measure the annual growth rate of their investments over a specified period of time. This article will provide an overview of AAGR, explain its calculation, and discuss its importance to investors. By understanding AAGR, you will be able to make better decisions regarding your investments and potentially enhance your returns.

What is Average Annual Growth Rate (AAGR) and How is it Calculated?

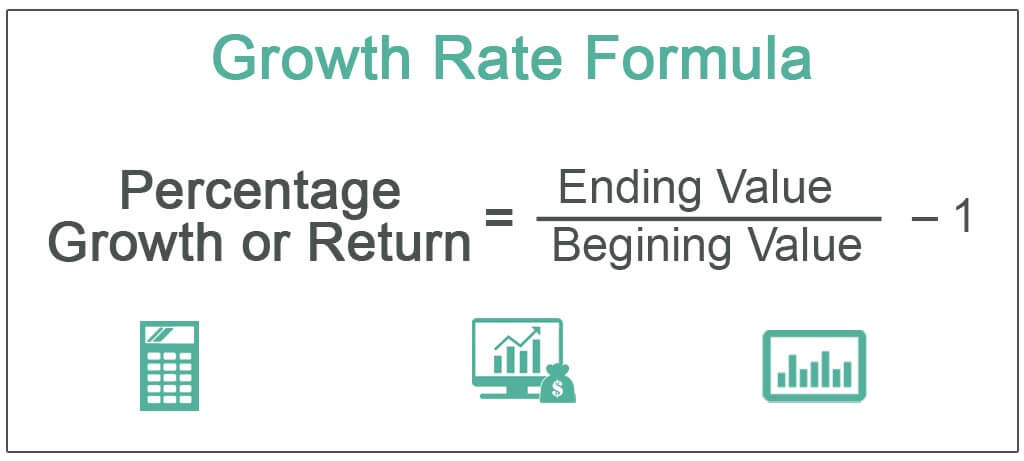

Average Annual Growth Rate (AAGR) is an important indicator of the growth of an investment over time. It is calculated by taking the total rate of growth of an investment over a specified period and dividing it by the average of the beginning and the ending values of the investment. AAGR is a great metric to gauge the success of an investment and can be used to compare different investments over time. It is also a useful tool for forecasting future performance. AAGR helps investors understand how their investments have grown over time, and can be used to make more informed decisions when investing.

Benefits of Knowing Your AAGR

Knowing your Average Annual Growth Rate (AAGR) is an important part of tracking your finances. AAGR measures the rate at which your investments are growing over time, so it can be an invaluable tool for helping you plan for the future. It can also be used to compare the growth of different investments, allowing you to make more informed decisions about where to put your money. With AAGR, you can easily identify areas of your portfolio that are growing too slowly and make adjustments accordingly. Knowing your AAGR can help you achieve your financial goals faster, as you can make decisions that maximize the growth of your investments. It’s a great way to stay on top of your finances and make sure your money is working for you!

Challenges of Calculating AAGR

Calculating the Average Annual Growth Rate (AAGR) can be a challenge, as it involves a lot of data and complex calculations. It requires analyzing the past performance of an organization or product over time and making projections for the future. To accurately calculate the AAGR, you must have access to accurate and up-to-date financial data, as well as an understanding of the various factors that can influence growth. Additionally, the AAGR must be calculated on a consistent basis to ensure that the results are reliable. This can be tricky, as different factors can change the growth rate from year to year. In order to get the most reliable results, it’s important to use the same method of calculation consistently over time. Calculating the AAGR can provide valuable insights into the performance of an organization or product, but it’s crucial to ensure that the data used is accurate and up-to-date in order to get the most reliable results.

Factors to Consider when Calculating AAGR

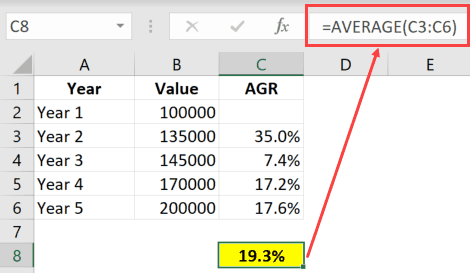

When it comes to calculating Average Annual Growth Rate, there are a few key factors to consider. First, you need to look at the total growth of the investment or asset over a certain time period. This is usually the past three to five years, but can vary depending on the situation. Additionally, you’ll want to take into account any changes in the value of the asset over that same period of time. This is important because it will help you get an accurate number for AAGR. Finally, you’ll want to consider the length of time over which you are measuring the growth. A shorter period of time may result in a higher AAGR, while a longer period of time may result in a lower AAGR. With all of these factors in mind, you’ll be able to get a better understanding of the Average Annual Growth Rate and make more informed decisions about your investments.

Examples of AAGR Calculations and Their Results

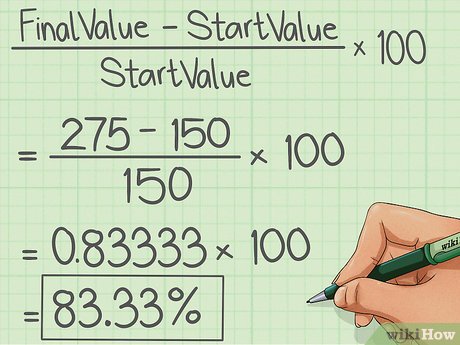

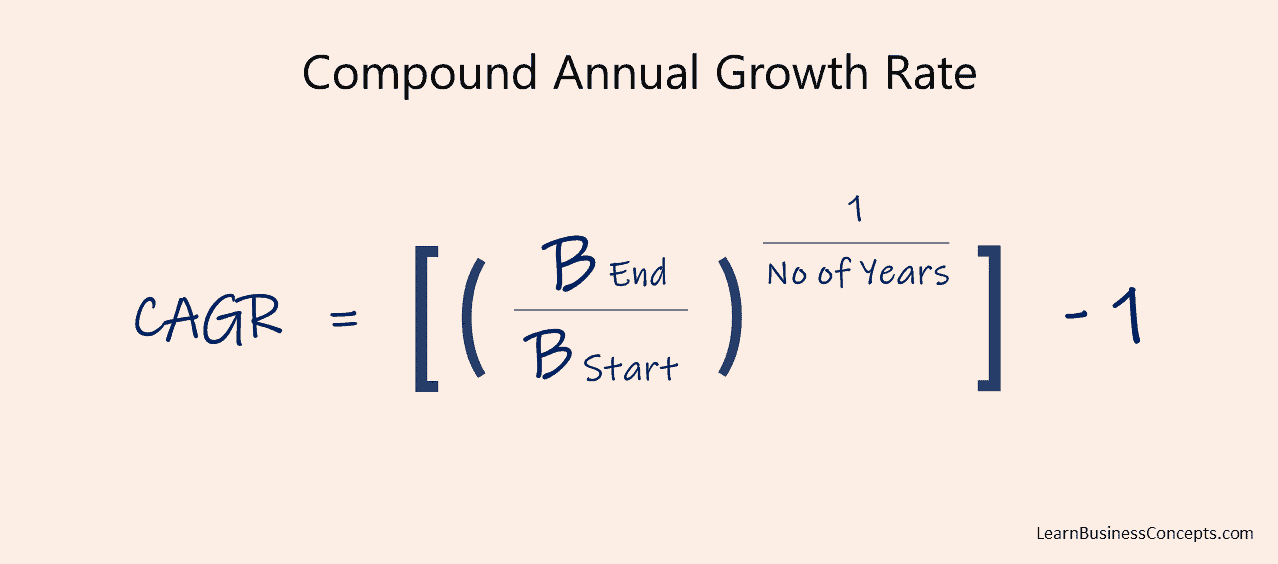

When it comes to understanding financial growth rates, it’s important to know how to calculate the Average Annual Growth Rate (AAGR). This calculation is a great way to measure the annual performance of an investment or company. AAGR is a simple calculation that takes the growth rate of a company or investment over a period of time, usually several years, and averages it out. This calculation is useful for investors to see the long-term performance of a company or investment and can help inform decisions about whether or not to invest. Examples of AAGR calculations are the percentage rate of change between the beginning and ending values over a period of years, or the compound annual growth rate (CAGR) of an investment over a period of time. With AAGR calculations, investors can easily see the performance of a company or investment and make educated decisions about their investments.