Are you looking to better understand your available balance and what it means for your financial situation? Available balance is an important concept to understand when it comes to managing your finances and it can help you make better decisions with your money. In this article, we’ll take a closer look at what an available balance is, how it is calculated, and the implications it has for your finances. We’ll also explain how having a good understanding of your available balance can help you stay on top of your financial goals. Get ready to learn more about available balance and how it can help you manage your money!

What is Available Balance and How Does It Affect Your Finances?

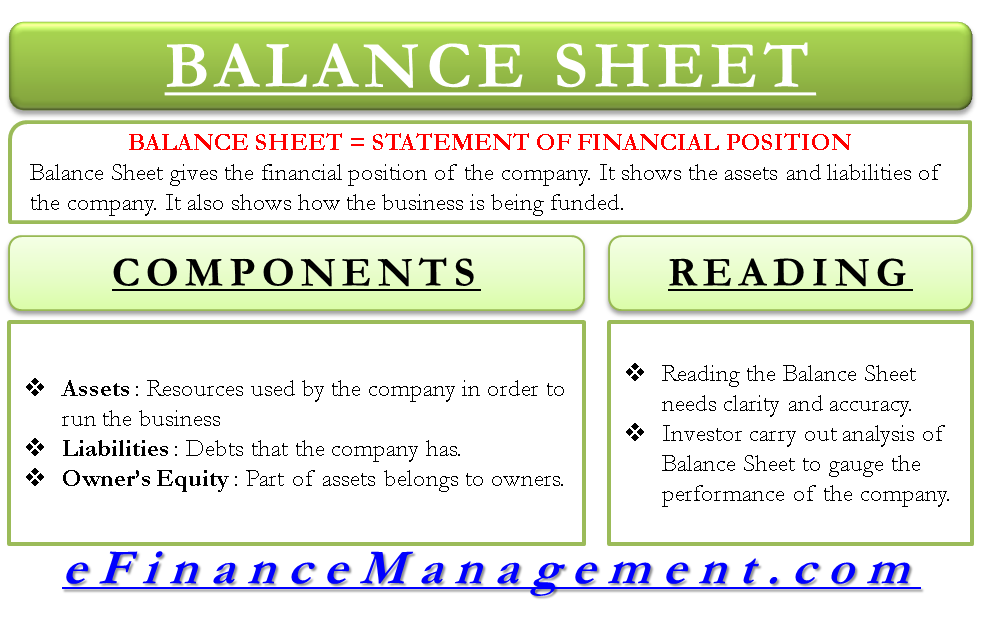

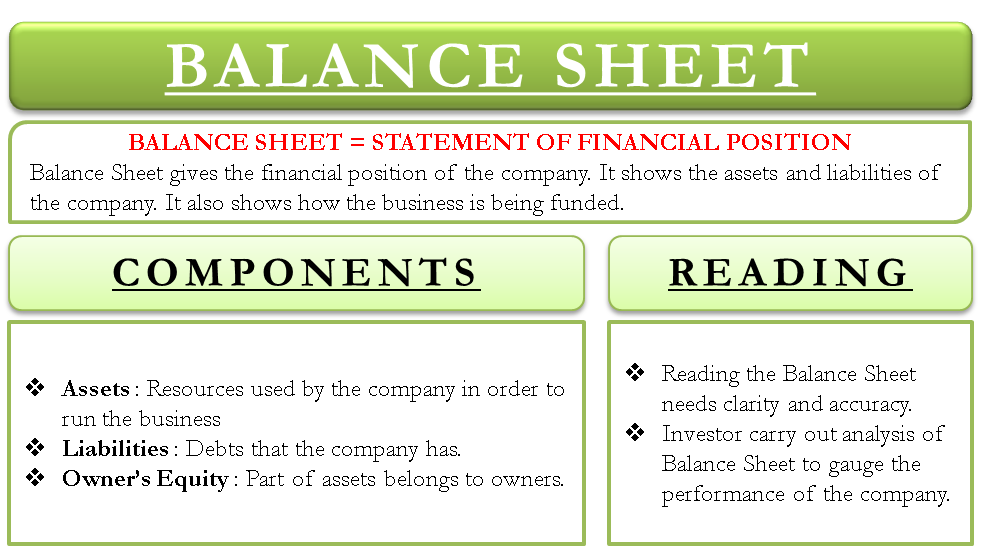

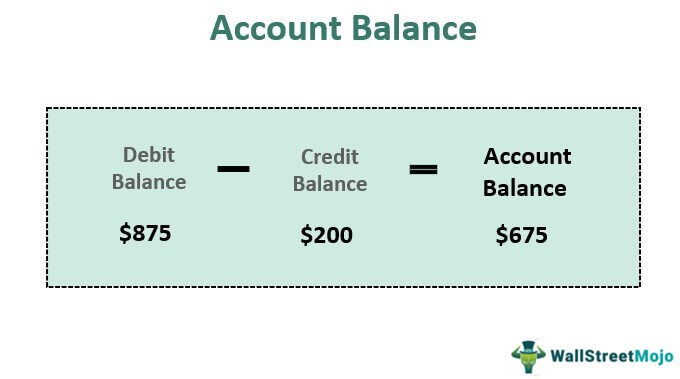

Available Balance is a term used to describe the amount of money in a bank or financial account that can be used for spending or investing. It’s important to understand what your available balance is, as it can have an impact on your financial decisions. Knowing your available balance can help you budget more effectively, avoid overdraft fees, and make sure you have enough money to cover your bills. It’s also important to remember that your available balance may not reflect your total account balance, as there may be other funds in your account that have not yet been made available for use. Knowing your available balance can help you make better financial decisions and be more mindful of your spending habits.

Understanding the Different Types of Available Balance

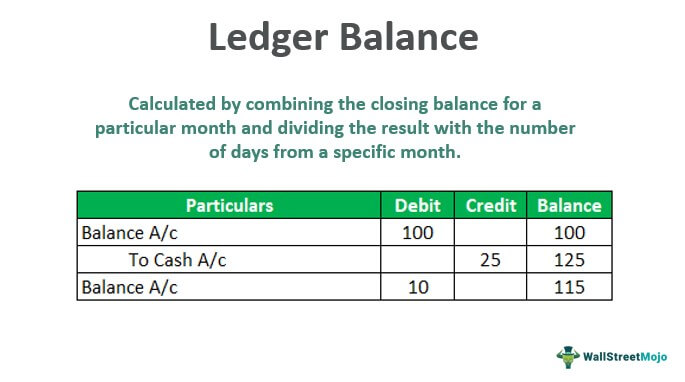

When it comes to managing your finances, understanding your available balance is key. Available balance is the amount of money in your account that you’re able to spend or withdraw. Depending on the type of account you have, there may be different types of available balances. For example, if you have a checking account, your available balance is the amount of money in your account minus any outstanding checks or transactions that have not cleared yet. If you have a savings account, your available balance is the amount in your account minus any deposits that have not yet posted or any withdrawals that have not yet cleared. It’s important to keep track of your available balance to make sure you’re not spending more than you have in your account. Knowing your available balance can also help you plan for future purchases and ensure you don’t overdraft.

How to Maximize Your Available Balance

Maximizing your available balance can help you make the most of your money and achieve your financial goals. It’s easy to do with a few simple steps. First, make sure you’re not spending more than you make each month. Make sure you’re paying down debt and setting aside money for savings. Then, take advantage of cash back rewards or loyalty programs that can help you earn extra money. You can also use budgeting tools to track your spending and make sure you’re staying within your limits. Finally, keep an eye on your credit score and make sure it’s not being negatively impacted by any of your financial decisions. With these tips, you can make sure your available balance is working for you and not against you.

The Pros and Cons of Having a High Available Balance

Having a high available balance has its pros and cons. On the plus side, having a large available balance can provide you with peace of mind and financial security. You’re less likely to incur overdraft fees or be charged for bounced checks. It can also give you access to more credit and loan opportunities, as lenders are more likely to approve requests from those with a larger available balance. On the other hand, having a large available balance can also lead to temptation. You may be more likely to splurge on items you don’t necessarily need or can’t afford. Having a high available balance can also make you a target of fraud, as there’s more money available to be taken. Ultimately, it’s important to find the balance between financial security and spending responsibly.

Strategies to Help You Manage Your Available Balance

If you’re looking to better manage your available balance, there are a few strategies you can use to help you stay on top of your money. First and foremost, you should set a budget and stick to it. Develop a realistic budget and make sure you’re only spending what you can truly afford. Second, you should research potential investments and opportunities to maximize your available balance. Look into stock market investments, real estate, and any other potential investments that could help you increase your available balance. Additionally, you should look into ways to minimize your spending to ensure that you’re saving as much as you can. By cutting back on unnecessary expenses and utilizing coupons and discounts, you can maximize your available balance. Finally, if you’re looking to make extra money, consider taking on a side hustle or freelance gig to help boost your available balance. With a little bit of research and dedication, you can easily find ways to make extra money and increase your available balance.