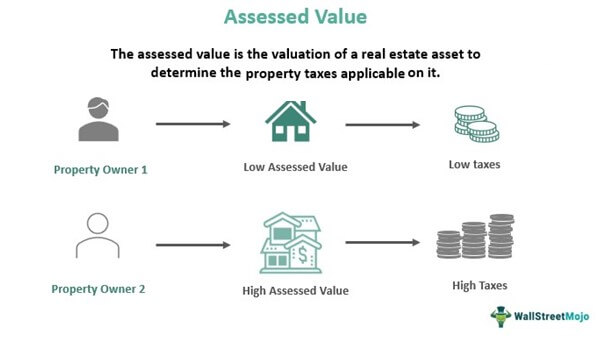

The idea of assessed value is a critical concept to understand when it comes to real estate and finance. Assessed value is the estimated market value of a property as determined by an assessor for the purpose of taxation. It is a key factor in determining the amount of taxes an individual or business must pay on a property. Understanding assessed value is important when deciding to buy or sell a property and when determining the amount of taxes due. This article will provide an overview of what assessed value is, how it is determined, and why it is important.

Definition of Assessed Value: What Does It Mean?

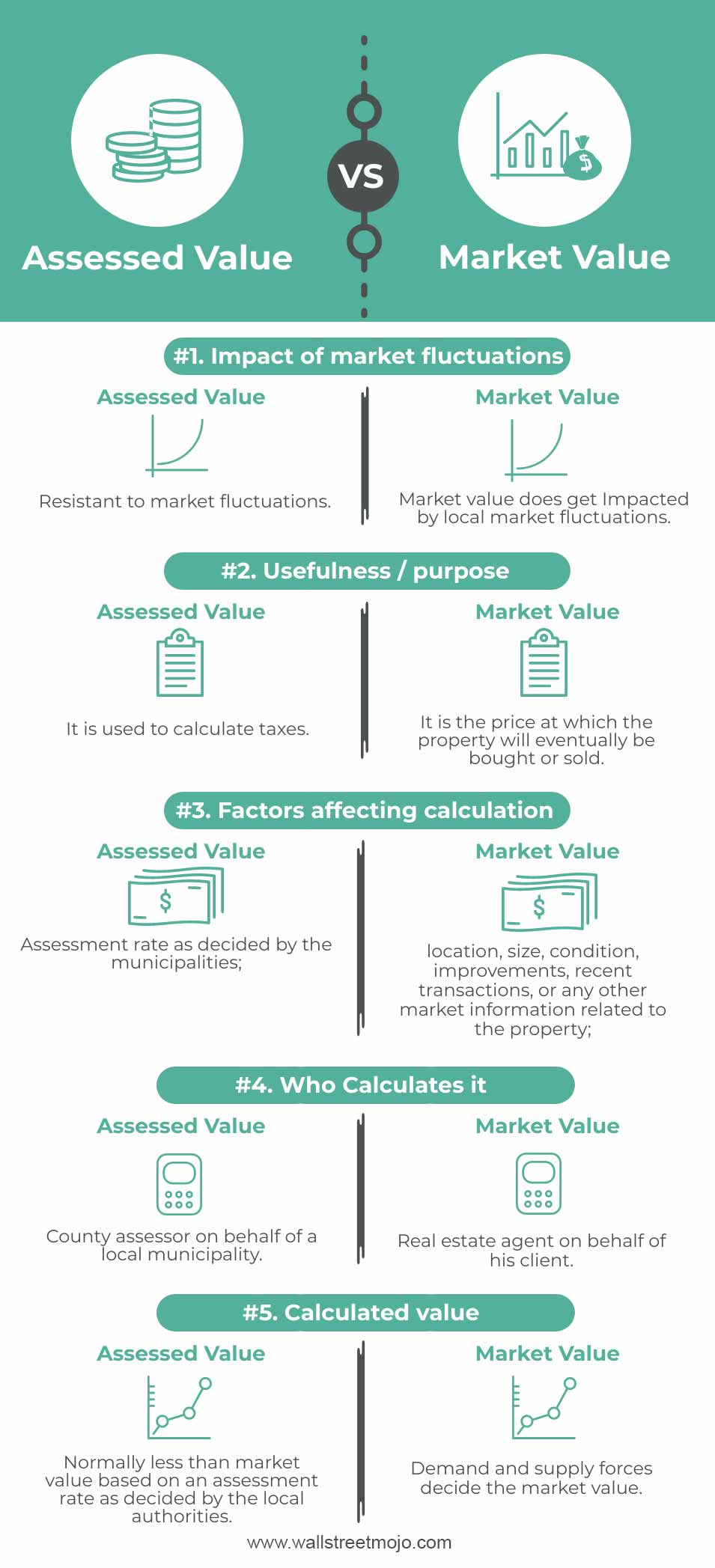

Assessed value is a term used to describe the value of a property or asset that has been determined by a tax assessor. This value is used to determine the amount of taxes that a property owner is responsible for paying. Assessed value is also used in some cases as a measure of the worth of an asset or property for insurance or loan purposes. It is important to note that assessed value is not the same as market value, which is the price that buyers are willing to pay for a property. Assessed value is usually lower than the market value, as it takes into account taxes, fees, and other factors. When it comes to real estate, the assessed value is often the basis for how much a homeowner will pay in property taxes each year. Knowing the assessed value of your property is important in order to ensure that you are paying the correct amount of taxes.

Benefits of Knowing Your Assessed Value

Understanding your assessed value can be incredibly beneficial. Knowing your assessed value can help you understand how much your property taxes will be, and can also help you make informed decisions when it comes to selling your home. Knowing your assessed value can also help you understand how much your home is worth compared to similar homes in your neighborhood. Understanding assessed value can help you stay up to date on the current market value of your home and can help you prepare for any future sales. Knowing your assessed value can be a great asset when it comes to making sure you’re getting the most out of your property.

Calculating Your Assessed Value

Calculating your assessed value is a key step in determining how much you’ll pay in property taxes. Assessed value is determined by your local municipality and is based on the fair market value of your home. To determine your assessed value, your local municipality will take into consideration the size of your home, its age, the condition of the property, the number of bedrooms and bathrooms, the quality of the construction, and the location. Once your assessed value is determined, the local municipality will use this number to calculate your property taxes. You can get an estimate of your assessed value by using online property tax calculators or by visiting your local municipality’s website. Knowing your assessed value can help you budget for your property taxes and make sure you’re not overpaying.

How to Appeal Your Assessed Value

Appealing your assessed value can be a difficult process, but it’s important to know your rights and options when it comes to your property taxes. There are many reasons why you might want to appeal your assessed value, such as if you believe the value is too high or if you’ve made improvements to your home or property. There are specific steps you need to take to make an appeal, such as understanding the assessment process, researching comparable properties, and gathering evidence to support your appeal. You’ll need to submit your appeal to the local assessor in the form of a written request. You might also want to consider hiring a professional appraiser to help you with the appeal process. After you’ve submitted your appeal, you’ll be notified of the assessor’s decision and if necessary, you can take the appeal to a higher authority for review. Understanding the process and gathering all the necessary evidence will help you get a fair result in your appeal.

Common Mistakes to Avoid When Working with Assessed Value

When working with assessed value, it’s important to avoid common mistakes. One of the biggest mistakes is not understanding what assessed value is. Assessed value is the value of an asset or property as determined by an assessing authority, typically for the purpose of taxation. It’s important to get a clear understanding of what assessed value is before you start working with it. Another common mistake is not understanding the impact of assessed value on taxes. Not understanding how assessed value affects taxes could lead to paying too much in taxes or even being under-taxed. Lastly, it’s important to keep in mind that assessed value can change over time, so it’s important to stay up-to-date with the latest assessed value and any changes that may occur. By avoiding these common mistakes when working with assessed value, you can ensure that your taxes are accurate and that you’re not overpaying.