Investing can be a great way to make your money work for you and generate long-term wealth. To help you understand the performance of your investments, it is important to understand the concept of annualized rate of return. This measure of investment performance takes into account the length of time your investment has been held and gives you an accurate idea of the return you’re receiving from your money. In this article, we’ll explain what an annualized rate of return is and how you can use it to measure the performance of your investments.

What Factors Impact Annualized Rate of Return?

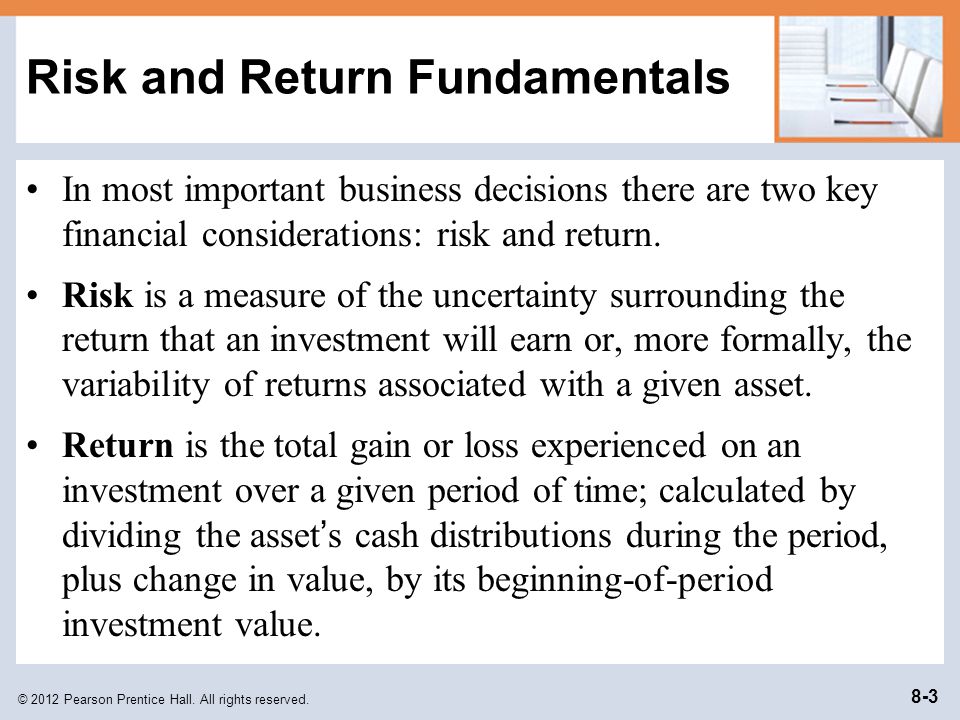

When it comes to annualized rate of return (ARR), it’s important to understand the factors that can impact the outcome. Your ARR can be affected by how long your investment is held, the amount of return you initially receive, the frequency of payments made, and other market conditions. In addition, the fees associated with the investment, such as annual management or performance fees, can also affect the ARR. It’s important to do your research and understand the underlying factors and associated risks before investing in any security or asset. Doing so can help you maximize the return you receive and minimize the risk of loss.

What Are the Benefits of Calculating Annualized Rate of Return?

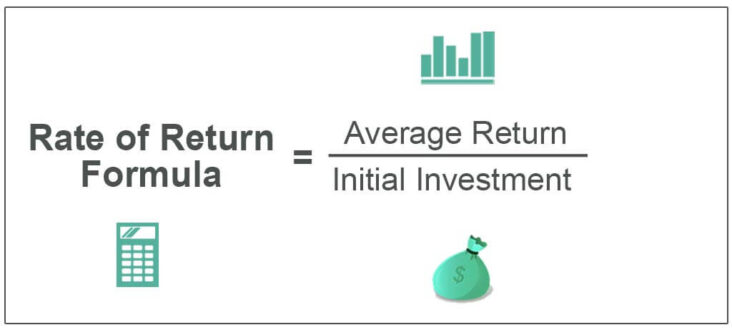

Calculating your Annualized Rate of Return (ARR) is an important step for any investor looking to measure their investment performance. ARR is a measure of the return an investment provides over a period of time, and is typically used to compare investments of different lengths. The benefits of calculating ARR are numerous, as it allows investors to compare the performance of their investments over different periods of time and evaluate the risk associated with each investment. ARR also helps investors determine their return on investment (ROI) and identify any potential areas of improvement or risk. By using ARR investors can make more informed decisions about their investments and optimize their portfolio for maximum returns. Additionally, the use of ARR helps investors to better understand the performance of their investments in relation to the market and their own goals.

How Can Investors Use Annualized Rate of Return to Make Investment Decisions?

Investing can be confusing and overwhelming, especially when you don’t understand the financial terminology. One key metric to understand is your annualized rate of return, or ARR. ARR is a number that summarizes the performance of your investments over a given period of time. It can help investors make smart decisions when it comes to where to put their money. By understanding your ARR and comparing it to other investment options, you can get a good idea of how your money is performing and where it should be allocated. It’s important to remember that your ARR is just a part of investing – other factors such as risk, liquidity, and your own financial goals should also be taken into account when making investment decisions. Taking the time to understand your ARR can help you make informed and smart investments for your future.

Should Investors Rely Solely on Annualized Rate of Return When Making Investment Decisions?

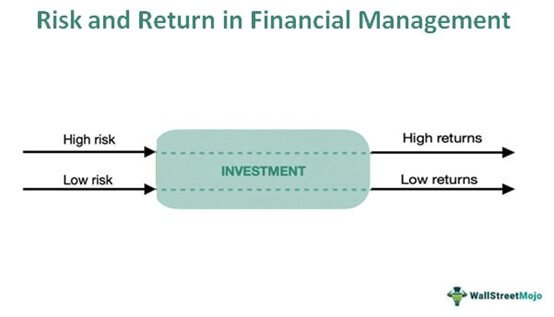

When it comes to making investment decisions, relying solely on the annualized rate of return is not the best idea. While this metric is useful in giving you an idea of potential returns, it doesn’t provide a full picture of the risks associated with an investment. It might be tempting to think that the higher the annualized rate of return, the better the investment, but this isn’t always the case. You need to look at other factors such as the volatility of the asset, the underlying economic conditions, and the fees and expenses associated with the investment to get a better understanding of the risks and rewards. Additionally, it’s important to consider your own financial goals and risk tolerance when making any investment decision. By taking all these factors into consideration, you can make an informed decision and ensure that your investments are meeting your expectations.

What Are Some Alternatives to Calculating Annualized Rate of Return?

When it comes to calculating an annualized rate of return, there are plenty of alternatives that can be used to get a more accurate picture of how your investments are performing. One of the most popular alternative methods is the XIRR, or Extended Internal Rate of Return, which takes into account all cash flows, including dividends, over a given period. Another alternative is the money-weighted rate of return, which measures the performance of an individual’s investments by taking into account the timing and size of contributions as well as withdrawals. Finally, the time-weighted rate of return is a more traditional approach that looks at the performance of an entire portfolio, rather than individual investments. All of these methods provide investors with different ways to measure the performance of their investments, so it’s important to consider all of them when trying to determine the annualized rate of return.