Ascending Channel is an important financial tool used by investors to identify and capitalize on patterns in the stock market. This strategy allows traders to identify upward trends in asset prices and capitalize on them, providing potential profits. As with any investment strategy, however, there are risks associated with Ascending Channel and it is important to assess and understand these before proceeding. In this article, we’ll take a closer look at Ascending Channel to provide you with a better understanding of what it is, how it works, and how to use it to your advantage.

Overview of an Ascending Channel – What Is It and How Does It Relate to Financial Markets?

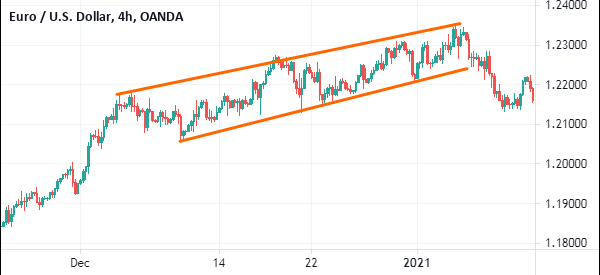

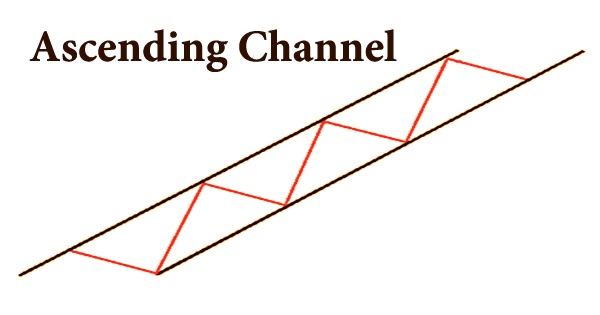

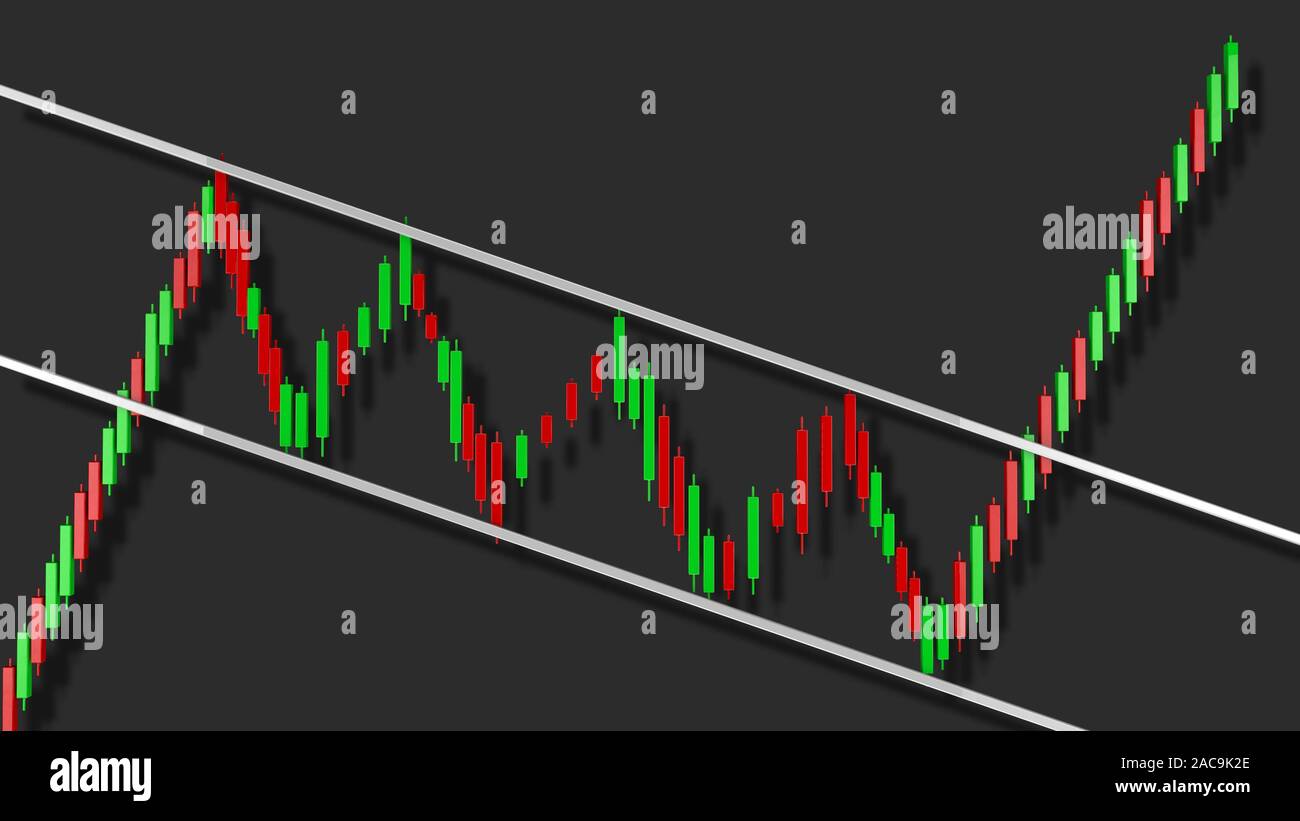

An ascending channel is a tool used by traders to identify trends and confirm potential trade opportunities in the financial markets. It is defined as a chart pattern in which price is moving between two trendlines that are angled upwards. The upper trendline is formed by connecting a series of highs, while the lower trendline is formed by connecting a series of lows. This pattern is indicative of an upward trend and helps traders to identify potential entry and exit points for their trades. This can be a great tool for traders looking to take advantage of short-term trends and make the most out of their investments. An ascending channel can help traders identify buying opportunities if the price breaks above the upper trendline, or selling opportunities if the price breaks below the lower trendline. By using this tool, traders can make informed trading decisions that capitalize on the current market trends.

Analyzing an Ascending Channel – How to Identify and Measure It?

An ascending channel is a powerful type of financial pattern that can help traders make more informed decisions with their investments. To identify an ascending channel, you must look for two upward trends that form together in a parallel line. This creates a channel that demonstrates a steady increase in price over time. To measure an ascending channel, you must first identify the highest and lowest points of the two lines. The higher point is the resistance level while the lower point is the support level. The distance between these two points is the measure of the channel. By understanding this pattern, traders can identify areas of support and resistance and make better decisions when it comes to their investments.

Identifying Trades with an Ascending Channel – What Types of Trades Can You Make?

When trying to identify trades with an ascending channel, there are several different types of trades you can make. One of the most popular is a breakout trade. This involves entering a long position when the price of an asset breaks above the upper line of the ascending channel. This is a sign that the asset is in an uptrend and has the potential to increase further. Additionally, you can take a short position when the price breaks below the lower line of the ascending channel. This signals that the asset is in a downtrend and has the potential to decrease further. Another type of trade is a momentum trade, which involves entering a position when the asset is moving within the channel. This is a sign that the asset is likely to continue in its current direction. No matter what type of trade you decide to make, it’s important to practice proper risk management to ensure that you don’t lose more money than you can afford to.

Benefits of Trading with an Ascending Channel – Advantages and Risks of Using This Pattern

Trading with an ascending channel can be a great way to make profitable investments. The advantages of using this pattern include the potential to identify trends early on, and by using an ascending channel, investors can spot possible entry points with high probability of success. But with any type of trading, there are risks associated, and using an ascending channel is no different. Understanding the risks associated with using this pattern is essential, as it can help you make informed decisions that can lead to successful investments. By knowing the risks and benefits, you can decide if trading with an ascending channel is the right choice for you.

Strategies You Can Use with an Ascending Channel – Tips for Successful Trading with This Pattern

When it comes to successful trading with an ascending channel, there are a few key strategies that you can use to maximize your profits. Firstly, it’s important to remember to keep an eye on the trend line. The trend line indicates the strength of the channel and the direction in which it’s heading. Secondly, it’s important to identify when the upper and lower boundaries of the channel are being tested. This will provide you with an indication of when to enter or exit a trade. Finally, it’s important to think about your risk management when it comes to trading with an ascending channel. You should set stop losses at the lower boundary and take profits at the upper boundary. By following these key strategies, you can ensure you make the most of your trading experience with an ascending channel.