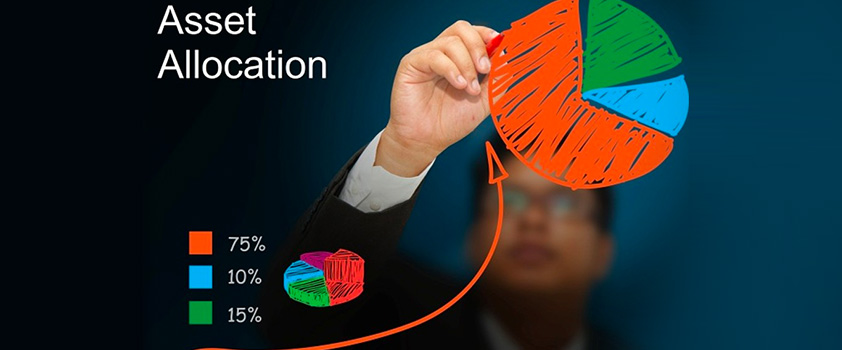

Asset allocation is an important strategy for investors to understand when it comes to managing their portfolios. It is the process of dividing funds among different asset classes such as stocks, bonds, and cash in order to maximize returns while minimizing risk. Asset allocation allows investors to diversify their investments, so that they are not overly exposed to any one asset class. By understanding the basics of asset allocation, investors can create a portfolio that is tailored to their individual goals and risk tolerance.

The Benefits of Asset Allocation and Why It’s Important

Asset Allocation is one of the most important strategies for any investor looking to build a successful portfolio. By diversifying your investments across different asset classes, you can reduce risk while still striving for maximum returns. Asset Allocation allows you to spread your investments across stocks, bonds, and other asset classes, helping you to limit risk and maximize returns, while still providing you with the flexibility to make changes as your needs and goals change. The benefits of Asset Allocation include having a better understanding of your risk profile, reducing volatility, and having a more consistent and predictable return on your investments. It also allows you to adjust and rebalance your portfolio as needed, ensuring that you are always making the best investment decisions for your current financial circumstances. Asset Allocation is an important tool for any investor looking to build a solid portfolio and achieve their financial goals.

Asset Allocation Strategies: What You Need to Know

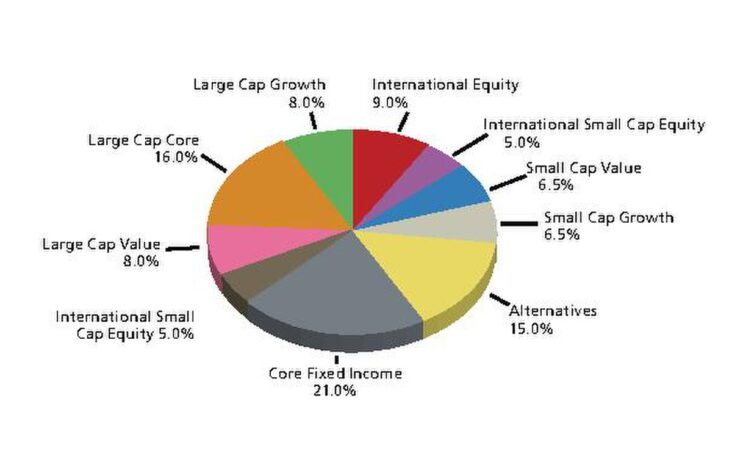

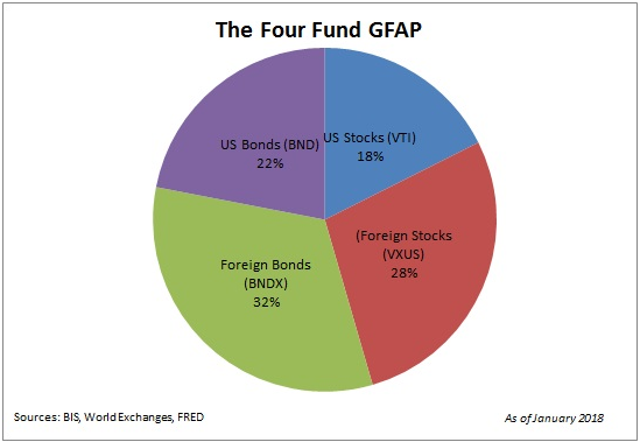

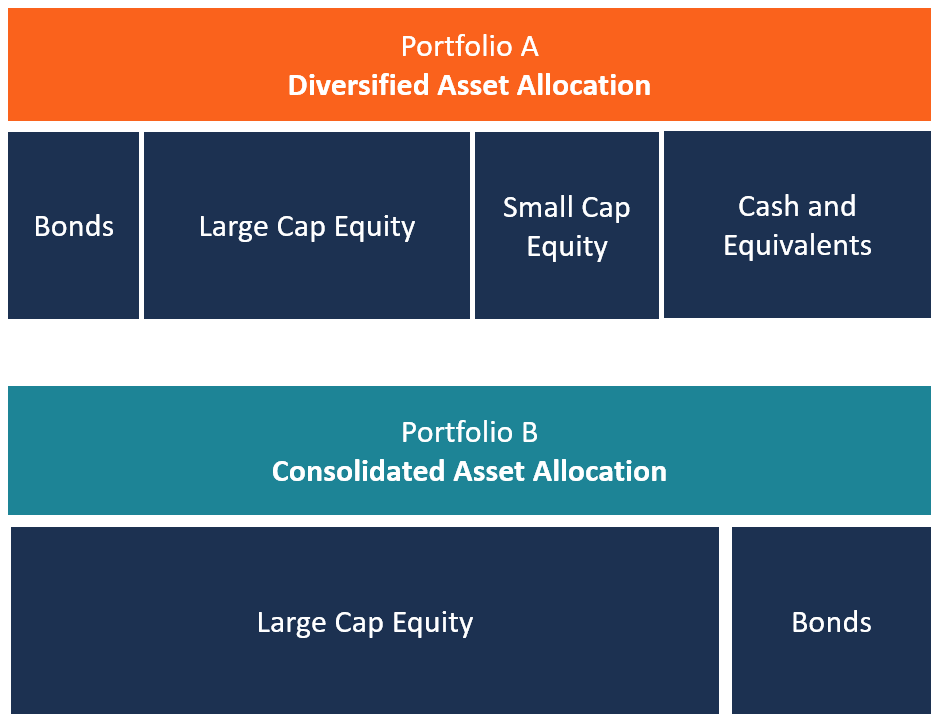

If you’re looking to diversify your investments, asset allocation is the way to go. Asset allocation is a strategy that involves dividing your investments among different asset classes, such as stocks, bonds, and cash, in order to minimize risk and maximize your return. It’s important to understand the different asset allocation strategies, so you know how to invest your money in a way that works best for you. There are several different strategies to choose from, such as equal weighting, sector rotation, and more. Each strategy has its own advantages and disadvantages, so it’s important to do your research and decide which one is best for your individual goals. With the right asset allocation strategy, you can make sure that your portfolio is balanced, diverse, and optimized for the best possible returns.

How to Develop an Asset Allocation Plan

When it comes to investing, an asset allocation plan is essential. It’s the best way to diversify your portfolio and ensure that you’re not putting all your eggs in one basket. Developing an asset allocation plan is easy. First, decide what your goals are and how you want to reach them. Do you want to build long-term wealth or just make a quick buck? Knowing your goals will help you decide what kind of investments you should make. Next, decide on a mix of stocks, bonds, and other investments that will help you reach those goals. You can use online calculators to determine the right mix for your needs. Finally, it’s important to review and adjust your asset allocation plan regularly. As markets and your goals change, you should review your plan and make adjustments to ensure that you’re still on track to reach your financial goals.

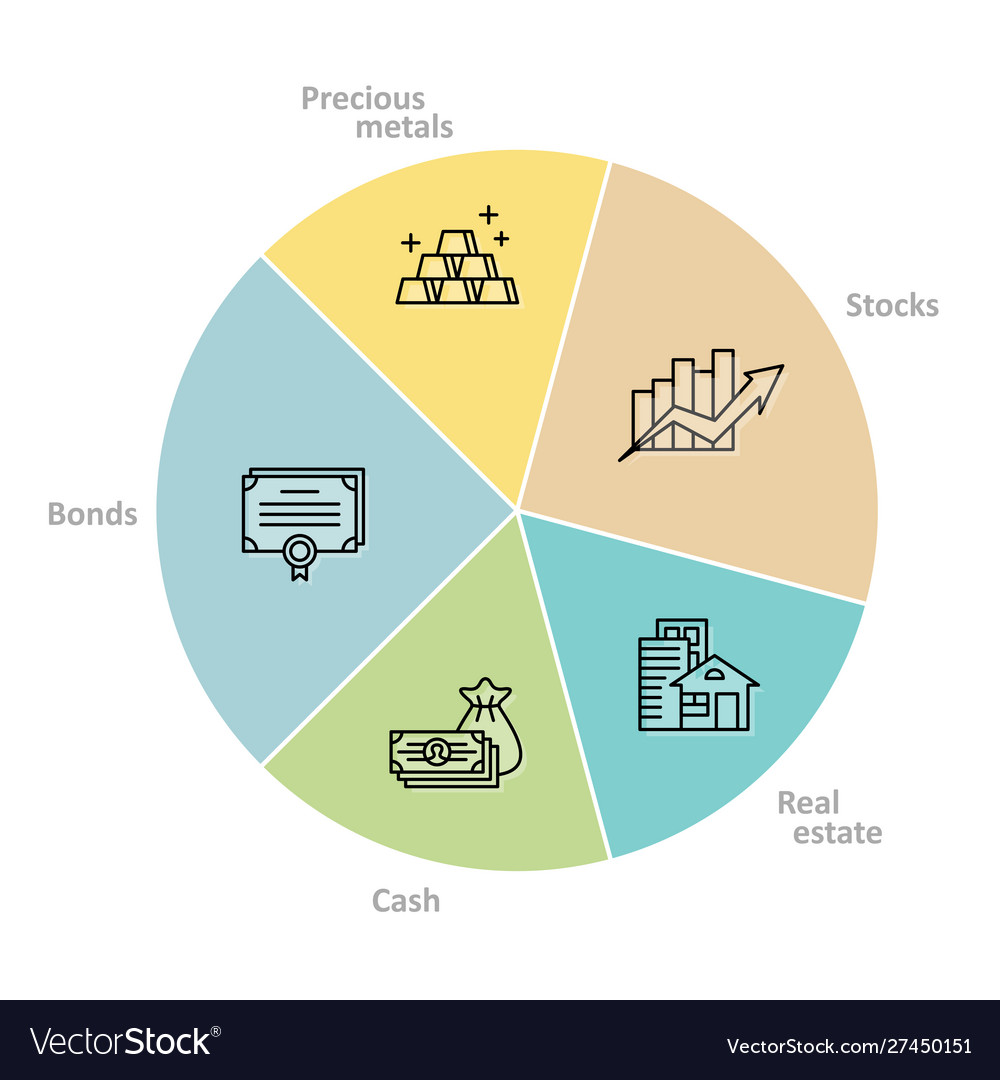

Different Asset Classes and What They Mean

Asset allocation is an important part of any investment strategy. It’s the process of diversifying your portfolio across different asset classes, like stocks, bonds, and cash, to help minimize risk and maximize returns. Different asset classes offer varying levels of risk and return, so it’s important to understand the different types and how they work together to create a balanced portfolio. Stocks are generally considered the riskiest asset class, while bonds are generally considered the least risky. Cash is usually seen as a safe-haven asset, and is often used to provide liquidity in times of market volatility. Allocating your investments correctly across these different asset classes can help protect your portfolio from losses and maximize your returns over the long-term.

Asset Allocation and Risk Management: What You Should Know

Asset allocation and risk management is a crucial part of financial planning that everyone should be aware of. Asset allocation is the process of dividing your investments among different asset classes, such as stocks, bonds, and cash equivalents, in order to balance the risk and reward of your portfolio. This allows you to spread out your investments and minimize the risk of putting all your money in one asset class. Risk management focuses on understanding the different types of risks associated with investing, such as volatility and liquidity risk, and implementing strategies to manage those risks. It is important to understand the different elements of asset allocation and risk management in order to develop an effective investment plan that meets your long-term goals.