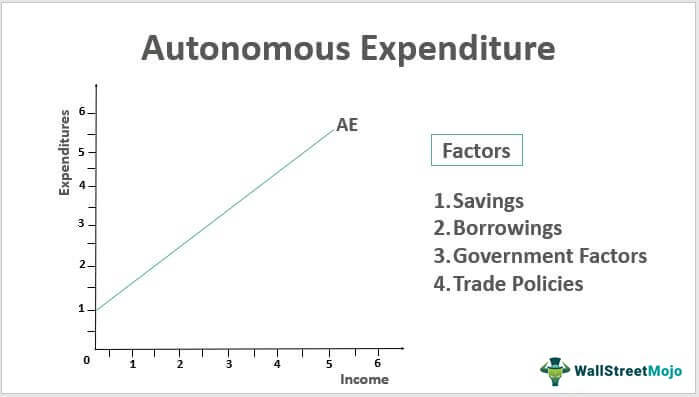

Autonomous Expenditure is an important concept in economics, as it refers to the part of spending in an economy that occurs regardless of changes in income levels. Autonomous Expenditure affects the overall economic health of a country, as it is the amount of money that is spent regardless of economic conditions. It is also a key factor in economic policies and fiscal decisions, as it can determine how much total spending is available. In this article, we’ll discuss the concept of Autonomous Expenditure and how it affects the economy.

Overview of Autonomous Expenditure – What it is and How it Works

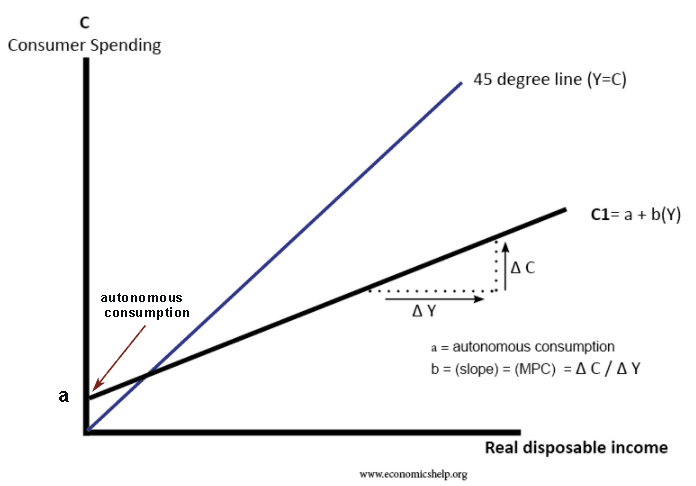

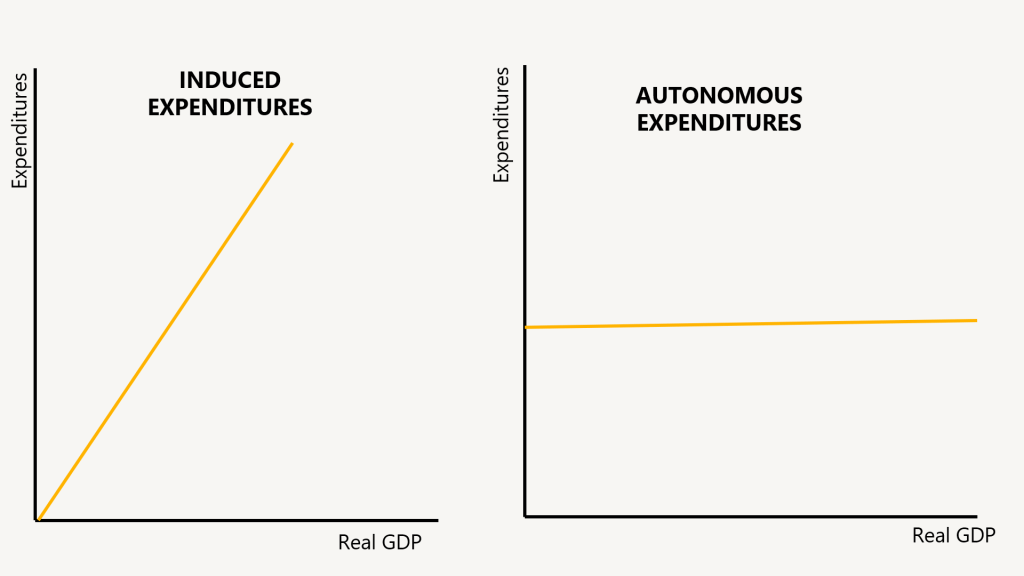

Autonomous expenditure, or autonomous consumption, is an important concept in economics. It refers to the sum of all consumer spending that occurs regardless of changes in income or the level of economic activity. This means that autonomous expenditure is not affected by the level of disposable income, and is not affected by changes in the economy such as recessions or expansions. Autonomous expenditure is the cornerstone of any fiscal or monetary policy, as it is the foundation upon which all other forms of consumer spending rest. It is also the main driver of economic growth, as it is the base of consumer spending that stimulates aggregate demand. Autonomous expenditure is a great tool for governments and central banks to use to stimulate the economy and ensure economic stability. It works by increasing consumer spending, which in turn stimulates business investment and economic activity. By understanding autonomous expenditure and how it works, governments and central banks can better manage the economy and ensure that economic growth occurs.

Different Types of Autonomous Expenditure

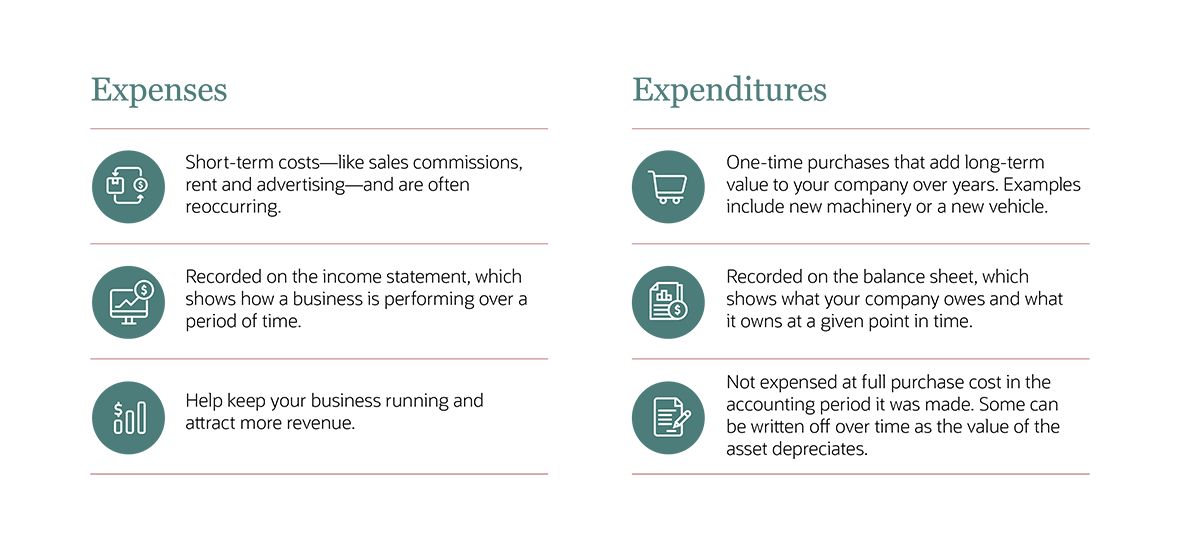

Autonomous expenditure is an important concept when it comes to understanding how the economy works. Autonomous expenditure refers to spending that occurs regardless of the level of disposable income or economic activity in a given area. This type of spending is typically driven by non-economic factors like population growth, government policy, and changes in consumer tastes and preferences. There are several different types of autonomous expenditure, each of which has its own unique impact on the economy. Investment spending is one of the most common forms of autonomous expenditure. This type of spending is driven by business decisions to invest in new equipment, technologies, and other resources in order to increase production and efficiency. Similarly, government spending is another type of autonomous expenditure, as it is largely driven by political decisions rather than economic factors. Government spending can include expenditures on infrastructure, defense, and social welfare programs. Lastly, consumer spending is another type of autonomous expenditure. This type of spending is driven by changes in consumer preferences and tastes, rather than changes in disposable income or economic activity. Examples of consumer spending include purchases of new cars, vacations, and entertainment. As these types of spending are largely driven by non-economic factors, they can often have a significant impact on the economy and are thus important to

Benefits of Autonomous Expenditure

Autonomous expenditure is a great way to bolster your financial security. It’s simply the act of setting aside money each month for expenses that you expect to come up. This could be anything from car insurance to groceries. By setting aside money each month for these expected expenses, you can rest assured that you’ll have the money to cover them without having to worry about dipping into your savings or taking out a loan. Autonomous expenditure can also help you budget more effectively, as you’ll know exactly how much money you need to cover your expenses and won’t have to worry about going over budget. Additionally, your money goes farther when you plan ahead, as you can take advantage of sales and discounts by purchasing items in advance. Autonomous expenditure is a great way to ensure that you always have the funds necessary to cover your expected expenses.

Challenges and Risks Associated with Autonomous Expenditure

Autonomous expenditure can be a great way to make your money work for you without having to worry about managing it all the time. However, it does come with some risks and challenges associated with it that you should be aware of. One challenge is that it can be difficult to keep track of your autonomous expenditure and make sure it’s going where you want it to. Another risk is that you may end up spending more than you plan to, as autonomous expenditure can be hard to control and monitor. If you’re not careful, you could end up spending more money than you intended. Finally, you’ll also need to consider the tax implications of autonomous expenditure and make sure you’re following the laws in your area. While autonomous expenditure can be a great way to make your money work for you, it’s important to be aware of the risks and challenges associated with it, and to make sure you’re taking the necessary steps to protect your financial health.

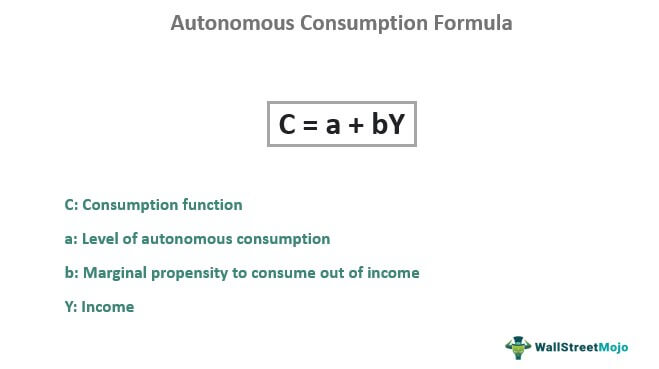

How to Calculate Autonomous Expenditure

Autonomous expenditure is an important part of any budget. Knowing how to calculate it can help you make better financial decisions. Autonomous expenditure is the spending you do without expecting to receive any income in return. This could include savings, taxes, and other non-discretionary expenses. To calculate your autonomous expenditure, start by listing out all of your non-discretionary expenses, such as rent, utilities, insurance, and car payments. Then add in any savings and taxes you need to pay. Finally, total up the numbers and subtract them from your total income. This will give you your autonomous expenditure. Knowing your autonomous expenditure can help you make better decisions about discretionary spending, and it’s an important part of budgeting.