Asset is an important financial term that is used to describe any item of value that a business, person, or organization owns. Assets can include tangible items such as cash, stocks, bonds, real estate, vehicles, and equipment, as well as intangible items such as patents, copyrights, and trademarks. Knowing what constitutes an asset is essential for understanding financial concepts and managing finances. In this article, we will discuss the definition of asset, different kinds of assets, and how they are used in financial planning.

What are the Types of Assets?

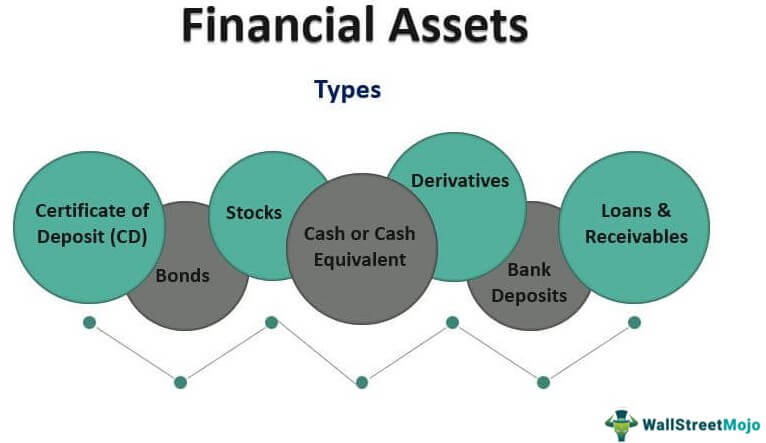

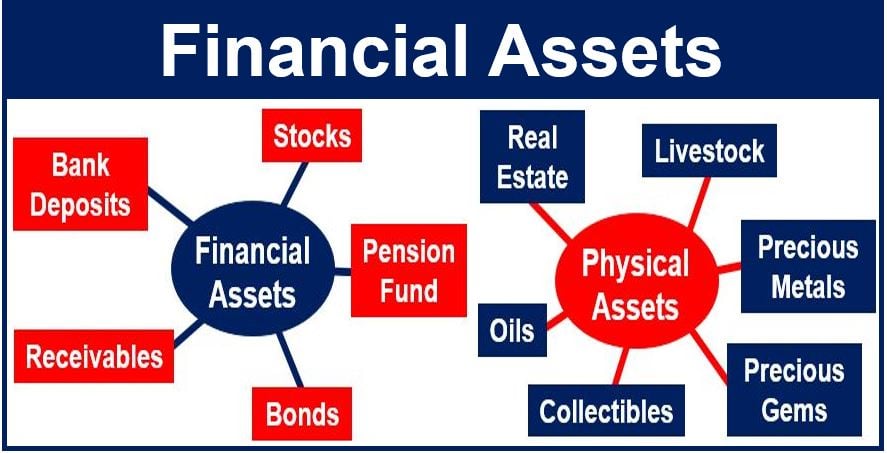

When it comes to managing your finances, understanding the different types of assets is key. Assets can be divided into two broad categories: liquid and non-liquid. Liquid assets are those that can be quickly and easily converted into cash, like stocks, bonds, and cash equivalents. Non-liquid assets, on the other hand, are usually harder to convert into cash and include things like real estate, precious metals, and artwork. It’s important to keep track of your assets and make sure that they fit your individual financial goals. Knowing the different types of assets and how to use them effectively can help you build a strong financial foundation.

What are the Benefits of Assets?

Having assets can be incredibly beneficial to your financial situation. Having assets means that you have something of value that can be used to increase your wealth. Assets can come in the form of real estate, stocks, bonds, mutual funds, cash, and more. When you have assets, you have the ability to generate income from them, as well as build equity in them. You can also use them as collateral for loans or to purchase other assets. Additionally, having assets can provide you with financial security, as you have something of value to fall back on in the event of an unexpected financial crisis. Having assets can also be a great way to build wealth over time, with the potential to increase in value as the market fluctuates.

What are the Different Types of Asset Management?

Asset management is the process of managing a company’s investments and financial resources. It involves creating and managing portfolios of investments and assets, such as stocks, bonds, mutual funds, real estate, commodities, and derivatives. Asset management can be done by individual investors, financial institutions, or by professional asset managers. There are different types of asset management strategies, including passive, active, tactical, and strategic. Passive asset management involves investing in low-cost index funds and ETFs, while active managers use a combination of fundamental and technical analysis to select investments. Tactical asset management involves adjusting the asset mix in a portfolio to capitalize on market trends, while strategic asset management involves creating long-term plans to maximize wealth. Whether you are an individual investor or a financial institution, it is important to have an asset management strategy in place that fits your needs and goals.

How to Effectively Manage Assets?

Managing assets effectively is essential for any business, and there are a few strategies that you can use to make sure everything is running smoothly. First, you should have a clear plan of how you want to use your assets. This might include which assets to invest in, what type of returns you want to see, and which assets should be liquidated. Secondly, you should regularly review your portfolio and assess the performance of each asset. This can help you make adjustments to your plan if needed. Third, you should keep track of your assets and document any changes, such as changes in value or depreciation. Finally, you should ensure that your assets are properly insured to protect them in case of any unforeseen circumstances. Following these steps can help you effectively manage your assets and ensure that you’re getting the most out of them.

What are the Legal Implications of Asset Ownership?

When it comes to owning assets, there are a few legal implications to consider. First and foremost, you must be aware of the laws in your jurisdiction, as they may vary depending on where you live. It’s also important to remember that owning certain assets may come with certain responsibilities. For example, if you own a car, you may be required to register it and carry certain types of insurance. You may also be required to pay taxes on certain types of assets, such as real estate. Additionally, it’s important to know who legally owns the asset, as this can affect your rights and obligations. Finally, it’s important to consider any potential liabilities associated with owning an asset, such as debts that may come with it. Knowing the legal implications of owning an asset can help ensure that you are making the most of your investment.