Appraisal costs refer to the fees charged by an appraiser, who is an expert in assessing the value of a property or asset. Appraisals are commonly used when buying or selling a house or other large asset, and it is important to understand the associated costs in order to make an informed decision. This article will explain what appraisal costs are, why they are important, and what to expect when paying for an appraisal.

Understanding the Basics of Appraisal Costs

.Appraisal costs can seem like a daunting subject, but it’s important to understand the basics so you can make the best decision when it comes to your home or property. Appraisal costs can vary depending on the type of appraisal you need, the size of the property, and the location. Generally, a professional appraiser will charge a fee for their services. This fee is based on the amount of time it takes to do the appraisal and any additional services that may be requested. Additionally, some appraisers may charge a fee for report preparation and/or administration. Knowing the exact appraisal cost for your specific situation can help you make the best decision for your home or property.

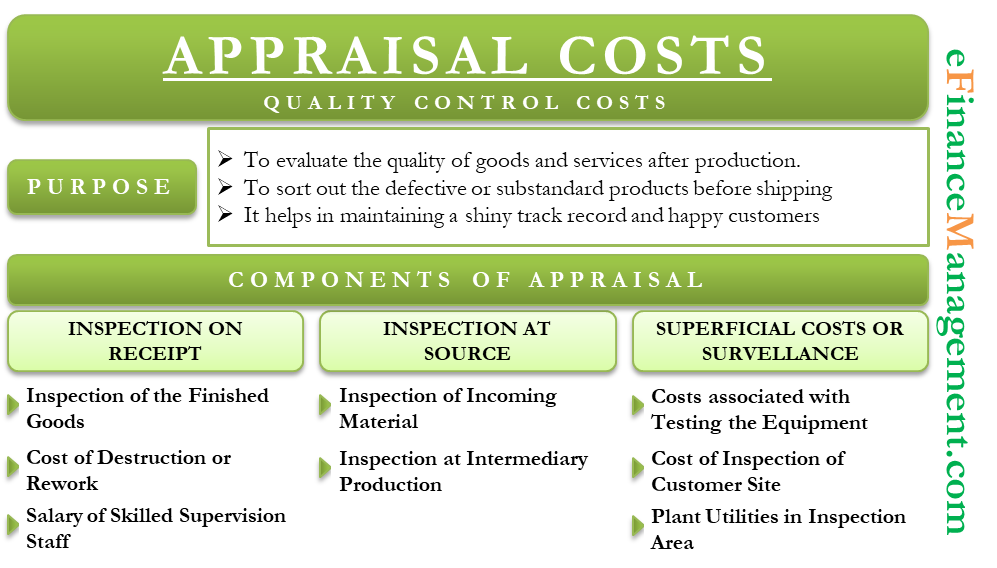

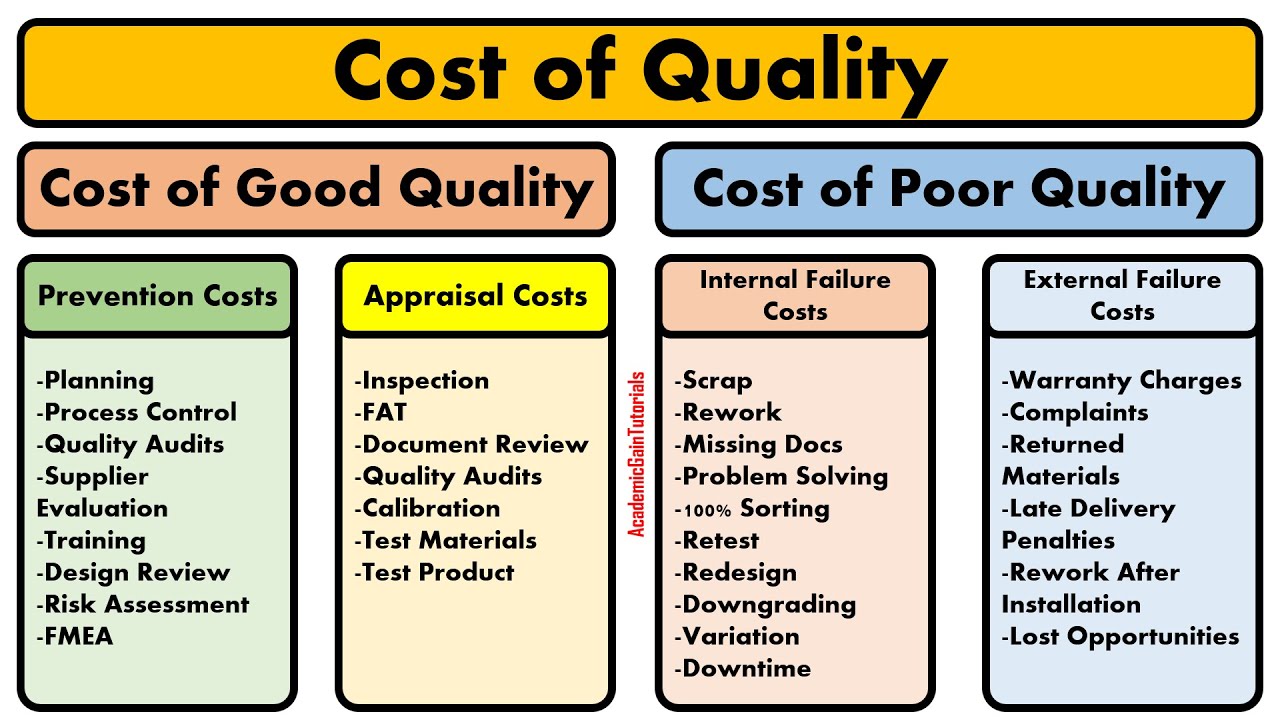

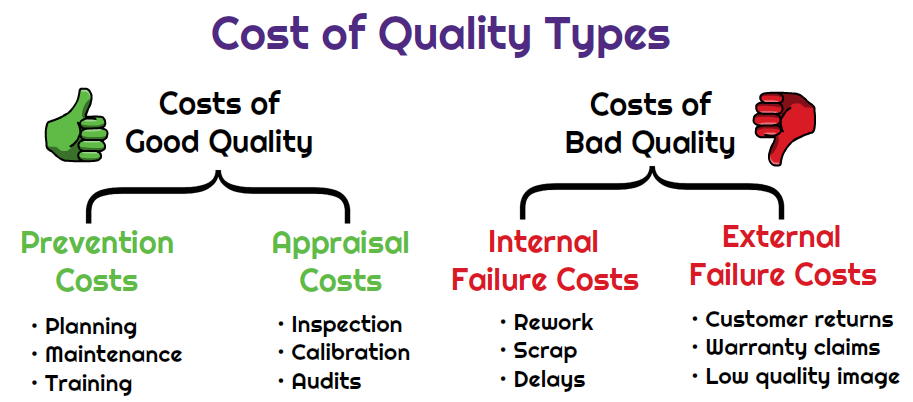

Exploring Different Types of Appraisal Costs

Exploring different types of appraisal costs can be confusing. When it comes to appraising the value of a property, it’s important to understand the different fees associated with the process. Generally speaking, appraisal costs vary depending on the type of property being appraised, the complexity of the appraisal, and the company that is performing the appraisal. Generally, appraisal costs can range from a couple hundred dollars to many thousands of dollars. For example, a residential appraisal may cost around $300 to $500, while a commercial appraisal may cost up to $10,000. The complexity of the appraisal, such as the need for additional research or surveys, can also influence the cost. Additionally, the location and size of the property being appraised, as well as the qualifications of the appraiser, can also affect the cost. Ultimately, the appraisal cost is an important factor to consider when planning the purchase or sale of a property.

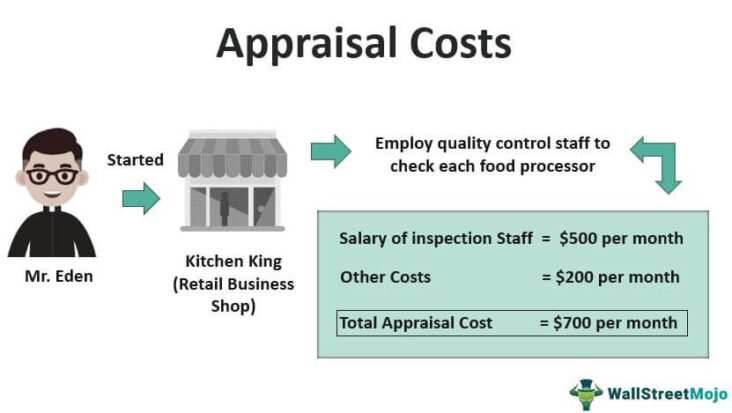

Calculating the Cost of an Appraisal

Figuring out how much an appraisal will cost is an important part of the home buying process. Knowing what to expect ahead of time can help you plan and budget for the cost of the appraisal. The cost of an appraisal typically depends on the size and location of the property you’re buying, as well as the type of appraisal and the qualifications of the appraiser. The cost of an appraisal can range anywhere from a few hundred dollars to a few thousand dollars. It’s important to do your research and shop around to find an appraiser that is qualified and experienced, and offers a fair price for the job. Factors that can affect the cost of an appraisal include the complexity of the appraisal, the experience of the appraiser, the type of property being appraised, the geographic location of the property, and the time frame for completing the appraisal. Once you have all of this information, you can get a better idea of how much your appraisal will cost and plan accordingly.

Tips for Minimizing Appraisal Costs

When it comes to minimizing appraisal costs, there are a few tips you should keep in mind. First, make sure you shop around for the best rate. Compare local appraisers and their fees to make sure you’re getting the best deal. Second, understand the scope of the appraisal and make sure you’re not paying for more than you need. Third, look for discounts or deals on fees as many appraisers may offer a lower rate if you’re able to provide certain details or documents in advance. Finally, ask if the appraiser offers any kind of payment plan, as this could help you spread out the costs over a period of time. By taking these steps, you can help keep appraisal costs under control.

How to Prepare for an Appraisal

Getting ready for an appraisal can be nerve-wracking, but with the right preparation, you can make the process a lot smoother. Before your appointment, it’s important to make sure you have the right documents in order. This includes any paperwork related to the property, such as legal documents, inspection reports, and past appraisals, if any. Additionally, you’ll need to ensure that the property is clean and organized, so that the appraiser can easily move around and identify any potential problems. You should also check that all systems and appliances are functioning properly. With all of these steps taken, you’ll be well prepared for the appraisal and ready to get the most out of it.