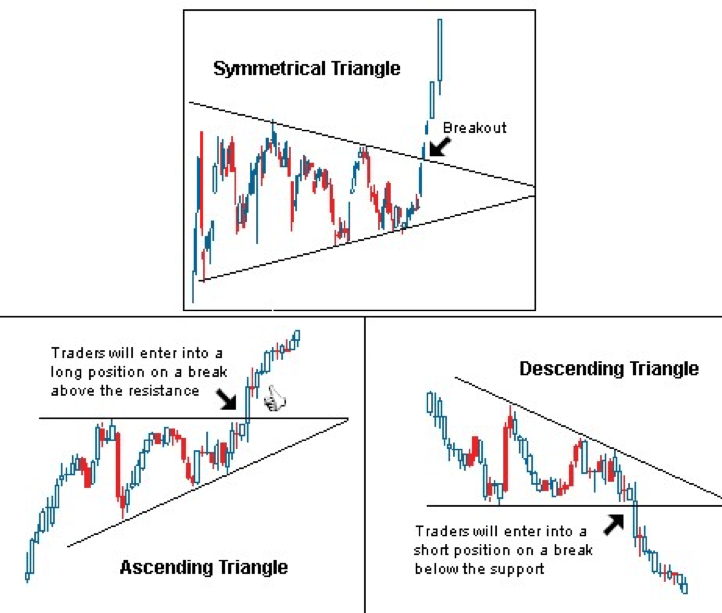

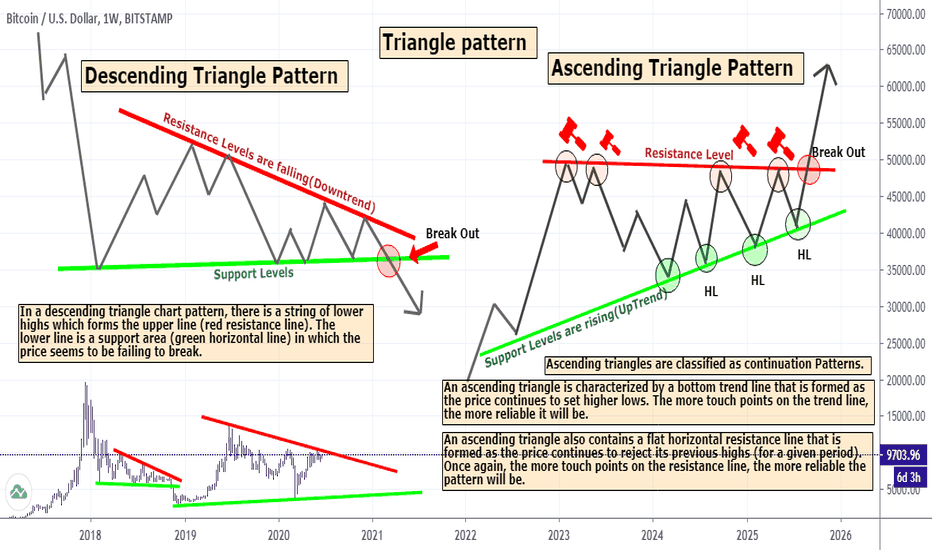

Understanding what an ascending triangle is and what it means for investors is a key element of any successful financial strategy. An ascending triangle is a chart pattern used in technical analysis that is created by drawing one trend line along a series of lower highs and another trend line along a series of higher lows. This can be used to predict potential price breakouts and market direction. This article will discuss the definition of an ascending triangle, its implications for investors, and the potential strategies involved.

Overview of the Ascending Triangle Pattern

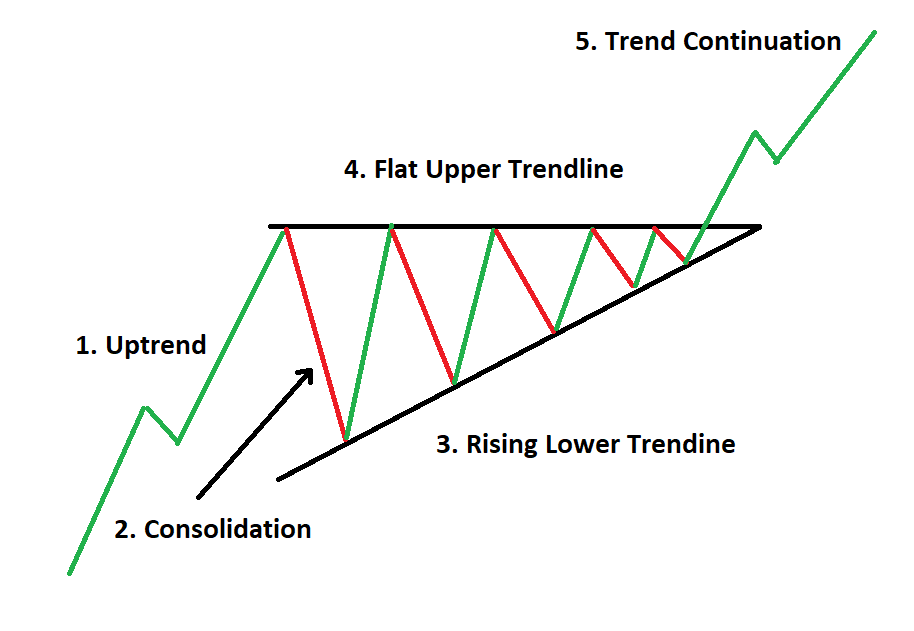

itThe Ascending Triangle pattern is a very popular chart pattern found in financial markets. It is a bullish pattern that is formed when the price of a security is confined within an upward sloping trend line and a flat horizontal resistance line. The pattern is formed over a period of several weeks or months and is a sign of an impending upward price move. Traders use the Ascending Triangle to identify potential buying opportunities. The pattern is created when the price of a security is ranging between a support and resistance level. The support line rises over time, creating the pattern of an ascending triangle. As the price approaches the resistance level, traders may enter a buy position as the pattern suggests a potential breakout above the resistance level. The pattern may also signal a reversal from a downward trend to an upward trend. Traders should also use other technical indicators to confirm the potential breakout.

Benefits of Trading with an Ascending Triangle

An ascending triangle is a great trading pattern to take advantage of if you want to make big profits in the stock market. This pattern is characterized by a horizontal line at the top, with the price gradually moving higher as it approaches the top. The benefits of trading with an ascending triangle are numerous. Firstly, you can get into a trade early and potentially catch a major breakout. Secondly, the pattern also acts as a great way to identify potential support and resistance levels, allowing you to enter and exit your trades with greater accuracy. Finally, the pattern can also be used to gauge market sentiment and help you make better trading decisions. Trading with an ascending triangle can be a great way to maximize your profits and minimize your risk.

Understanding Risk Management with an Ascending Triangle

Understanding risk management with an ascending triangle is an important concept when it comes to investing. An ascending triangle is a chart pattern that can help you make informed decisions about your investments and potentially reduce your risk of losses. This pattern is created when a stock or other asset’s price forms an uptrend that is bounded by two trend lines. The upper trend line is formed by connecting a couple of the asset’s highs, while the lower trend line is formed by connecting a couple of the asset’s lows. When the asset’s price is contained within these two trend lines, it creates a triangle shape. It is important to note that the upper trend line does not need to be completely flat, as it can have some slight variation. However, the overall trend should be upward. The ascending triangle is seen as a bullish pattern, as it typically signals that the asset’s price is likely to break out in an upward direction. This means that investors should be careful when trading on the asset, as they could potentially incur losses. Risk management is key when trading on an ascending triangle, as it can help protect your investment and ensure you don’t lose more than you can afford to.

Recognizing the Possible Breakouts of an Ascending Triangle

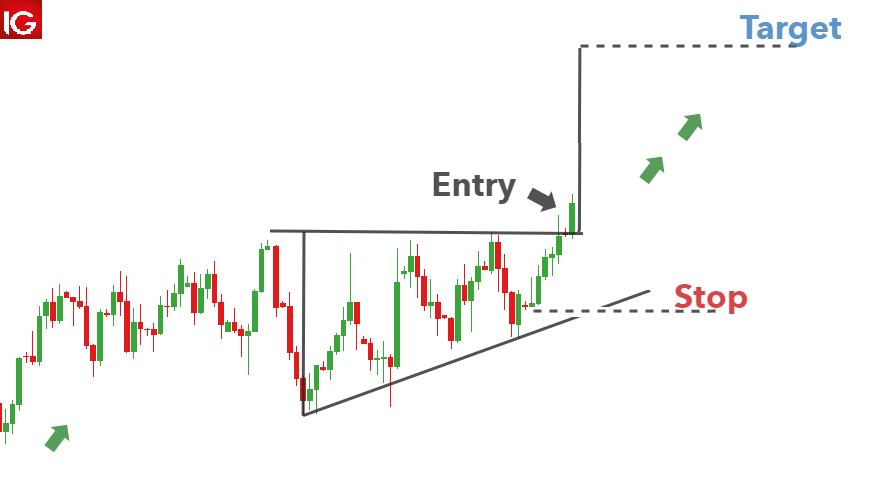

An ascending triangle is a chart pattern that indicates a possible breakout. Recognizing the possible breakouts of an ascending triangle is key in understanding the potential of the pattern. Traders look for a breakout of the upper line of the triangle to signal a strong buy, while a breakout of the lower line of the triangle can indicate a time to sell. It’s important to watch the volume during the triangle formation as it can help confirm a breakout. If the volume is increasing as the triangle forms, it may be a sign that the breakout will be sustained. On the other hand, a decrease in volume could indicate that the breakout may be short-lived. The ascending triangle is a great pattern to identify potential breakouts and can be a great tool for traders to use in the market.

Tips for Trading with an Ascending Triangle

If you’re looking to get into trading, you’re going to want to familiarize yourself with an ascending triangle. An ascending triangle is a chart pattern that typically signals a bullish trend. It’s characterized by a flat upper trend line and a rising lower trend line that converges at a point. By understanding the basics of an ascending triangle, traders can better understand potential future market movements and make more informed trading decisions. Here are some tips for trading with an ascending triangle:1. Look for breakouts: When trading with an ascending triangle, look for a breakout. This would be when the price action has moved above the upper trend line. Breakouts indicate that the trend is continuing and will likely move higher.2. Consider the volume: Another important factor to consider when trading with an ascending triangle is the volume. Generally, a good breakout should come with an increase in volume. If the volume is low, it may indicate a false breakout and the trend may not continue.3. Use a stop loss: When trading with an ascending triangle, it’s important to use a stop loss order. This will protect your position in case the breakout fails or the trend reverses. A stop loss order should