Annualized income is an important concept to understand when it comes to managing your finances and planning for the future. It refers to the total income received over the course of a year, including wages, interest, dividends, and other sources of income. This concept is often used to calculate tax liability and other financial obligations. Additionally, annualized income is a useful tool in determining an individual’s eligibility for certain benefits or programs. Learning the fundamentals of annualized income can be a crucial step in making sure you’re on the right track to achieve your financial goals.

What Are the Different Types of Annualized Income?

When it comes to annualized income, there are a few different types you should know about. One of the most common types of annualized income is salary or wages. This is income earned from an employer for the services you provide. Another type is interest income. This is money earned from investments such as stocks, bonds, and other investments that generate interest over time. Dividend income is income earned from ownership of stocks or other investments that pay dividends on a periodic basis. And finally, passive income is income earned with little to no effort, such as rental income. No matter what type of annualized income you have, it can be a great way to generate a steady stream of income.

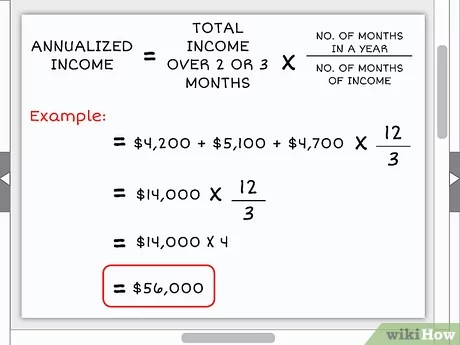

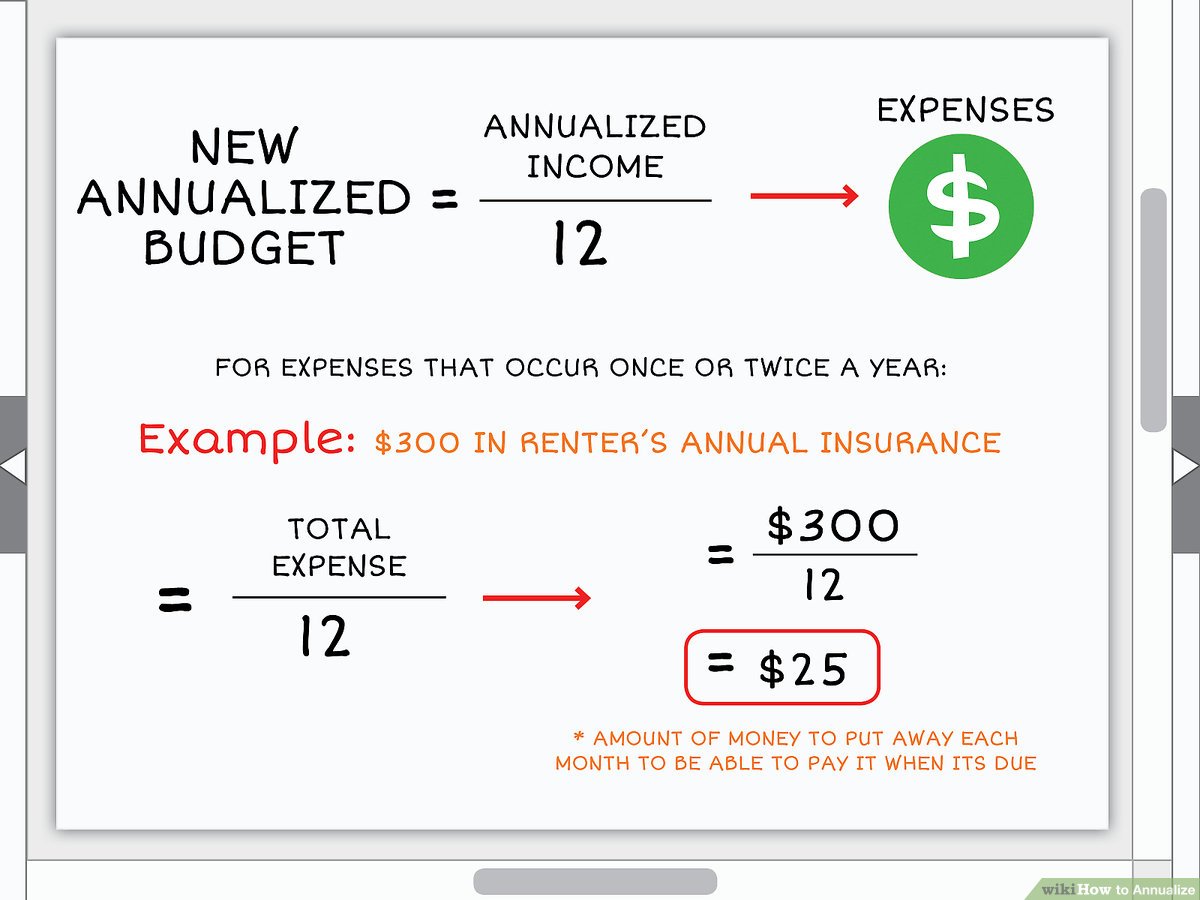

How to Calculate Annualized Income?

Calculating annualized income is an important tool for budgeting and personal financial planning. It’s a way to estimate how much money you make in a year, taking into account any irregular income or one-time payments. To calculate your annualized income, you’ll need to add up all your income sources over a 12-month period, including any bonuses, commissions, or other forms of irregular income. You can then divide the total by 12 to get your annualized income. This figure can help you better plan for expenses and save for the future. If you’re self-employed, annualized income can be especially important, as it can provide a better picture of your overall financial health. Calculating your annualized income can also help you determine if you’re eligible for certain tax deductions or credits.

Benefits of Annualized Income in Tax Filings

One of the biggest benefits of using annualized income when filing taxes is that it can save you a lot of money. The key to annualized income is that it allows you to spread out your income over 12 months, even if you only earned a certain amount in a few months. Because of this, you can end up paying a lower tax rate and avoiding any unnecessary tax penalties. Additionally, it’s a great way to keep track of your income for the entire year in one place, making it easier to make sure you’re paying the right amount of taxes. Annualized income is a great way to make sure you’re filing your taxes correctly and saving as much money as possible.

Reasons to Consider Annualized Income in Financial Planning

Annualized income is a great tool for financial planning, as it allows you to standardize income over a 12-month period. This makes it easier to budget, as you know exactly how much you’ll be bringing in each month. Plus, you can compare your income to the average income in your area, or to other financial goals like saving for retirement. It also helps you plan for unexpected expenses, such as medical bills or unexpected car repairs, since you know exactly how much you have to work with. With annualized income, you can ensure you’re prepared for whatever life throws your way.

Risks Associated with Annualized Income Strategies

When it comes to annualized income strategies, it is important to understand the potential risks associated with them. For example, if an investor has annualized income strategies that are heavily reliant on the stock market, they can potentially face large losses if the market takes a downturn. Additionally, if the investor’s annualized income strategies are based on short-term investments, they can be exposed to high levels of volatility. As such, it is important to understand the risks associated with these strategies before investing in them. Furthermore, it is important to have an understanding of the economic cycle, since economic conditions can have a direct impact on the performance of these strategies. Finally, investors should consider their own risk tolerance when determining whether an annualized income strategy is right for them.