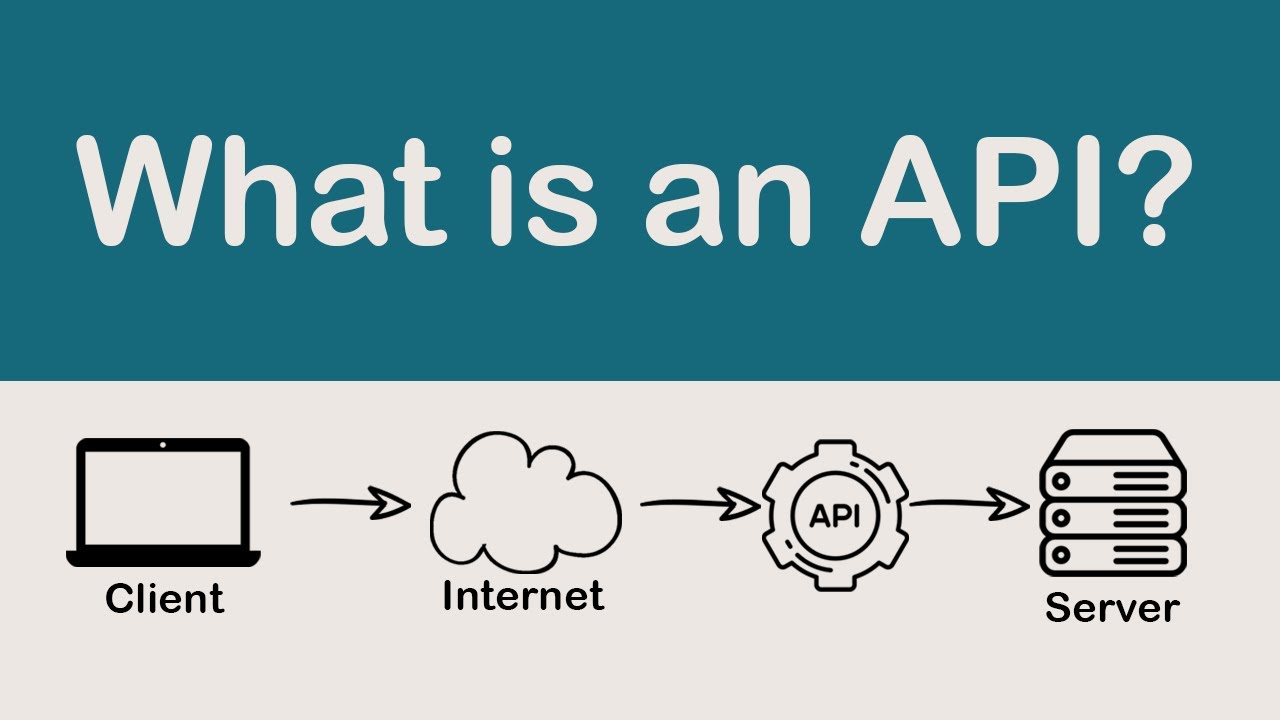

Application Programming Interface (API) is a way of connecting different software components or applications in order to share data and information. APIs are becoming increasingly important in the world of technology, as they allow developers to create innovative web applications that are interconnected with other services and applications. This article will explain what an API is, what types of APIs exist, and how APIs can be used to make applications more efficient and user-friendly. The article will also discuss the importance of API security and how APIs are being used in the financial world.

What is an API and What Does it Do?

.An API, or Application Programming Interface, is a way for developers to communicate with different software systems. APIs allow developers to access and manipulate data from other applications in a secure, organized way. With an API, developers can easily add features and functionality to their work without having to start from scratch. They can also integrate data from multiple sources, giving them a more comprehensive view of the project they’re working on. APIs are an essential tool for developers, as they help them create better and more efficient software solutions.

An Overview of the Different Types of APIs

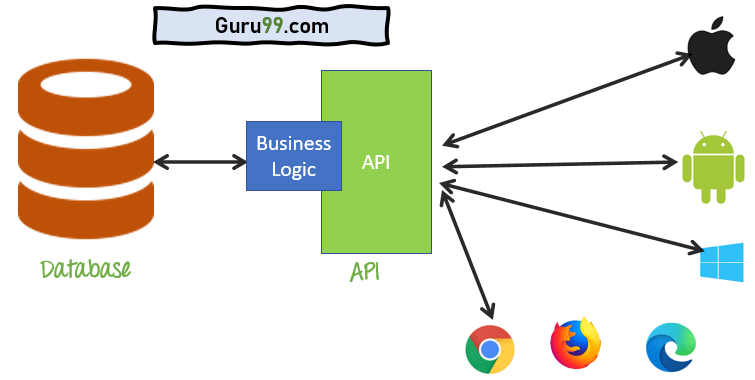

An Overview of the Different Types of APIsAPIs are an important part of the software development process. They allow developers to access data and services from other applications, enabling them to create powerful applications that can be used across multiple platforms. There are a variety of APIs available, each with their own unique set of features and capabilities. From REST APIs to SOAP APIs, each type of API offers its own advantages and drawbacks. REST APIs are the most popular type of API, as they are simpler to use, faster, and can be used across multiple platforms. SOAP APIs are more powerful, offering greater functionality, but they are more complex and require more development time. There are also APIs that allow developers to access specific data or services, such as Twitter APIs or Google Maps APIs. All of these APIs are essential for building powerful applications and websites that can be used in a variety of ways. No matter what type of API you need, there is sure to be one that fits your project perfectly.

The Benefits of Using an API

Using an API is a great way to simplify your development process and increase your efficiency. APIs allow developers to access data and services from another application, without having to manually collect and integrate the data. This means that developers can spend more time concentrating on the features of their own application, rather than having to spend time and resources on data collection and integration. Additionally, APIs provide a layer of security, allowing developers to control access to their data and services, as well as allowing for easier debugging and error handling. Overall, APIs are a great way to streamline the development process and make better use of resources.

Commonly Used APIs in Financial Services

Financial services companies have been utilizing Application Programming Interface (API) technology for years. APIs allow financial services companies to provide their customers with access to their services through a secure digital platform. Commonly used APIs in financial services include Open Banking APIs, which facilitate the exchange of financial data between banking institutions and their customers, and Payment APIs, which allow customers to make secure payments online. APIs are a vital part of the digital banking experience, as they allow customers to access their financial information and services quickly and securely. Additionally, financial services companies can use APIs to integrate their services with third-party applications, allowing them to provide a more seamless experience and increase customer engagement. APIs are an integral part of the financial services industry and are essential for companies to provide their customers with a safe and reliable digital banking experience.

How to Get Started With Your Own API

If you’re ready to get started with your own API, the first thing you’ll want to do is figure out what type of API you need. There are a variety of different APIs available, so it’s important to determine which one is right for your project. Once you’ve narrowed down your choices, you’ll want to create a plan for how to build and use your API. Depending on the complexity of the project, you may need to hire a team of developers or find an API development firm to help you. Once you have a plan and the appropriate resources, you can begin the process of building your API. This will include setting up the hosting environment, coding the API, and testing the API to make sure it works as expected. Once the API is built and tested, you can then begin to integrate it into your application or system. With a properly developed API, you can unlock the full potential of your application and allow users to interact with it in new and innovative ways.