Autoregressive (AR) models use historical data to predict future outcomes. AR models are a powerful tool for financial forecasting and can help investors and traders make better decisions. AR models are rooted in statistics and are based on the assumption that past events are likely to recur in the future. These models are used in a wide range of applications such as stock market analysis, sales forecasting, and currency exchange analysis. In this article, we will discuss what an autoregressive financial definition is, its advantages, and how it can be used to make better decisions in the financial markets.

Overview of Autoregressive: What It Is and How It Works

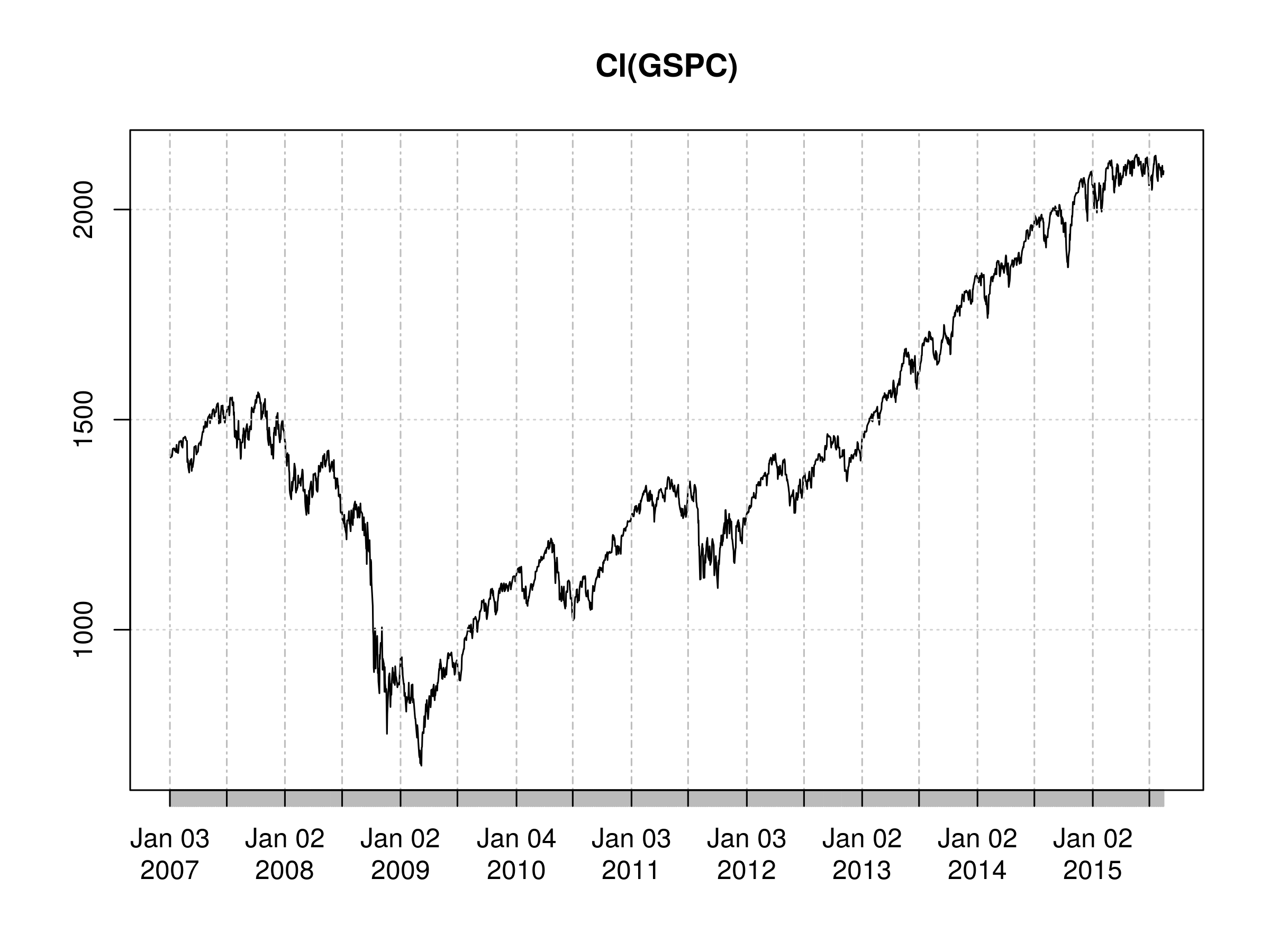

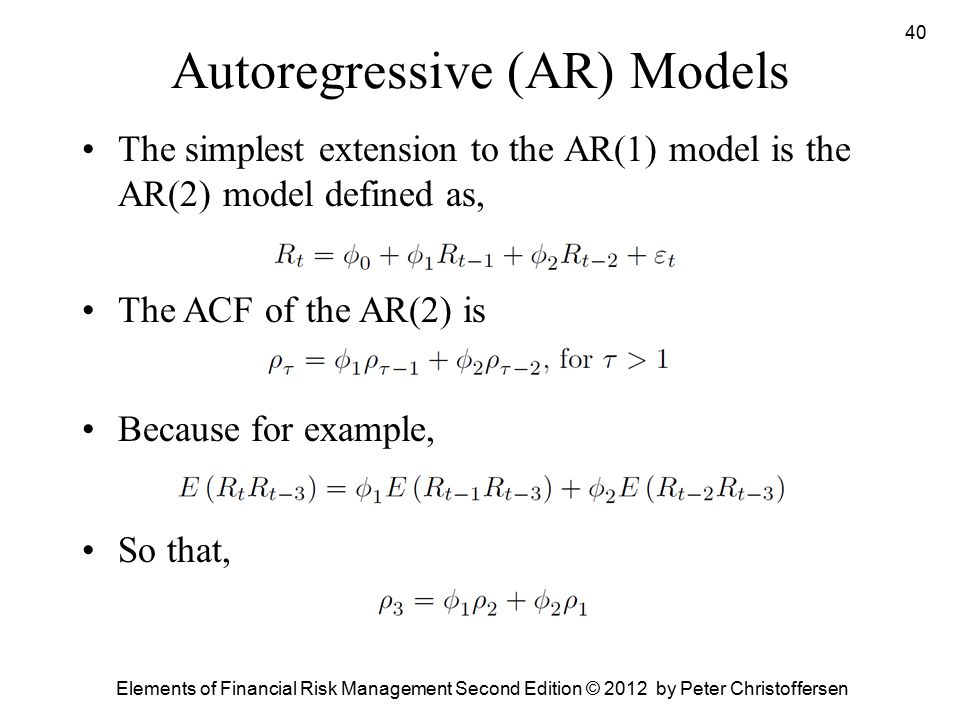

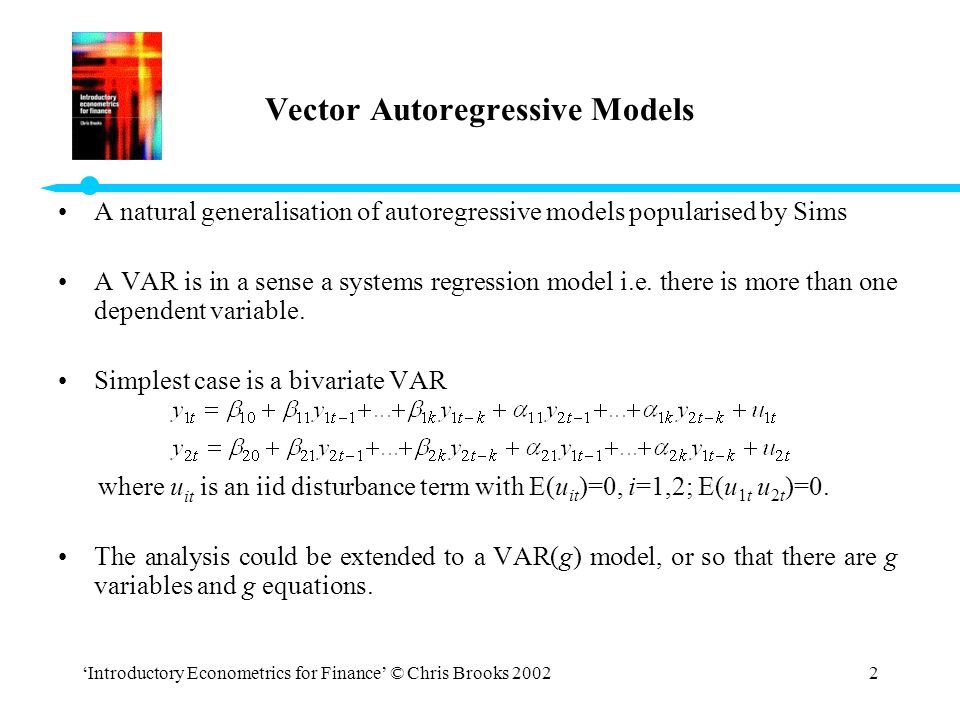

Autoregressive (AR) is a type of statistical model used to analyze and predict future events or values based on past data. It works by taking past data points and using them to create a regression equation which can be used to predict future outcomes. AR models are often used in financial forecasting, as they can be used to predict stock prices and other financial data. AR models are also used in time series analysis, which is a type of statistical analysis that looks at how a variable changes over time. AR models are powerful tools that can be used to identify patterns and trends in data and to make predictions about future values.

What Are the Benefits of Autoregressive Financial Models?

Using autoregressive models in financial analysis is a great way to get a handle on complex data sets. Autoregressive models help identify relationships between variables and allow economists to make accurate predictions. The benefits of using autoregressive models are numerous. Autoregressive models are relatively simple to use and can provide an accurate picture of the future of a given financial system. They are also useful for forecasting the volatility of a given asset, as well as for providing an understanding of the underlying dynamics of an economy. Autoregressive models can also help with making decisions about investments, as they can provide an accurate picture of the future of a given financial system. Autoregressive models can also be used to identify trends in a given market, allowing investors to make more informed decisions. Overall, autoregressive models are a powerful tool for financial analysis and can provide valuable insights into the future of a given market.

Understanding Autoregressive Financial Definitions

Autoregressive financial definitions are a type of technical analysis used to analyze the past performance of stocks, commodities, and other assets. Autoregressive models make predictions about future price movements by looking at the past behavior of a particular asset. It takes into account factors such as past market trends, economic indicators, and other factors that can influence financial markets. Autoregressive models are often used in combination with other types of technical analysis to create a more comprehensive analysis of the asset. Autoregressive models are one of the most popular technical analysis tools used by traders and investors to make decisions about their investments. They are an effective tool that can help traders make well-informed decisions and have been used to great success by many successful traders.

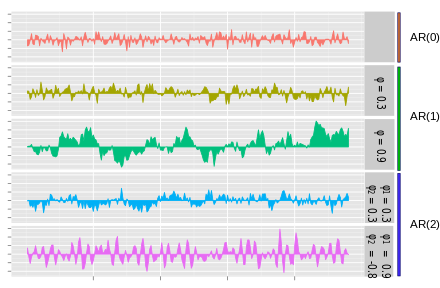

Examples of Autoregressive Financial Models

Autoregressive models are used in finance to predict future values of a given variable based on past values. These models are used to analyze time series data, and they are incredibly useful in forecasting future trends. Autoregressive models work by using past values of a given variable to predict future values. By analyzing a set of values, the model can attempt to identify patterns and use them to make predictions. Autoregressive models are used in a variety of financial areas such as stock market forecasting, risk analysis, and portfolio optimization. Examples of Autoregressive financial models include Autoregressive Moving Average (ARMA) models, Autoregressive Integrated Moving Average (ARIMA) models, and Autoregressive Conditional Heteroskedasticity (ARCH) models. Each model is used to capture different patterns in the data and make more accurate predictions. Autoregressive models are extremely powerful tools used by financial analysts to make informed decisions about the future.

How to Avoid Plagiarism When Using Autoregressive Financial Definitions

Using Autoregressive financial definitions can be tricky and it’s important to make sure you’re not plagiarizing. To avoid plagiarism, be sure to understand the material and then write it in your own words. Make sure to use different sentence structure and language than the original source to give your writing a unique spin. Avoid copying and pasting from the original source and instead, cite it and use it as a reference. Utilizing tools like a plagiarism checker can also help to make sure you’re not inadvertently plagiarizing. By taking the time to properly read and understand the Autoregressive financial definitions you’re using and then writing your own unique take, you’ll be able to avoid plagiarism and keep your writing fresh and original.