Animal Spirits are a term coined by Nobel Prize winning economists John Maynard Keynes and George Akerlof to describe the psychological forces that can drive markets and economies. Animal Spirits refer to the emotions that influence investor behavior, such as fear, optimism, and irrational exuberance. They also refer to the underlying confidence that people have in the markets, which can drive economic growth. Understanding Animal Spirits and how they affect financial markets can be a valuable tool for investors and economists alike. This article will explore the concept of Animal Spirits in greater detail, including a definition of the term and how it relates to financial markets.

What Are Animal Spirits and How Do They Affect Financial Markets?

Animal spirits are a term used to describe the enthusiasm and confidence of investors in financial markets. They can be seen as a type of “psychology” that affects how people make investment decisions. Animal spirits are based on the idea that investors can be easily swayed by their emotions, rather than making decisions based on rational analysis. Animal spirits can have a huge impact on the financial markets, as they can cause investors to become overly optimistic or pessimistic, resulting in a bull or bear market. This can lead to a huge increase or decrease in the prices of certain stocks and even entire markets. It is important to understand how animal spirits can affect the financial markets in order to make informed investment decisions.

What Is the Origin of the Term “Animal Spirits” and Who First Used It?

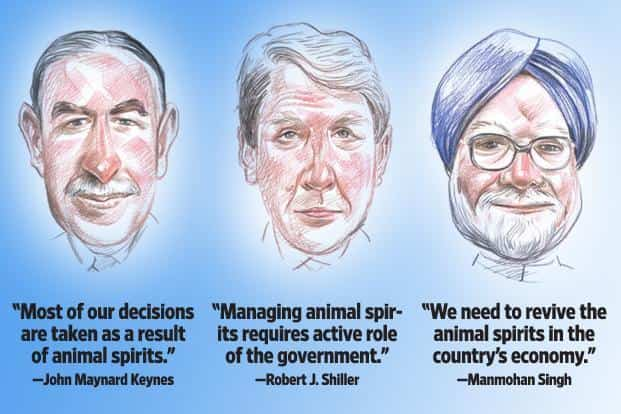

Animal Spirits is a term coined by British Economist John Maynard Keynes in his 1936 publication The General Theory of Employment, Interest, and Money. Keynes was influenced by the theories of his contemporary, the philosopher and economist Alfred Marshall. Marshall’s concept of “animal spirits” was a reference to the irrational behavior and psychological biases that often influence economic decision-making. Keynes expanded on this idea, suggesting that “animal spirits” were essential for economic growth and stability. He argued that these irrational behaviors had a positive effect on investment decisions and consumer confidence, ultimately leading to economic growth. Keynes’ innovative idea of animal spirits is still relevant today, and has been used to explain the boom and bust cycles of the stock market, as well as the instability of the global economy.

Understanding the Role of Human Emotion and Psychology in Financial Markets

When it comes to understanding financial markets, it’s important to remember that human emotion and psychology plays a big role. Animal spirits is a term that refers to the collective emotional and psychological state of investors. It can be described as a feeling of optimism or pessimism that can affect the decisions people make in the stock market. Animal spirits can be a powerful force that can cause markets to go up and down, depending on the sentiment of the investors. While understanding animal spirits is not an exact science, it is something that can be monitored and taken into account when making investment decisions. Knowing how the collective emotional state of the market is likely to affect your investments can help you maximize your profits and minimize your losses.

What Are the Different Types of Animal Spirits and How Can They Be Measured?

Animal spirits can be categorized into four main types: psychological, economic, political, and sociological. Psychological animal spirits refer to the emotions and sentiments that people experience in the market. Economic animal spirits are related to the market fundamentals such as interest rates, inflation, and unemployment. Political animal spirits refer to the effect of government policies that influence the market. Finally, sociological animal spirits are associated with the cultural and social environment of the market.Measuring animal spirits can be done by studying the sentiment of market participants, analyzing the economic fundamentals, paying attention to the political environment, and keeping an eye on the social trends. Sentiment can be measured by monitoring the trading activity of investors as well as the sentiment of news reports, analysts’ opinions, and surveys. Economic fundamentals can be determined by looking at various economic indicators, such as GDP growth, inflation, and interest rates. The political environment can be tracked through the policy decisions of governments, such as tax rates and regulations. Finally, social trends can be measured through surveys, polls, and other sources of data. By understanding the four types of animal spirits and how to measure them, investors can make better decisions when it comes to investing in the stock market.

How Can Investors Use Animal Spirits to Make Investment Decisions?

Investing can be a tricky business, but understanding animal spirits can help investors make more informed decisions. Animal spirits, a term coined by John Maynard Keynes, refer to the confidence and sentiment of investors. By understanding animal spirits, investors can use them to make better investment decisions, by looking at market trends and sentiment to predict potential risks or opportunities. Animal spirits can be used to identify market cycles, help investors identify the best times to buy and sell stocks, and to assess how the market is feeling overall. As an investor, it is important to consider the animal spirits of the market when making investment decisions, as they can provide valuable insight into the current economic climate. By keeping an eye on animal spirits, investors can be better equipped to make more informed decisions.