An Appraisal Management Company (AMC) provides a valuable service for lenders and other real estate professionals. An AMC provides these professionals with an efficient and accurate way to manage the appraisal process. They help ensure that all appraisals meet the standards of the Uniform Standards of Professional Appraisal Practice (USPAP) as well as the standards of the lender. An AMC is a professional third-party firm that provides a comprehensive and compliant appraisal management system, allowing real estate professionals to focus on their core business while still receiving accurate and reliable appraisal services.

Introduction to Appraisal Management Companies (AMCs)

An Appraisal Management Company (also known as an AMC) is an independent third-party service provider that assists lenders in managing the appraisal process for real estate and other collateral-backed loan transactions. An AMC typically contracts with a panel of independent, state-licensed and certified appraisers who are qualified to perform appraisals for specific geographic areas, property types, and loan products. By utilizing an AMC, lenders can reduce their risk and increase efficiency when managing the appraisal process. AMCs are also able to provide lenders with more in-depth reporting and insights into the quality of the appraisals, which helps to ensure the accuracy and reliability of the data. In addition, AMCs are able to provide lenders with access to the latest technology and software, which can help them streamline the appraisal process and reduce the risk of errors or omissions.

What Services Do Appraisal Management Companies Offer?

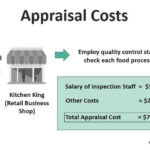

Appraisal Management Companies (AMCs) offer a wide range of services to help make the appraisal process easier for lenders and borrowers alike. From managing the ordering, tracking, and review of appraisals to providing quality assurance for the appraisals completed, AMCs are able to streamline the entire process and ensure that all parties involved have the best experience possible. AMCs can also provide access to a network of qualified appraisers, which makes it easier for lenders to get the appraisals they need in a timely fashion. In addition, AMCs are able to provide detailed reports and analysis of the appraisal process, giving lenders the data they need to make informed decisions. With all these services, AMC’s make the entire appraisal process much smoother and more efficient, allowing lenders to focus on their core business.

Benefits of Using an Appraisal Management Company

Using an Appraisal Management Company (AMC) can have a ton of benefits for any business. First, an AMC can help you save time and money. They are experts in the appraisal industry and can handle the entire appraisal process from start to finish, freeing up your time to focus on more important tasks. Additionally, AMCs can help ensure that you are compliant with state and federal regulations and laws, which can save you a headache in the long run. Furthermore, AMCs often have access to a network of appraisers, so you can be sure that you are getting the best possible deal on your appraisal. Finally, an AMC will be able to handle any issues that may arise throughout the appraisal process, making sure that the process goes as smoothly as possible.

Disadvantages of Utilizing an Appraisal Management Company

Using an Appraisal Management Company (AMC) can have some disadvantages. For one, it can be expensive to use an AMC, as they usually charge a fee in addition to the appraisal fee. This can add up to quite a bit of money, especially for larger appraisals. Additionally, the AMC may require an appraiser to use certain forms and procedures that may not be the best for the situation at hand. This may not be an issue for a small appraisal, but for larger ones, it could result in a less accurate appraisal. Furthermore, it may be difficult to get in touch with the AMC, as they are usually located in different parts of the country. This can result in delays in getting the appraisal completed. Ultimately, using an AMC might not be the best choice for those needing appraisals, as the disadvantages could outweigh the advantages.

Tips for Finding an Appraisal Management Company That Is Right for You

Finding the right Appraisal Management Company (AMC) for your needs can seem like a daunting task. Here are some tips to help you find the AMC that’s the perfect fit for you. First, make sure the AMC is certified and compliant with all local, state, and federal laws. Ask if they have experience in your particular area of real estate and ensure that they utilize the latest technology. Make sure that they have a good reputation and check their customer reviews. Additionally, look at their turnaround time and make sure they are able to provide quick and accurate appraisals. Finally, compare prices and services to get the best value. By following these tips, you’ll be sure to find an AMC that meets your needs and delivers the highest quality service.