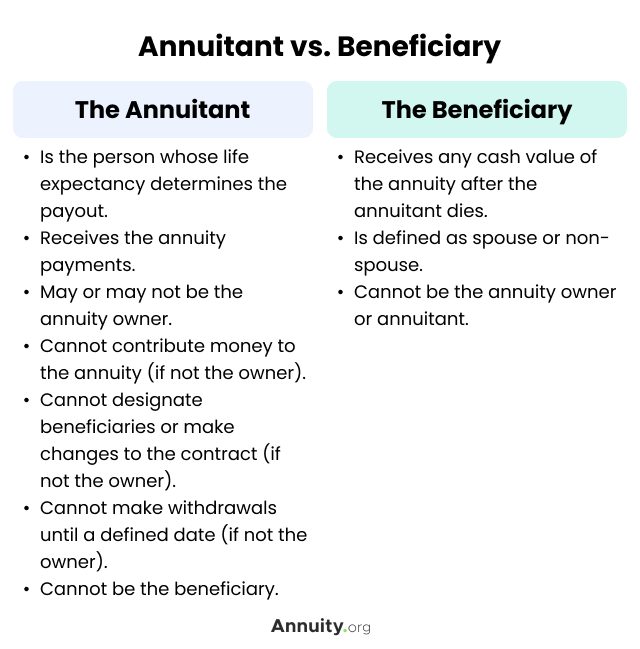

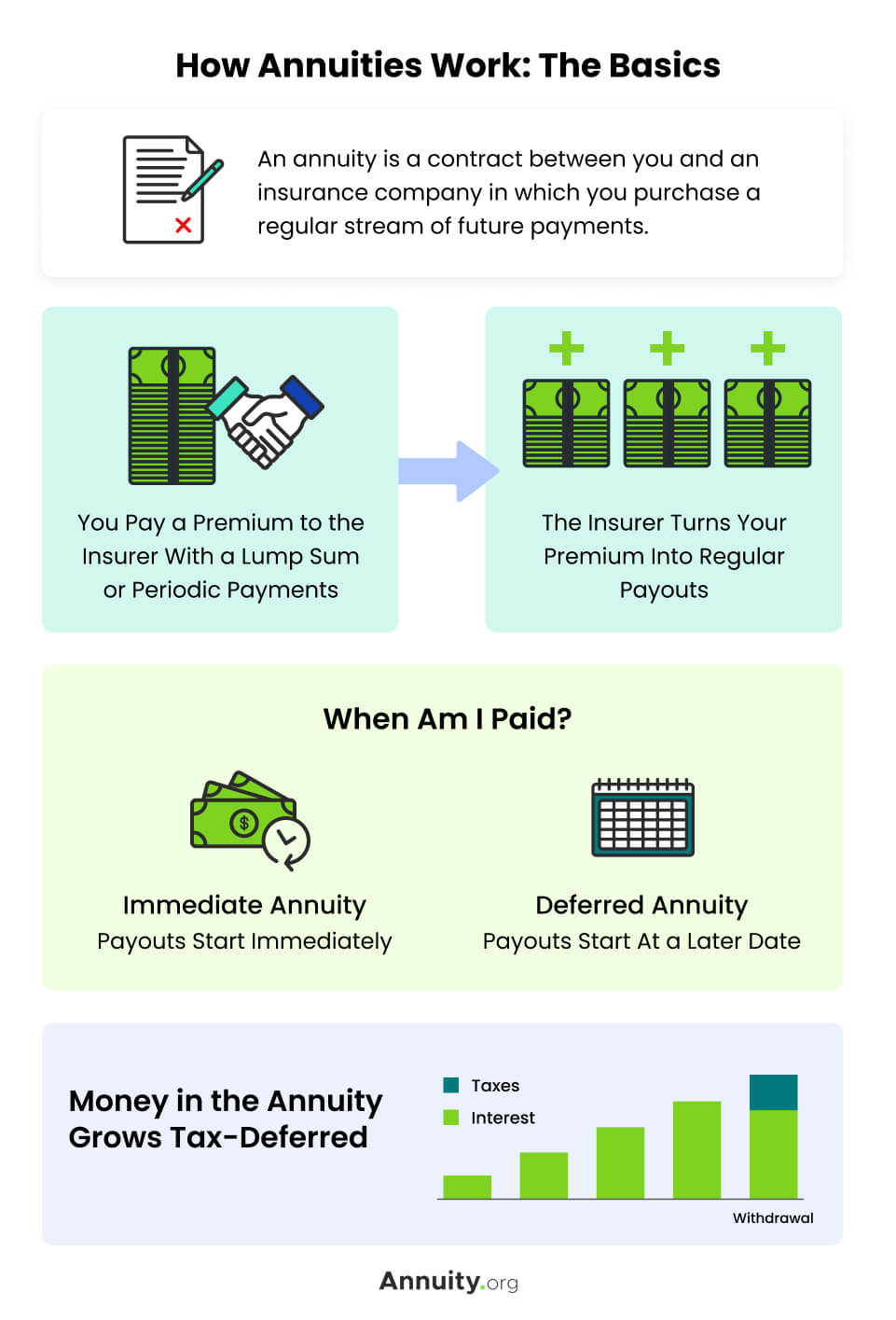

Annuitants are individuals who are entitled to receive regular payments from an annuity. An annuity is an insurance product which pays out a set amount of money over a specific period of time. Annuitants can be individuals or organizations and the payments are typically made in either monthly or yearly installments. Annuitants are often retirees, beneficiaries, or other individuals receiving income from a pension or other retirement plan. Understanding what an annuitant is and how annuities work can help you to secure a comfortable retirement for yourself or your loved ones.

What is an Annuitant and What Are the Benefits?

An annuitant is someone who receives a steady stream of income from an annuity. An annuity is a financial product that provides regular payments to the annuitant over a period of time. The payments can be a lump sum or a series of smaller payments. There are many benefits to being an annuitant. For one, annuitants can enjoy a steady source of income over a period of time, allowing them to plan for their future without worrying about where their income will come from. Additionally, annuitants may enjoy tax benefits, as the payments are often taxed at a lower rate than income from other sources. Finally, annuitants may be able to leave a legacy to their heirs, as some annuities provide death benefits that can be passed on to the annuitant’s family. With these potential benefits in mind, annuities can be a great financial product to consider.

The Different Types of Annuities and How They Work

Annuities come in a variety of different forms and types. Each type of annuity is designed to meet a specific set of needs and can provide different levels of financial security. The most common types of annuities are fixed, variable, indexed, and immediate. Fixed annuities provide a guaranteed fixed rate of return, while variable annuities offer the potential for higher returns but also carry more risk. Indexed annuities provide returns based on the performance of a stock market index, while immediate annuities provide a guaranteed stream of income for a certain number of years. All of these different types of annuities can be a great way to supplement income and plan for retirement.

What to Consider When Choosing an Annuity

When considering an annuity, there are a few things you should keep in mind. Make sure you understand the terms of the annuity, so you can be sure you’re getting the best deal possible. You’ll also want to make sure you know what kind of fees and charges are associated with the annuity, as these can eat into any potential returns. You’ll also want to look into the annuity’s performance history and make sure it’s a good fit for your investment goals. Finally, make sure you understand the tax implications of investing in an annuity. Knowing all these factors will help you make an informed decision when it comes to choosing an annuity.

Tax Implications with Annuities

An annuity can be a great way to make sure you have money in retirement, but it’s important to know the tax implications that come along with them. Annuities are usually taxed differently than other investments and retirement accounts, meaning that the amount of money you can make off them can be affected. It’s important to understand the tax implications of annuities before investing in one, as it can make or break your retirement savings. Depending on the type of annuity you choose, you may face taxes on interest, early withdrawal fees, and other fees. It’s always a good idea to consult a financial advisor before investing in an annuity, as they can help you navigate the tax implications and make sure you are getting the most out of your annuity.

Common Questions About Annuitants and Annuities

Common Questions About Annuitants and Annuities are some of the most common financial questions asked by individuals who are looking for a way to secure their future financial stability. Annuities are a great option for those who want to ensure a steady stream of income for their retirement years. Annuitants are the individuals who purchase an annuity contract and benefit from the guaranteed income. Questions regarding annuitants and annuities can range from what an annuitant is, how to purchase an annuity contract, and what type of annuity is best suited for you. It is important to understand the details of annuities before making a purchase. Knowing the ins and outs of annuities can help you make an informed decision that will best suit your needs. Annuitants should consider the fees and expenses associated with their annuity contract, the terms of the contract, and their own financial needs when making their decision. With the right research and knowledge, annuitants can ensure they make an investment that will secure their financial future.