The Annual Equivalent Rate (AER) is an important tool that investors use to compare different savings and investment products. AER is a way to measure the true cost of a savings or investment product by taking into account the effect of compound interest over time and providing an annualised rate of return. It is important for investors to understand what AER is, how it works and how to use it in order to make informed decisions when it comes to their savings and investments. In this article, we’ll explore what AER is and how to use it to ensure you get the most out of your investments.

What Is Annual Equivalent Rate (AER)?

Annual Equivalent Rate (AER) is a great way to compare the different interest rates of different savings accounts. It’s an important tool to use when you’re looking to make sure you’re getting the best return on your savings. AER is the rate of interest which, if applied to the principal sum for one year, would produce the same total amount of interest as applying the same rate for a shorter period of time. This means that if a savings account offers a 5% interest rate for six months, then the AER would be 10%. AER is a great way to compare different accounts, as it takes into account the effect of compounding and ensures that you’re getting the best possible return on your money.

How Does AER Impact Your Financial Decisions?

When it comes to managing your money, understanding the Annual Equivalent Rate (AER) is key for making wise financial decisions. AER is the rate of interest that you will earn on your savings over a full year and is typically expressed as a percentage. It’s important to understand how AER works so that you can make an informed decision when choosing the best savings account or investment. AER can help you to compare products, so you can decide which ones are most beneficial for your financial goals. It’s important to consider the AER when deciding which savings account is best for you, as it can have a major impact on the amount of money you will earn over time. Knowing and understanding AER can help you make the most out of your money and ensure you are getting the most out of your savings.

What Is the Difference Between AER and APR?

AER and APR are two different ways to measure interest rates. AER stands for Annual Equivalent Rate and is a measure of the annual rate of return on an investment. It takes into account both the interest rate and the compounding effect on the investment. APR stands for Annual Percentage Rate and is a measure of the cost of borrowing money. It is the interest rate plus any fees or other costs associated with the loan. The difference between AER and APR is that AER measures the return on an investment and APR measures the cost of borrowing money. AER is useful for investors, as it reflects the true rate of return on the investment. APR is important for borrowers, as it reflects the actual cost of borrowing money.

Pros and Cons of AER

Pros and Cons of AERAER offers investors a convenient and easy way to compare different interest rates from different sources. It’s important to know the pros and cons of AER before deciding whether or not to invest. AER can be beneficial if you’re looking for a higher return than what traditional savings accounts offer, as it can provide a more competitive rate of return. Additionally, AER offers a more predictable financial return, which can be helpful when budgeting and forecasting. On the other hand, AER can be risky if you don’t understand the associated risks. It’s important to understand the terms and conditions of any investment before investing and to be aware of the associated risks. AER can also lead to bad decision-making if you don’t take the time to understand the associated risks and risk-adjusted returns. Additionally, AER can lead to higher taxes for some investors, so it’s important to understand the associated tax implications before investing. In conclusion, AER can be a great way to earn a higher return on your money, but it’s important to understand the associated risks and tax implications before investing.

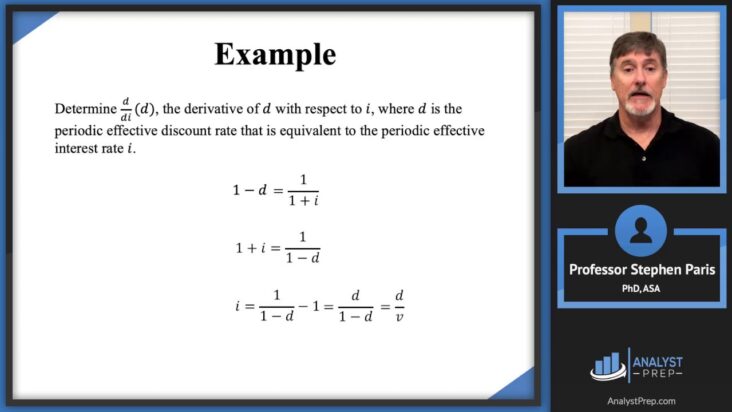

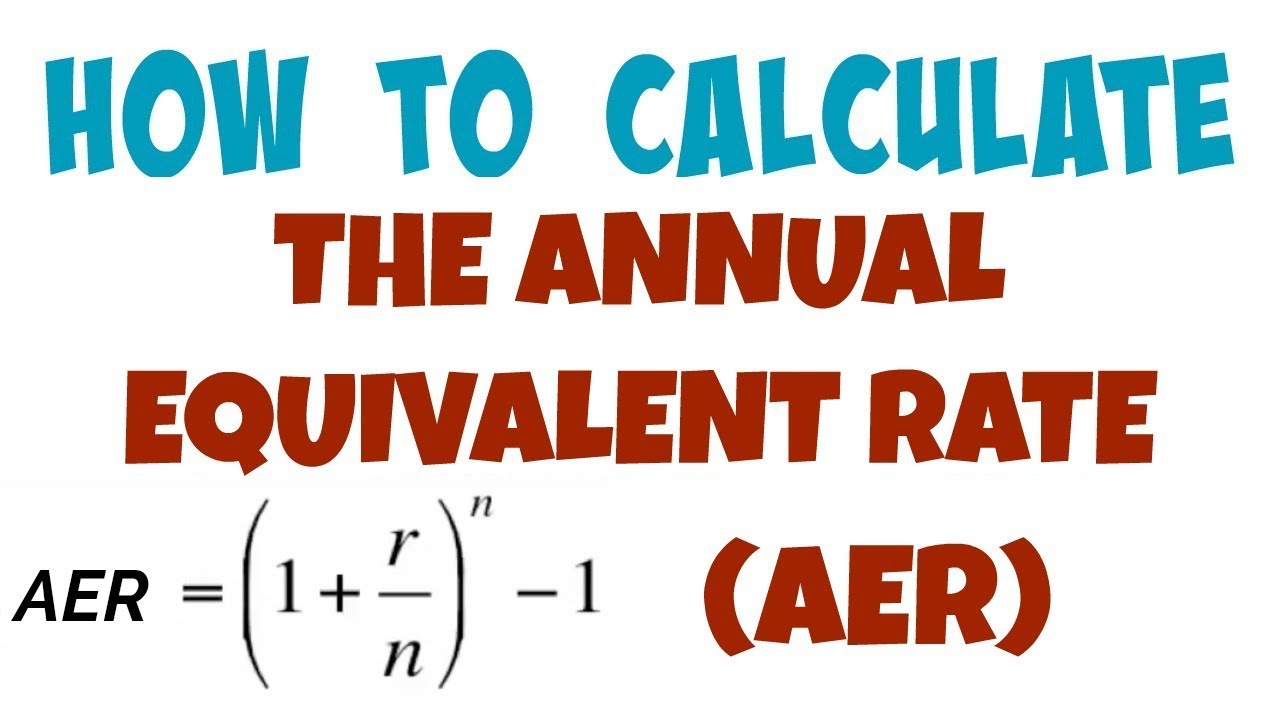

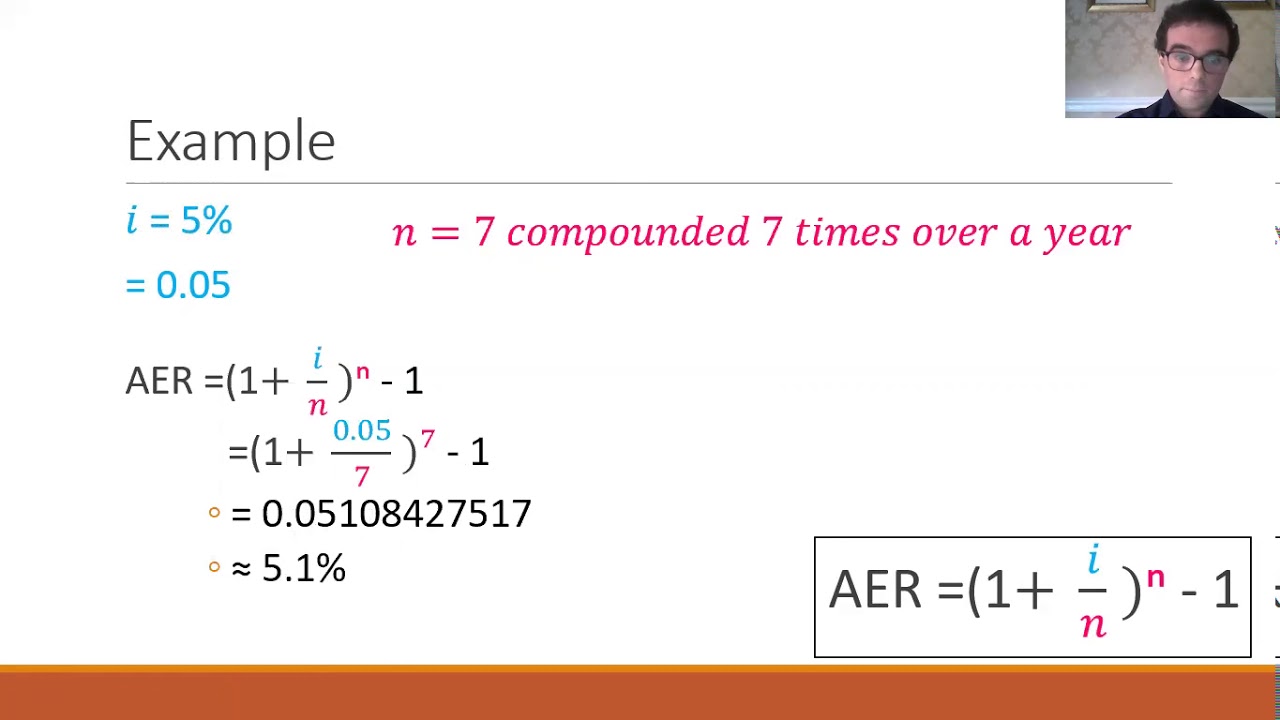

Tips for Calculating AER

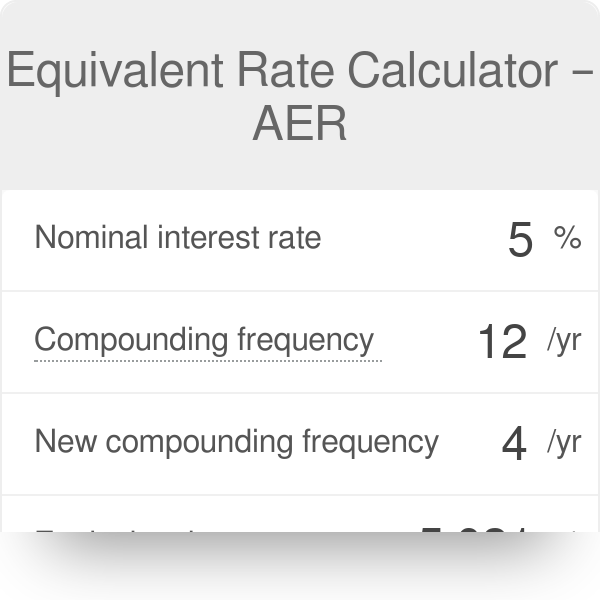

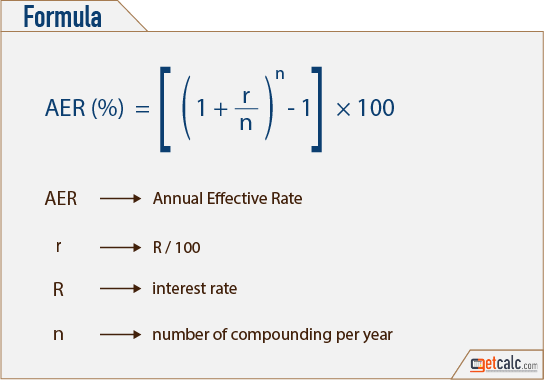

Calculating AER can seem a bit intimidating, but it doesn’t have to be! Here are a few tips to help you out. First, make sure you understand exactly what AER is and how it applies to your investments. Knowing the basics will help you calculate the correct AER value. Secondly, always use the correct interest rate when calculating AER. This is important as different interest rates will result in different AER values. Finally, make sure to factor in any fees or taxes associated with your investment when calculating AER. This will ensure that you get an accurate AER value for your investments. With these tips, you’ll be able to easily calculate AER and make the most of your investments!