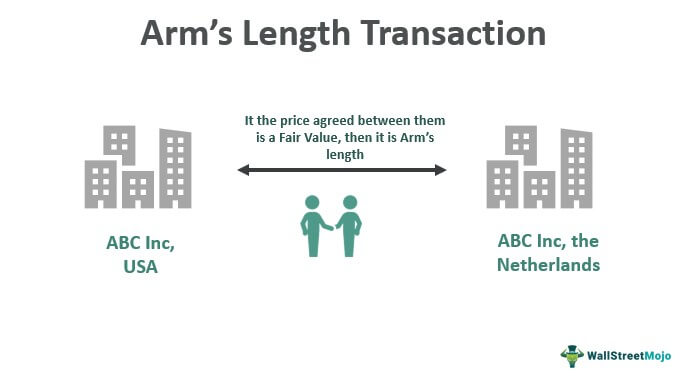

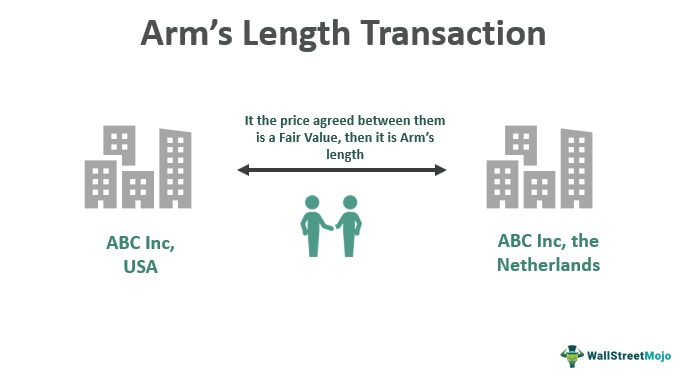

When it comes to finances, arm’s length transaction is a very important concept to understand. An arm’s length transaction is a financial transaction between two parties that are not related and in which each party acts independently to achieve their own best interests. This means that each party involved in the transaction is free to negotiate their own terms and conditions, without the influence of the other party. This type of transaction is especially important to consider when making financial transactions between parties that have a relationship, such as family members or business partners. This article will discuss in detail what an arm’s length transaction is and why it’s important to consider when making financial decisions.

Understanding the Basics of Arm’s Length Transactions

Arm’s length transactions are a common term you will hear if you’re involved in any kind of business. This type of transaction is a basic principle of business dealing, which is used to ensure that both parties involved are treated fairly and ethically. An arm’s length transaction is between two parties who are not related, and who act as if they were unrelated in a business setting. This means that the parties involved act in their own best interests, and don’t have any knowledge of the other party’s financial situation. This allows for a fair, open and transparent deal to be negotiated. The arm’s length principle is important to protect both parties from potential conflicts of interest that can arise when parties are too close to each other. It also ensures that any deal is made in a way that is mutually beneficial, and not biased to either party. This is why arm’s length transactions are so important to businesses and why they should always be followed.

The Benefits of Arm’s Length Transactions

Arm’s length transactions are a great way to ensure you get the most out of your financial dealings. By engaging in deals with people or businesses at an arms length, you can ensure that both parties get a fair deal. This type of transaction prevents any conflicts of interest and helps to protect your assets and financial interests. The process of an arm’s length transaction can be beneficial for both parties involved and can help create a sound business relationship. It also helps to ensure that all parties are legally protected and that all terms of the agreement are clearly laid out. This type of transaction can be used in many different types of financial arrangements, from mergers and acquisitions to investment transactions. By using arm’s length transactions, you can ensure that all parties are getting a fair deal and that you are getting the most out of your investment.

Potential Challenges of Arm’s Length Transactions

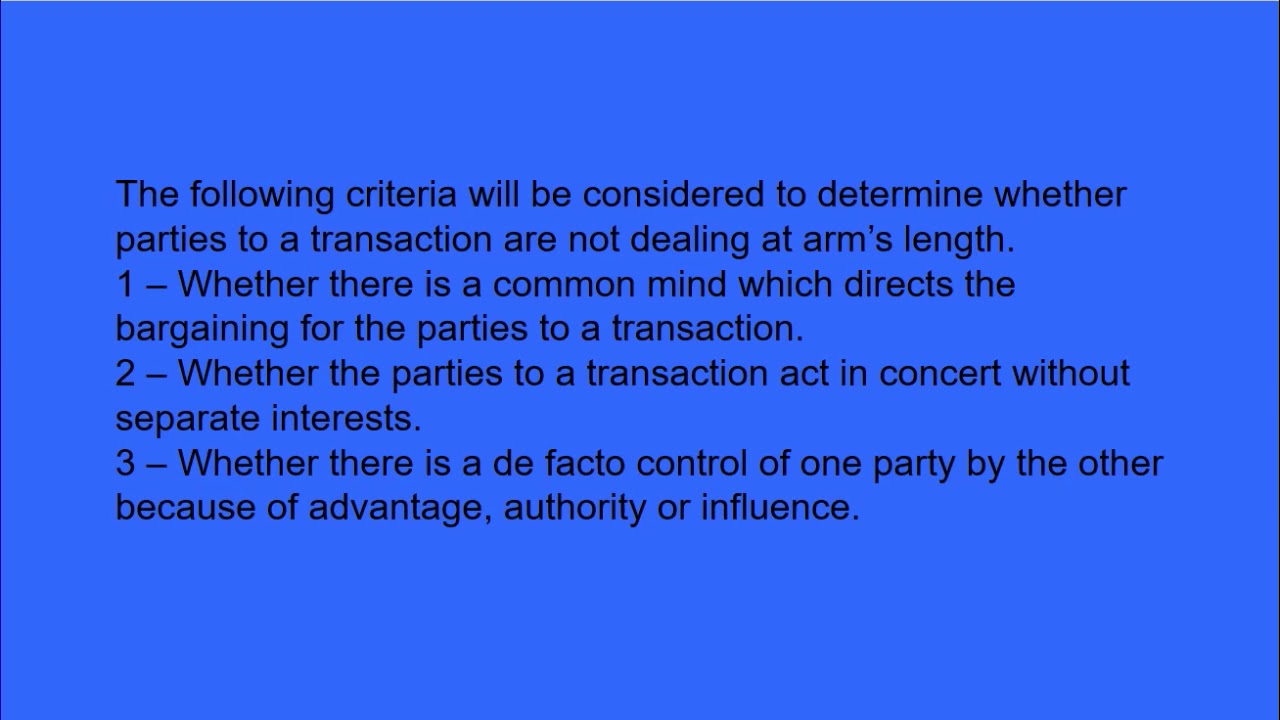

Potential challenges of arm’s length transactions are something that all parties involved should be aware of before entering into a deal. An arm’s length transaction is a business deal between two parties that are not related, so there can be a lack of trust and understanding between them that can lead to problems. Issues can arise if the parties do not have a clear understanding of the terms of the agreement and the implications of entering into the agreement. Additionally, if either party is not aware of the laws and regulations governing the transaction, they could be in violation of these laws. Furthermore, the parties should be aware of potential conflicts of interest that could arise between them. For instance, if one party has a financial interest in the other party, this could create a conflict of interest and the parties should be aware of this. To ensure that the deal goes as smoothly as possible, all parties involved should be well-informed and should be aware of any potential risks or challenges that could arise.

Strategies to Ensure Arm’s Length Transactions are Compliant

When it comes to ensuring arm’s length transactions are compliant, there are a few strategies you can use. First, it’s important to document the transaction in detail and make sure the parties involved are acting independently of each other. This means that each party should have their own set of books and records and no party should have an advantage over the other. You should also make sure the transaction is being done at fair market value, meaning that the price of the transaction should be equal to the price a willing buyer and seller would agree to. Additionally, make sure all parties have access to the same information and that everyone is acting in good faith. With these strategies in place, you can rest assured that your arm’s length transaction is compliant.

Real-Life Examples of Arm’s Length Transactions

Arm’s length transactions are an important concept in finance and accounting. They are used to ensure that any transaction between two parties is conducted fairly and at a fair market value. In real life, arm’s length transactions can be seen in many different contexts, such as when two companies are negotiating a contract, or when a person is buying or selling a house. In these cases, both parties are assumed to be acting independently and negotiating in good faith. This means that the price of the goods or services being exchanged should not be affected by any special relationship between the two parties. This ensures that both parties get a fair deal, and that the transaction is conducted at an arm’s length. This kind of transaction is essential in any business environment, as it helps to ensure that both parties are treated fairly and that the market value of the goods or services is not inflated or manipulated in any way.