Asset Retirement Obligation (ARO) is an accounting term that describes the estimated costs associated with the removal and disposal of tangible long-term assets. It is important for businesses to plan for these costs in order to ensure that they are able to meet their financial obligations in the future. Understanding the implications of Asset Retirement Obligations can help businesses make better financial decisions, plan for the future, and remain compliant with regulations. In this article, we will discuss what an ARO is, how it works, and why it is important.

Overview of Asset Retirement Obligation

An Asset Retirement Obligation (ARO) is a liability associated with the retirement of a long-term asset. It’s important to consider the financial impact of an ARO when making investments or business decisions. For example, if you’re purchasing a factory that has an ARO associated with it, you must factor in the cost of decommissioning and disposing of the asset when making your decision. AROs are also important from a regulatory and environmental standpoint; these obligations must be taken into account when assessing the long-term impact of proposed projects. Companies must also consider their impact on the environment when making decisions about asset retirement. Understanding and accounting for Asset Retirement Obligations is an important part of any modern business plan.

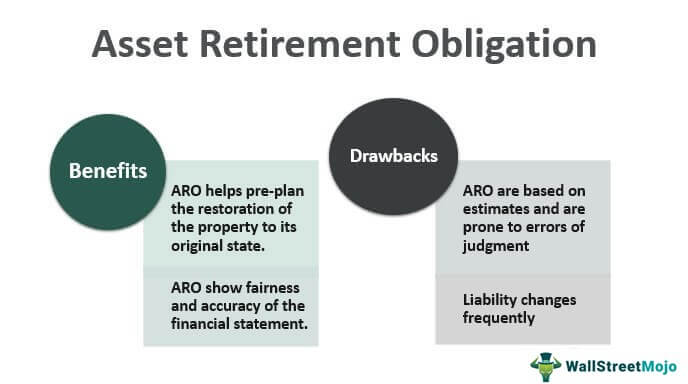

Advantages and Disadvantages of Asset Retirement Obligation

An Asset Retirement Obligation (ARO) is a legal obligation to decommission and restore an asset to its original state once it has reached the end of its life. An ARO is a common feature in many industries, such as the oil and gas, power, and mining sectors. While the advantages of an ARO may seem obvious, there are some potential disadvantages that should be considered. One of the primary advantages of an ARO is that it provides a degree of certainty regarding the costs associated with facility decommissioning. This helps to reduce uncertainty and risk in the early stages of project planning, allowing businesses to make more informed decisions. Additionally, having a clear plan in place for decommissioning and restoration helps to ensure that environmental regulations are met.On the other hand, there are some potential drawbacks to implementing an ARO. One of the main disadvantages is that it can create a large financial burden on the company, especially since the full extent of the costs associated with decommissioning and restoration may not be known until the asset is retired. Additionally, an ARO typically requires a large upfront investment and long-term funding commitments, which can be difficult for some businesses to manage. Finally, an ARO creates a situation where costs are spread

Accounting Treatment of Asset Retirement Obligation

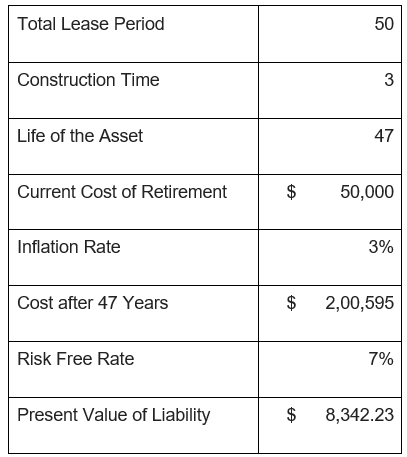

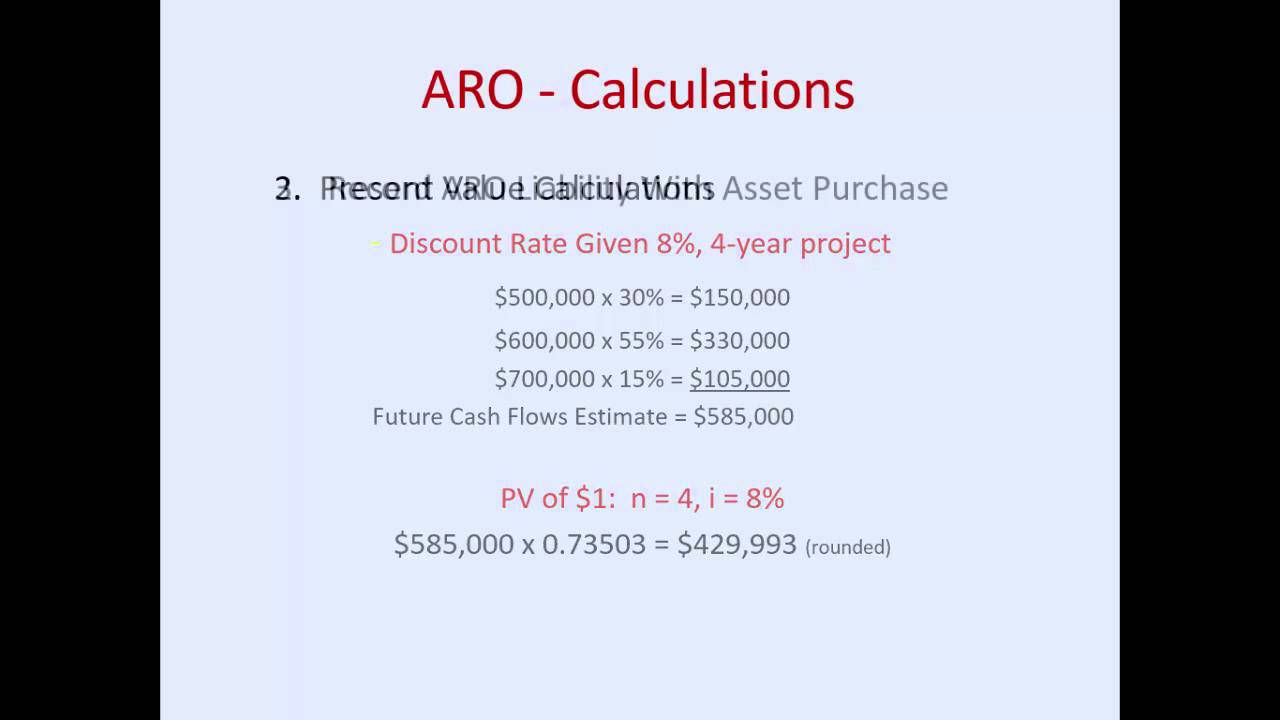

Accounting for asset retirement obligations (AROs) can be a tricky process. AROs are legal obligations that require a company to remove, repair, replace, or restore an asset at the end of its useful life. These obligations must be recognized in the company’s financial statements, and it’s important to understand the proper accounting treatment for these types of liabilities. When recording an asset retirement obligation, the company must estimate the fair value of the liability and record it as a long-term liability on its balance sheet. The company must also record an equal amount as a deferred charge (asset) on its balance sheet. The company must then amortize the deferred charge over the life of the asset. Additionally, the company must record any changes in the fair value of the liability in the period in which the change occurs. Accounting for AROs can be a complex process, and it’s important for businesses to understand the proper accounting treatment for these liabilities. By following the correct accounting process, companies can ensure that their financial statements are accurate and up-to-date.

Compliance Requirements for Asset Retirement Obligation

Asset Retirement Obligation (ARO) compliance requirements are often confusing and overwhelming for many companies. ARO is a legal liability that companies have to incur when they retire assets from their operations. This includes the removal of physical assets, such as buildings and machinery, as well as the clean-up of any environmental damage or contamination from those assets. Companies must adhere to the various regulations related to ARO, such as environmental protection laws, financial accounting standards, and other laws and regulations. Failure to comply with these requirements can result in hefty fines, penalties, and even jail time. To ensure compliance, companies must keep track of their ARO obligations and ensure that they are properly managed and taken care of. This includes keeping accurate records, setting up appropriate financial reporting, and regularly monitoring their ARO obligations. Companies must also ensure they are aware of any changes in the regulatory environment that could affect their ARO compliance requirements. Keeping up with these compliance requirements is essential to ensure your company is compliant and can avoid potential legal and financial consequences.

Strategies for Minimizing Asset Retirement Obligation Costs

Minimizing Asset Retirement Obligation costs can be a tricky process but there are a few strategies you can use to make sure you’re getting the most bang out of your buck. One way to reduce the costs associated with ARO is to make sure you’re properly accounting for the future costs associated with asset retirement. This means taking into account not only the costs related to the immediate retirement of the asset, but also the costs associated with any future maintenance or decommissioning associated with the asset. Another way to reduce costs is to ensure that you are taking advantage of any applicable tax credits and incentives that may be available. Lastly, you may be able to reduce costs by working with vendors and contractors to negotiate better terms and prices. By taking the time to explore these strategies, you can save money and, ultimately, reduce the burden of Asset Retirement Obligation costs.