The Annualized Income Installment Method is an effective tax strategy that can help taxpayers save money. This method allows taxpayers to spread out the taxable income they have earned over a period of more than one year, reducing their annual tax bill. It is important to understand how this method works and what requirements must be met in order to take advantage of its benefits. With the right knowledge and planning, the Annualized Income Installment Method can provide a great way to reduce your tax burden.

Overview of Annualized Income Installment Method

The Annualized Income Installment Method is a tax treatment that allows taxpayers to spread out their income tax liability over a period of time. This method is beneficial for taxpayers who expect their income to increase in the near future and don’t want to pay the large lump sum in taxes that could come with that increase. With the Annualized Income Installment Method, taxpayers can pay their taxes on a quarterly basis instead of all at once. This allows them to spread out their payments and minimize their tax burden. Additionally, the method can help taxpayers plan ahead and budget for their future income tax liability. For example, they can set aside money each quarter to pay their taxes, or they can adjust their withholding to accommodate the payments. The Annualized Income Installment Method is a great way to plan ahead and manage your taxes more efficiently.

Advantages of Annualized Income Installment Method

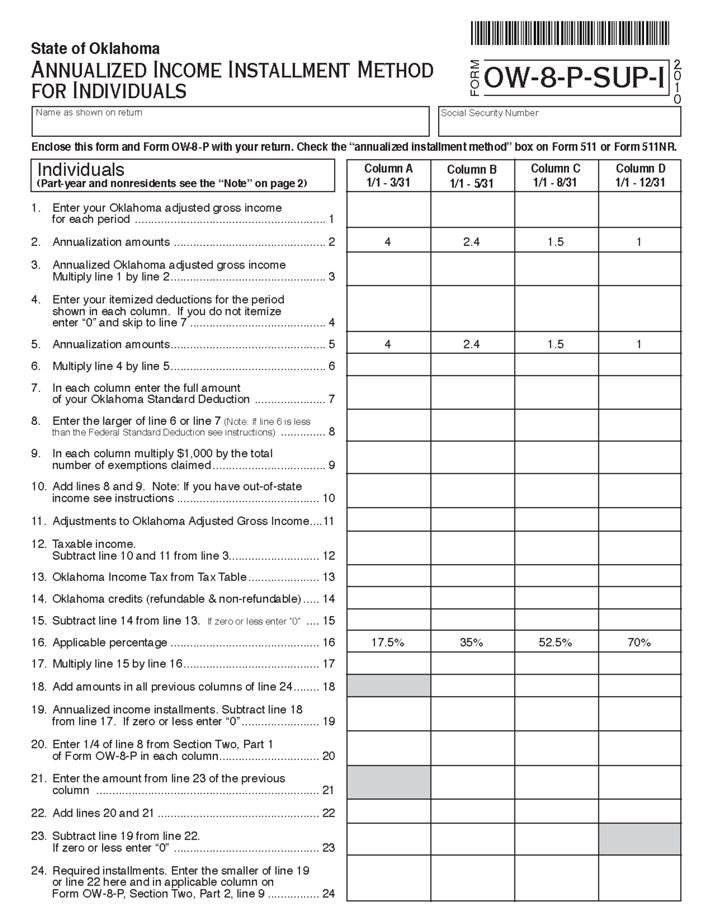

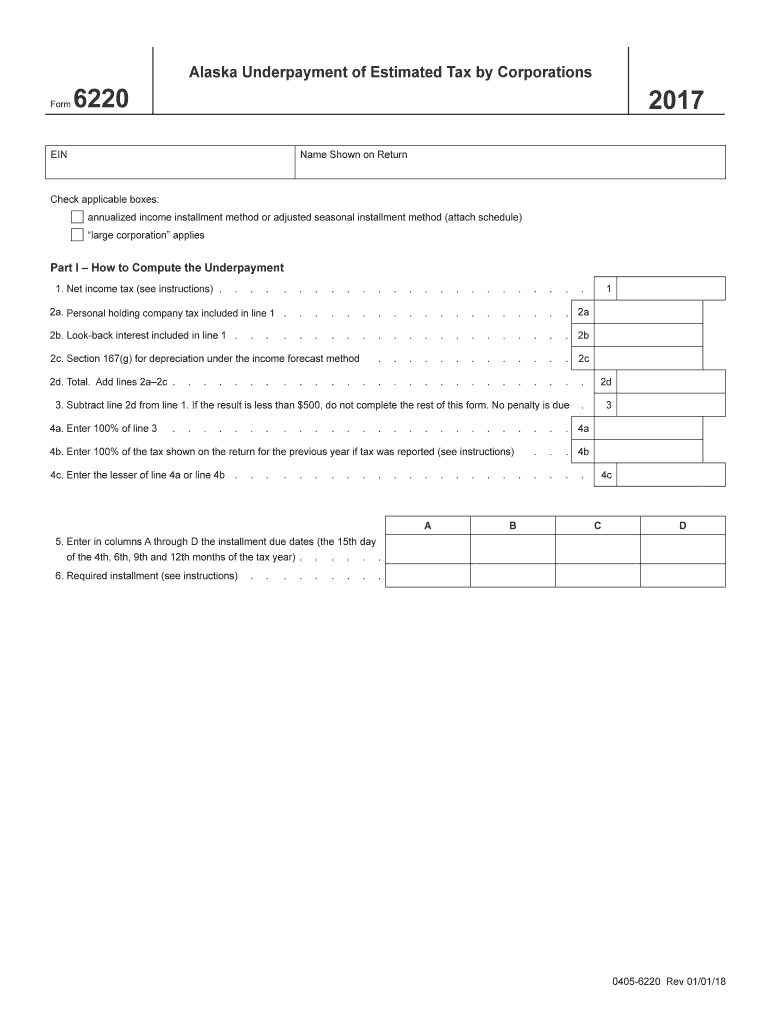

The Annualized Income Installment Method (AIIM) is a tax payment method that can help taxpayers pay off their tax liabilities without having to pay a large lump sum up front. With AIIM, the taxpayer pays estimated taxes due in four installments over the year. This method can make it easier to pay taxes, since they are spread out in smaller payments throughout the year instead of one large payment. The advantage of AIIM is that it can help taxpayers avoid penalties for not paying taxes on time. Furthermore, the installment payments can be tailored to the taxpayer’s income, making it easier to budget for taxes over the course of the year. Taxpayers who are self-employed or who have fluctuating income can especially benefit from this method as it allows them to adjust their payments to match their income. AIIM is a great option for anyone who is looking for an easier way to pay their taxes on time.

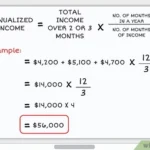

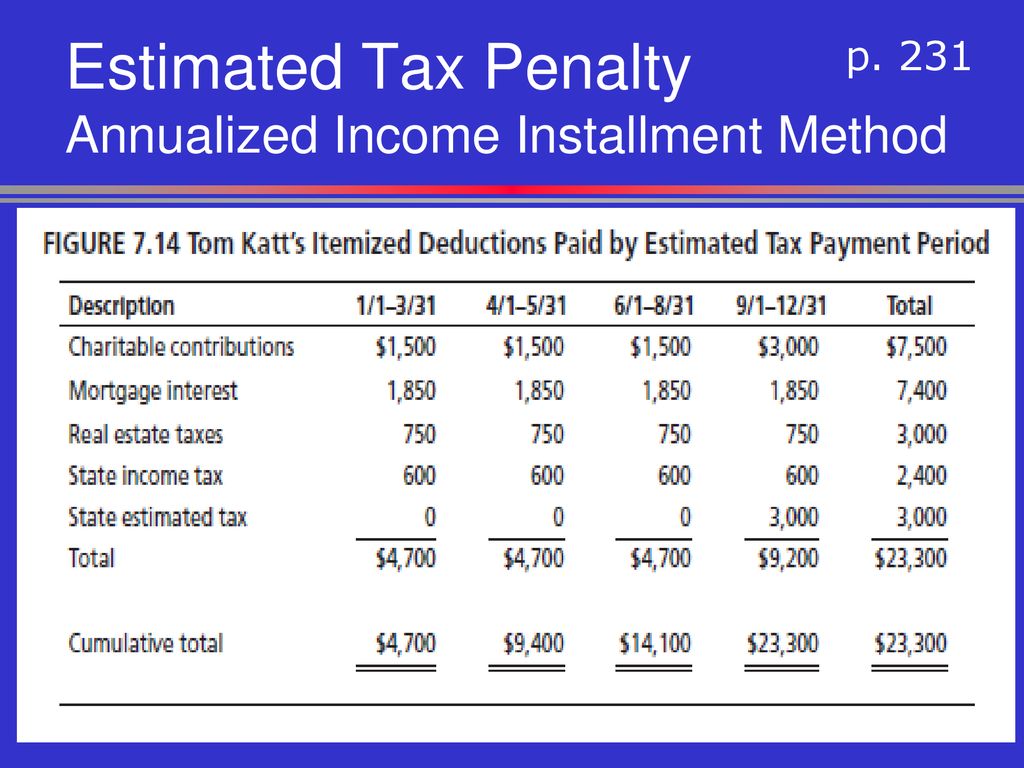

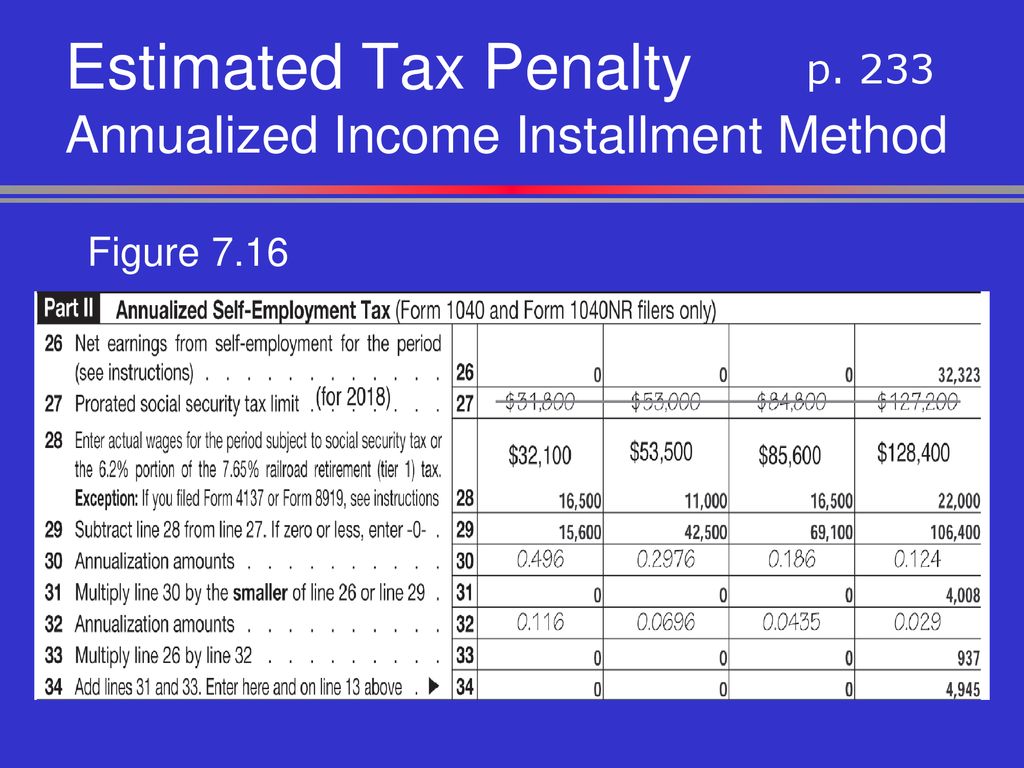

Calculating Income Using the Annualized Income Installment Method

The Annualized Income Installment Method (AIM) is a powerful tool that can help you calculate your income. It works by taking into account all of your sources of income, such as wages, investments, and other sources of money, and then annualizing them. This means that instead of just looking at your income for the current year, the AIM will look at your income for the last few years and make an estimate of what your income will be for the upcoming year. It takes into account any changes in your income sources, such as a new job or an increase in investments, so that you can accurately calculate your income. This method can be extremely useful for budgeting, tax planning, and other financial decisions. With the AIM, you can easily estimate your future income and make informed decisions about your financial future.

Drawbacks of Annualized Income Installment Method

When it comes to calculating taxes, the Annualized Income Installment Method (AIM) is a great way to go. This method allows taxpayers to pay their tax obligations in four installments throughout the year. The four payments are due on April 15th, June 15th, September 15th, and January 15th of the following year. The AIM is a great way to avoid a large tax bill all at once by spreading out the payments. However, this method does have some drawbacks. For one, taxpayers must estimate their income for the year correctly in order to get the payments right. Furthermore, any changes in income can cause a taxpayer to owe more than the four payments, resulting in penalties and interest. Lastly, taxpayers must file a special form with the IRS for the AIM, and keep up with their payments. All in all, the AIM is a great way to pay your taxes, but it’s important to make sure you know what you’re doing before you start.

How to Avoid Plagiarism When Writing About the Annualized Income Installment Method

The Annualized Income Installment Method (AIIM) is an important financial concept that can help you manage and plan your budget. It is a way of calculating your total income and dividing it into equal payments over a set period of time, usually per month. This method allows you to budget your income more effectively and plan for future spending. To avoid plagiarism when writing about the Annualized Income Installment Method, it’s important to make sure you understand the concept and use your own words to explain it. When you’re done, double-check to make sure you haven’t used any phrases or ideas from any other sources. With a little bit of research and some creativity, you can avoid plagiarism and write about the Annualized Income Installment Method in your own words.