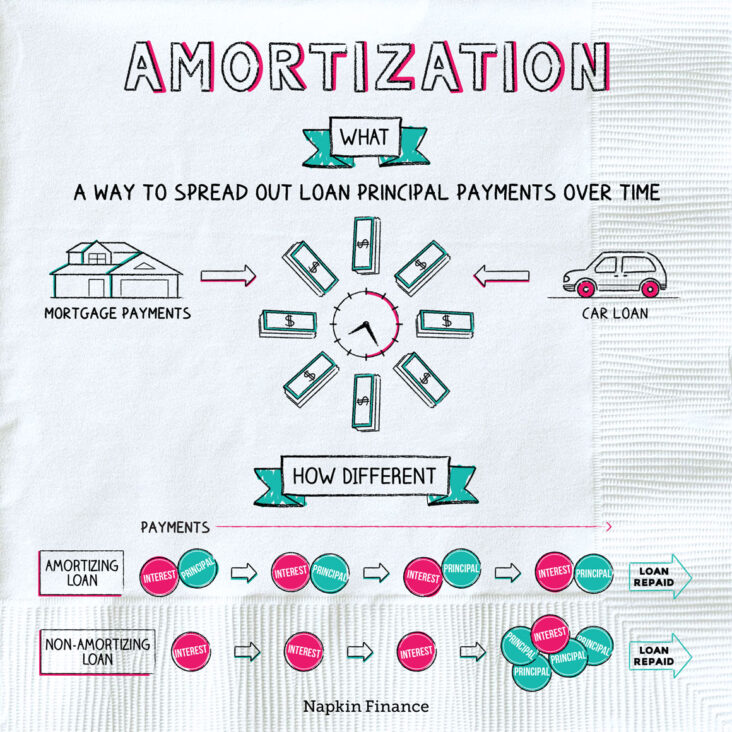

Are you looking for a way to pay off your large loan in an affordable way? An amortized loan may be the answer for you. An amortized loan is a loan that is split into scheduled payments over the life of the loan. This type of loan ensures that your payments are consistent and that you pay off the loan in a predictable amount of time. Amortized loans can be beneficial in a number of ways, including lower interest rates, easier budgeting, and a lower total cost of borrowing. Read on to learn more about what an amortized loan is and how it can help you.

Overview of Amortized Loans

An amortized loan is a type of loan that involves spreading out the payments over a period of time, usually with a fixed interest rate. It’s a great option for those wanting to make sure their payments are consistent and on time. With an amortized loan, you’re able to spread out the cost of the loan over the life of the loan, making it easier to manage your payments and budget. This type of loan is often used for large purchases like a car or home. The benefit of an amortized loan is that you can spread out the cost of the purchase, making it more affordable. You also benefit from a fixed interest rate which makes it easier to plan your budget. Amortized loans are a great option for those looking to make a large purchase while still managing their finances.

Benefits of Amortized Loans

Amortized loans are a great way to help manage debt and keep up with loan payments. These loans are beneficial because they allow you to make small payments over time, instead of having to pay the loan off in one lump sum. With an amortized loan, the payments are spread out over the life of the loan, making the payments more manageable. The payments are also typically fixed, meaning that you won’t have to worry about interest rates changing throughout the life of the loan. The payments are also predictable, as you will know how much you’re paying every month. This makes it easier to budget and plan ahead. Plus, with an amortized loan, you can pay off the loan early without a penalty, so you can save on interest and pay off the loan faster.

Amortized Loan Repayment Plans

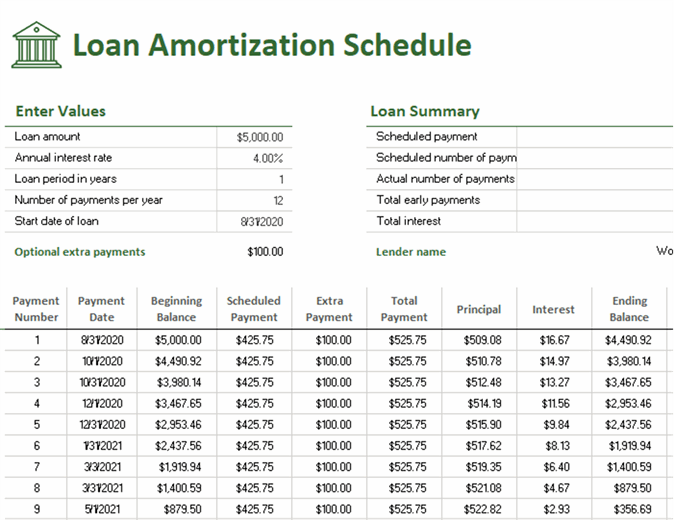

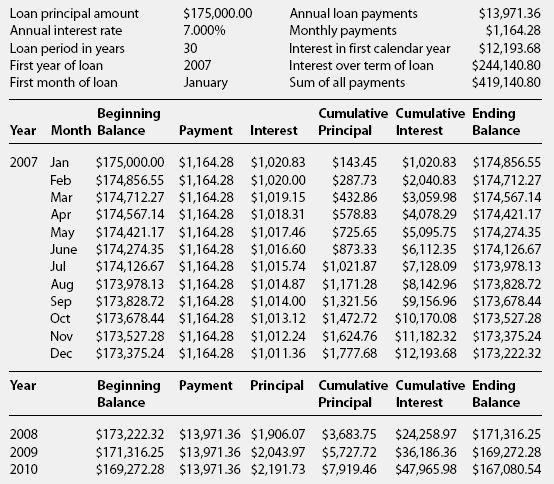

When it comes to repaying an amortized loan, there are a few different repayment plans you can use. One of the most common options is the fixed-rate repayment plan, which allows you to make the same payments for the entire duration of the loan. This makes it easy to budget and plan for your payments, since you know exactly how much you’ll be paying each month. Another option is the adjustable-rate repayment plan, which allows you to adjust your payment amount based on changes in the interest rate. This way, you can take advantage of lower interest rates if the market shifts and save money on your loan payments. Finally, you can also opt for a graduated repayment plan, which allows you to start off with lower payments that gradually increase over the course of the loan. This can help you save money in the long run and is a great option if you’re expecting your income to increase over time. Whichever repayment plan you choose, make sure you understand the terms and conditions of the loan so you can make an informed decision and make sure your payments are on time.

How to Choose an Amortized Loan

When it comes to choosing an amortized loan, it’s important to understand what you’re getting into and shop around for the best deal. Know the interest rate, the length of the loan, and any other terms and conditions so you can compare offers. Ask questions and do research to make sure you’re getting the best deal. Consider the fees associated with the loan and make sure you can afford the monthly payment before signing on the dotted line. Make sure you understand all of the details of the loan, including the repayment schedule, and look for any hidden fees. Knowing the full cost of the loan upfront can help you make an informed decision and get the best deal possible.

When an Amortized Loan Is the Right Choice

When it comes to making the right decision for your financial future, an amortized loan may be the perfect option. An amortized loan is a type of loan where the payments are spread out over a period of time, with a fixed interest rate, and payments that stay the same amount each month. This type of loan is ideal for those who are looking for a predictable payment schedule, as well as those who want to pay off the loan as quickly as possible. It’s also a great choice for those who are looking to make a major purchase, such as a house or a car, as it allows them to spread the cost out over a longer period of time, making it easier to manage. With an amortized loan, you can be sure that you’re getting the best rate and terms for your loan and that your payments will remain consistent.