Aggregation is a powerful financial tool that can help you maximize your savings and investments. Through aggregation, you can combine multiple accounts, investments, and assets into one single platform, giving you an easy way to manage, track, and analyze your finances. This article will explain what aggregation is, its various benefits, and how you can use it to make your financial life simpler and more efficient.

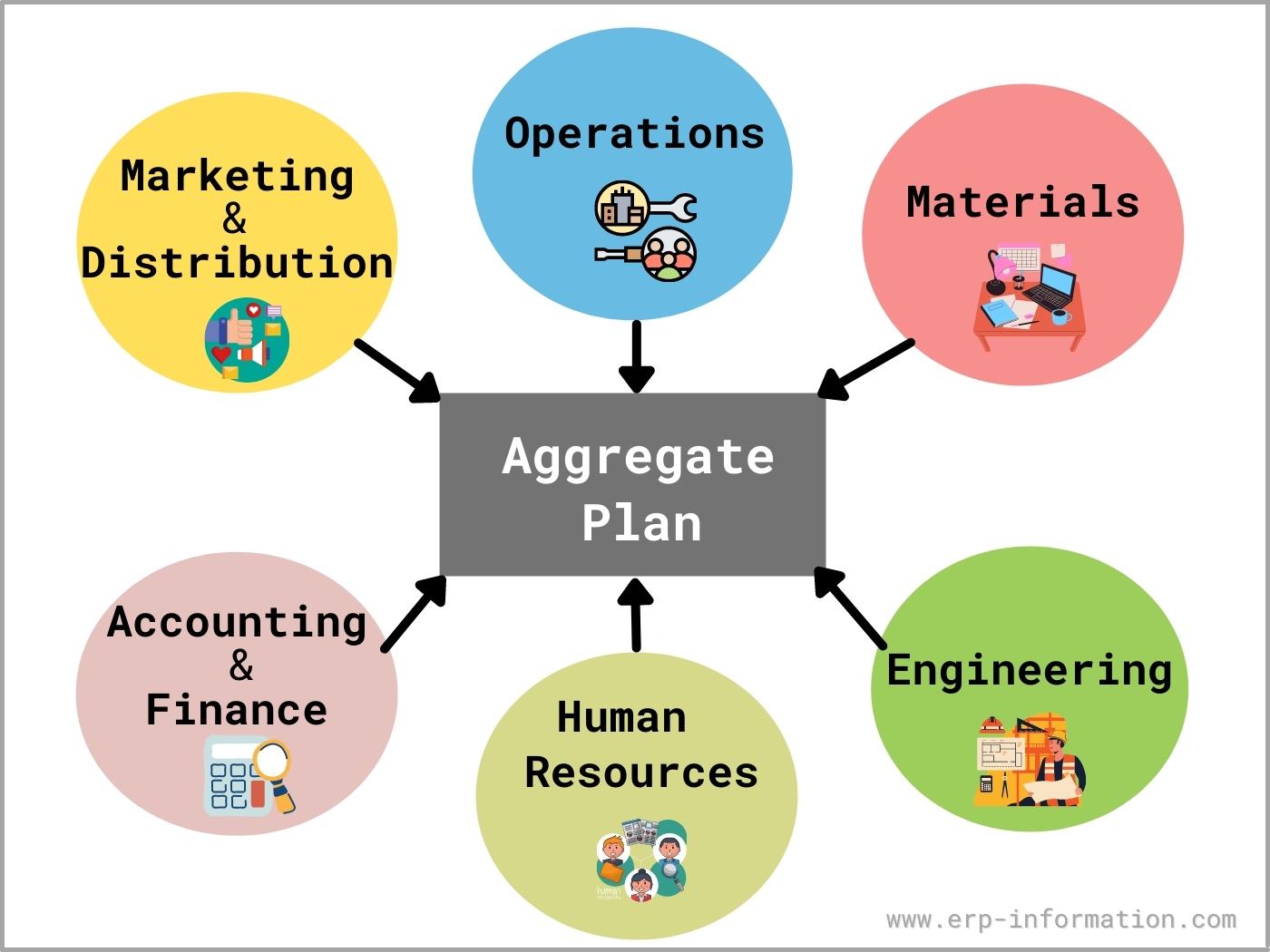

What Are the Different Types of Aggregation?

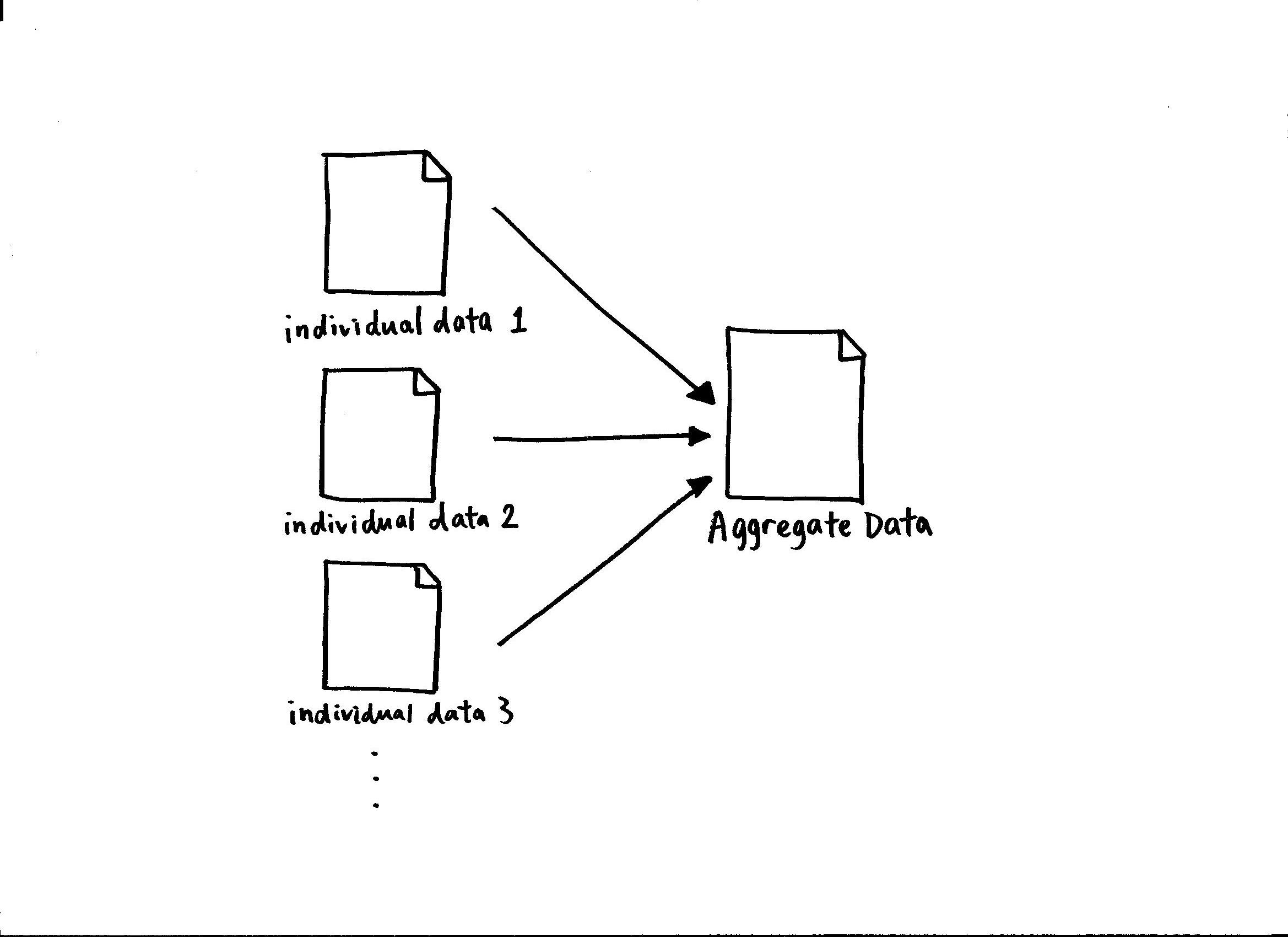

When it comes to aggregation, there are several different types you should be aware of. The most common type of aggregation is portfolio aggregation, which is when a financial institution or advisor pools together multiple investments from different clients. This type of aggregation allows these clients to have their investments managed by one party, rather than having to manage each investment individually. Another type of aggregation is data aggregation, which is when a person or company collects data from multiple sources and then organizes it in a usable way. This type of aggregation is becoming increasingly important as more businesses rely on data to make decisions. Finally, there is transaction aggregation, which is when a person or business combines multiple transactions into a single transaction. This type of aggregation can be used to reduce costs, increase efficiency, and provide better customer service. Understanding the different types of aggregation can help you make more informed decisions when it comes to managing your finances.

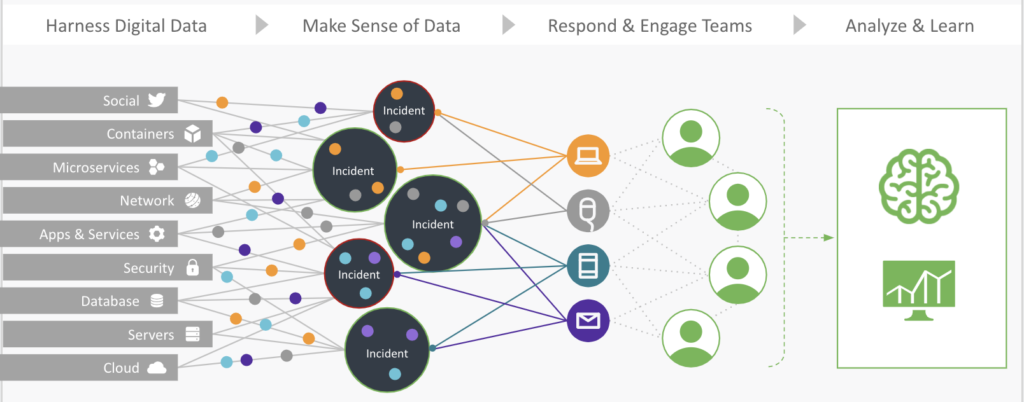

How Does Aggregation Affect Financial Markets?

When it comes to financial markets, aggregation has a huge impact. Essentially, it’s a process that combines data from a variety of sources to create a comprehensive overview of the market. By using aggregation, traders are able to get a better understanding of the market and make more informed decisions about their investments. Aggregation is also useful for predicting potential trends and helping to identify potential risks. This can help traders to minimize losses and maximize profits. Aggregation also helps to reduce the amount of time that traders have to spend manually researching the financial markets, which can save them a lot of time and money in the long run. Overall, aggregation is a great tool for traders and investors looking to get the most out of their financial investments.

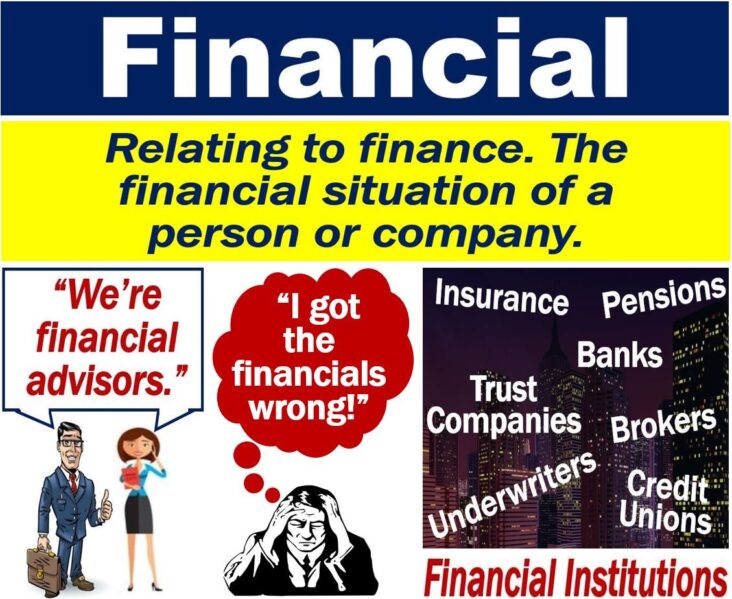

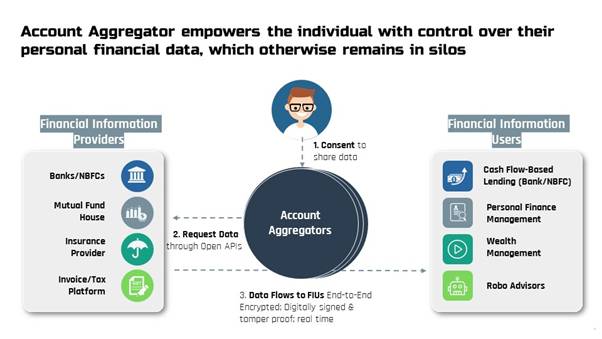

Benefits of Aggregation for Financial Institutions

Aggregation is a great tool for financial institutions to maximize their resources and increase their efficiency. It allows them to bundle similar services together, making it easier for customers to access the services they need. This can make it much easier for customers to choose the services that are right for them, and it can help financial institutions save time and money by streamlining their processes. The benefits of aggregation for financial institutions include more efficient customer service, improved customer experience, and increased cost savings. Aggregation also makes it easier for financial institutions to track customer data and analyze customer behavior, which can help them make better decisions and improve their services. By leveraging aggregation, financial institutions can improve their customer service, increase their bottom line, and make their customers happier.

Strategies to Avoid Plagiarism When Using Aggregated Data

Aggregated data is a great way to quickly get the information you need, but it’s important to make sure you’re avoiding plagiarism. Here are a few strategies to help you make sure you’re not accidentally copying someone else’s work: cite your sources, use direct quotations sparingly, and reword information in your own words. Citing your sources is the most important way to avoid plagiarism when using aggregated data. Whenever you’re using facts or quotes from a source, you should always provide a citation. This allows your readers to easily find the original source of the information and makes it clear that you aren’t claiming it as your own. Additionally, it’s important to use direct quotations sparingly. While you can use them to provide information, you should always try to reword them in your own words to make sure you’re not plagiarizing. Lastly, when you’re summarizing information or ideas, make sure to always reword them in your own words. This helps to make sure you’re not accidentally copying someone else’s work. By following these strategies, you can make sure you’re not plagiarizing when you’

Differences Between Aggregation and Consolidation in Financial Reporting

Aggregation and Consolidation are two important financial reporting techniques that must be understood in order to accurately report and analyze financial information. They are both used to group financial information into larger, more meaningful segments, but there are some key differences between them. Aggregation is the process of combining multiple individual financial elements into one total figure. It is typically used to combine multiple values, such as sales or costs, into a single number. Consolidation, on the other hand, involves combining entire companies or entities into one larger entity. This is done by combining the financials of each company into the financials of the larger entity. While both aggregation and consolidation are used to group financial information, they are quite different and should not be confused. Aggregation is used to combine individual financial elements into one total figure, while consolidation is used to combine entire companies or entities into one larger entity. Understanding the differences between aggregation and consolidation is essential for accurate financial reporting and analysis.