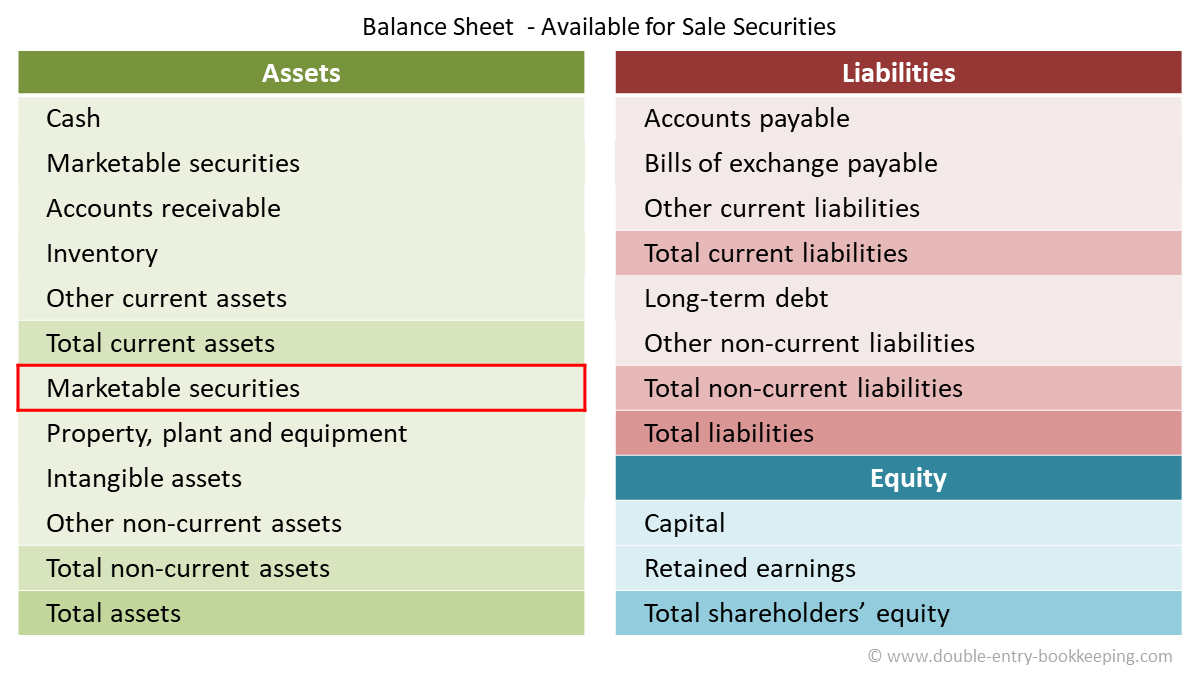

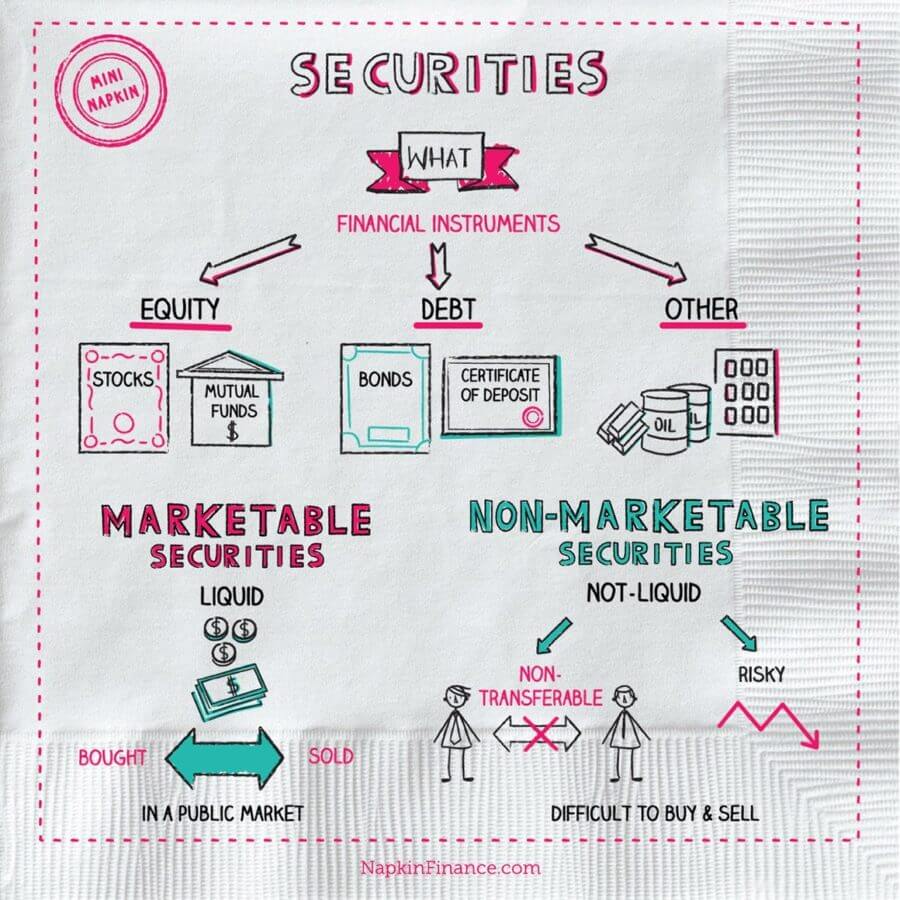

An available-for-sale security is a type of financial security that is bought and sold in the secondary market. These securities are usually traded on a major exchange, such as the New York Stock Exchange or Nasdaq, and can be bought and sold by individual investors as well as financial professionals. Investing in available-for-sale securities can be a great way to diversify and manage risk, as the security can be sold at any time if needed. This article will explain the basics of available-for-sale securities, including the different types, advantages, and disadvantages.

Exploring the Risks and Benefits of Available-for-Sale Securities

Available-for-Sale Securities can be a great way to diversify your portfolio and make sure you’re getting the most out of your investment. But it’s important to weigh the risks and benefits before you decide to go with this type of security. The biggest risk associated with Available-for-Sale Securities is the potential for price fluctuation. Since the market can be unpredictable, it’s possible that the price of the security could drop drastically and cause you to lose money. On the other hand, if the market is stable, you could potentially make a large profit. When weighing the risks and benefits, it’s important to consider the current market conditions and the potential for the security to increase or decrease in value. Additionally, you should be aware of any associated fees or taxes that you may incur from investing in Available-for-Sale Securities. Doing your research is key to making sure that you make the best decision for your portfolio.

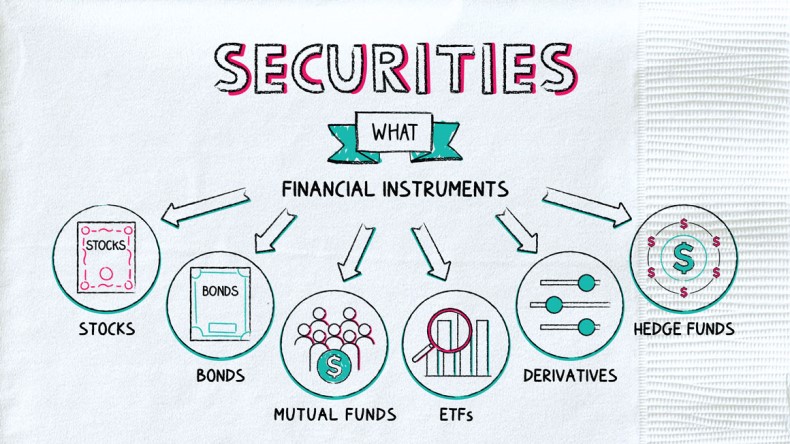

Understanding the Various Types of Available-for-Sale Securities

For those looking to invest in the stock market, available-for-sale securities are a great option to consider. These securities can come in a variety of forms, including bonds, stocks, and mutual funds, and are typically acquired and sold on the open market. When investing in available-for-sale securities, it’s important to understand the different types available and the potential risks associated with each. Bonds are a popular type of available-for-sale security that typically offer a fixed rate of return over a set period of time. Stocks, on the other hand, are a more volatile form of security that can offer substantial gains or losses depending on the market. Mutual funds, meanwhile, allow investors to pool their money together and invest in a variety of securities at the same time. Understanding the various types of available-for-sale securities is essential when making an informed investment decision.

How to Evaluate the Financial Performance of Available-for-Sale Securities

Evaluating the financial performance of available-for-sale securities can be a tricky task. It’s important to understand the market factors that affect the value of the security and the underlying economic conditions. First and foremost, investors should consider the security’s liquidity and volatility when determining its financial performance. The liquidity of a security helps to determine how quickly it can be sold and the volatility of a security helps to determine how much its price may change over time. Investors should also consider the interest rate environment, the current credit quality of the issuer, and the security’s risk profile. All these factors can have a major impact on the security’s financial performance. Additionally, investors should do their own research on the security and consult with a financial advisor to make sure they’re making the right decision. Taking the time to properly evaluate the financial performance of available-for-sale securities can help investors make smart and profitable investments.

The Tax Implications of Investing in Available-for-Sale Securities

Investing in available-for-sale securities can be a great way to diversify your portfolio and earn a return on your investments. However, it’s important to be aware of the tax implications of your investments before you begin. Generally, available-for-sale securities are taxed as capital gains when you sell them, which means you’ll be taxed on the difference between the purchase price and the sale price. Depending on the length of time you held the security, the amount of tax you’ll have to pay could be significantly different. Long-term capital gains (held for more than a year) are taxed at a lower rate than short-term gains (held for less than a year). It’s important to understand the tax implications of your investments before you make them so you know what you’re getting into.

Tips for Effectively Managing Available-for-Sale Securities Portfolios

When it comes to managing available-for-sale securities portfolios, it’s important to stay on top of market trends, do your homework on each company’s financials, and practice good portfolio management habits. Having a good grasp on the types of investment securities that are available to you and how they behave in different market conditions will help you make informed decisions and maximize your returns. Additionally, it’s important to keep your portfolio diversified, and to monitor and rebalance it regularly to ensure that it’s working for you. Taking time to research and understand the different types of investments available for sale and the risks and rewards associated with them can help you build a portfolio that will provide you with the best chance of achieving your financial goals.