Are you curious about what is applicable federal rate (AFR)? The AFR is an important interest rate set by the Internal Revenue Service (IRS) that is used to determine the annual rate of interest and other financial transactions. In this article, we’ll explain the AFR in depth, and look at how it relates to other financial transactions. We’ll also discuss why understanding the AFR is important, and provide some examples of how it is used.

What Is The Applicable Federal Rate (AFR) – An Overview

The Applicable Federal Rate (AFR) is a rate that is set by the IRS each year. It’s important to know what the AFR is because it affects how much money you can save when you make certain types of investments. For example, if you make an investment in a low-risk bond, you could get a lower AFR rate than if you invested in a riskier stock. Knowing the AFR rate can help you make better financial decisions and maximize your returns. It’s important to stay up-to-date with the AFR rate so you can make sure you’re making the most of your investments.

How The Applicable Federal Rate (AFR) Is Used in Tax Planning

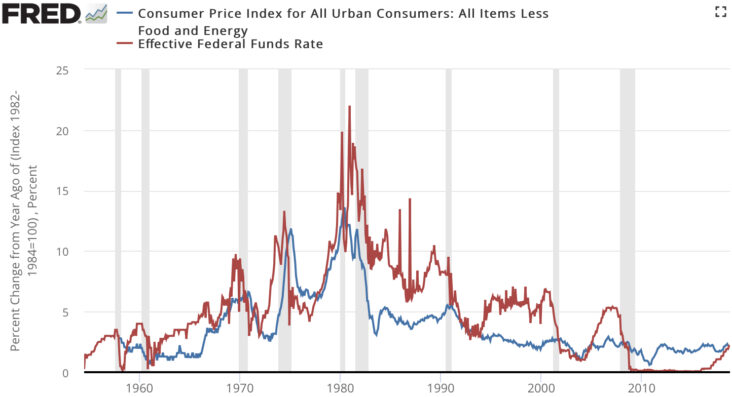

Tax planning is a key part of managing finances and making sure that you are taking advantage of all the potential tax savings that are available to you. The Applicable Federal Rate (AFR) is one of the key elements of the Internal Revenue Code (IRC) that you will need to understand in order to get the most out of your tax planning. AFRs are used to determine the minimum rate of return that must be earned in order to avoid gift and estate taxes, as well as to set the rate of interest on certain types of loans. This rate is determined by the Treasury Department every three months and is based on the current economic conditions. By understanding the AFRs, you can better plan for your taxes and make sure that you are making the most of your money.

The Advantages of Knowing the Applicable Federal Rate (AFR)

Knowing the applicable federal rate (AFR) can be beneficial when making decisions involving finances. It is important to stay up to date on AFR as it can help you understand the current tax climate. AFR helps to determine the interest rate for certain types of investments such as certain types of loans and transfers of property. By understanding the current AFR, you can make more informed decisions when it comes to investments, taxes, and more. Having knowledge of AFR can also allow you to make better decisions about when to use more tax-advantaged investments like IRAs and 401(k)s. Additionally, AFR can also help you understand how to take advantage of certain tax benefits, such as deductions and exemptions. Knowing the AFR can help you make better decisions when it comes to your finances, so it is important to stay up to date on the current rate.

Different Types of Applicable Federal Rates (AFR)

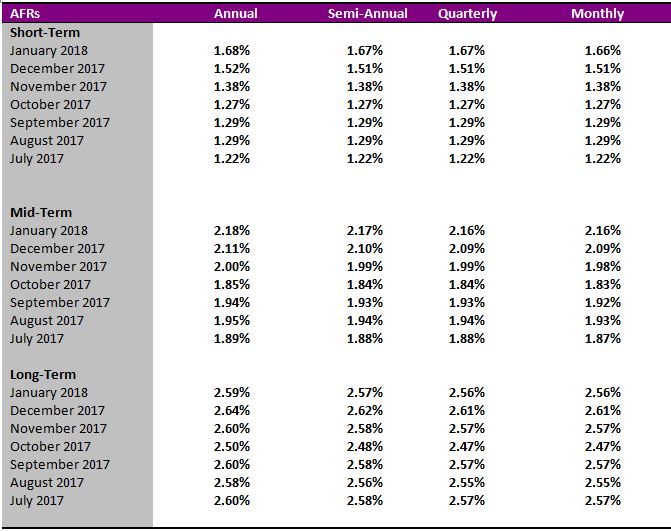

The Applicable Federal Rate (AFR) is the minimum rate of interest that the IRS requires when transferring certain assets between related parties. It’s used to ensure that all parties in the transaction are paying fair market value. There are different types of AFRs that are applicable depending on the type of asset being transferred and the length of time the asset is held. The short-term AFR is used for assets held for less than three years, the mid-term AFR is used for assets held between three and nine years, and the long-term AFR is used for assets held for more than nine years. Knowing which type of AFR to use is important for those transferring assets between related parties, as the IRS will use the AFR to calculate the minimum amount of interest owed to the other party.

Strategies to Minimize Your Tax Liability with the Applicable Federal Rate (AFR)

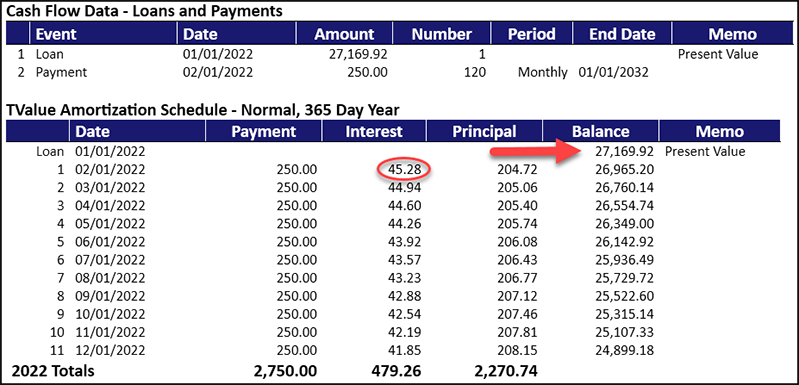

If you’re looking for a way to reduce your tax bill, consider using the applicable federal rate (AFR) as part of your tax strategy. AFR is a set of interest rates that the Internal Revenue Service (IRS) uses to determine the value of a loan or investment for tax purposes. By taking advantage of the AFR, you can save money on your tax bill and put that money to use elsewhere. For example, you can use the AFR to make a loan to yourself with a lower interest rate than a bank loan, or to make investments with a higher rate of return than a traditional savings account. Take the time to research the AFR and explore how it can help you minimize your tax liability.