Aggregate Stop-Loss Insurance is an essential financial tool for protecting businesses from large financial losses. It is a form of risk management that provides a layer of protection from unexpected medical claims. By providing coverage for the aggregate of all employee medical costs, Aggregate Stop-Loss Insurance helps businesses keep their medical costs within budget. Through Aggregate Stop-Loss Insurance, businesses can reduce their risk of financial hardship due to medical claims exceeding expected costs. With this protection, businesses can confidently provide employee benefits without worrying about the financial repercussions of unexpected medical claims.

What Is Aggregate Stop-Loss Insurance?

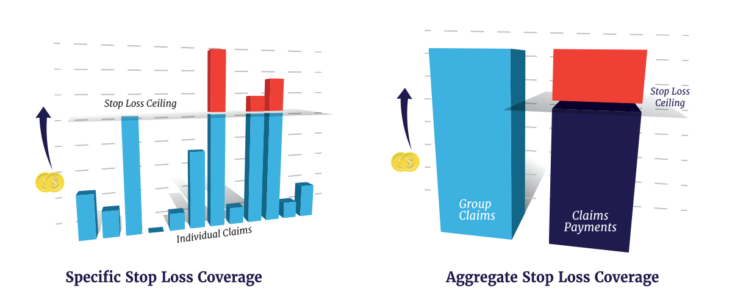

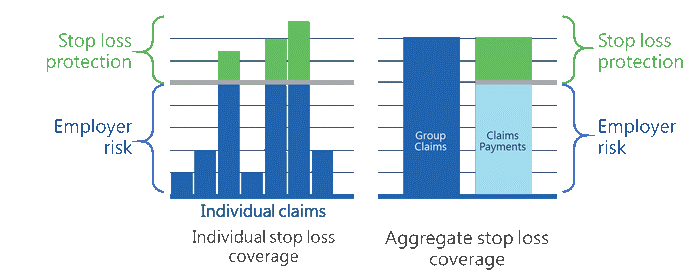

Aggregate Stop-Loss Insurance is an insurance policy that helps protect businesses from high costs associated with employee health benefits. This type of insurance works by limiting the amount of money the business is responsible for paying out in claims each year. It works by setting an aggregate limit on the amount the company has to pay for claims, and if the company exceeds this limit, the insurance company will be responsible for paying the remainder. This type of insurance helps protect businesses from the high costs of providing health benefits to employees, ensuring that the financial burden of providing health benefits remains manageable.

The Benefits of Aggregate Stop-Loss Insurance

Aggregate Stop-Loss Insurance is a great way to protect your business from high medical costs. This type of insurance provides coverage for any hospital and medical expenses that are over a certain limit, which is set by the policyholder. With Aggregate Stop-Loss Insurance, you can rest assured that you won’t have to worry about footing the bill for expensive medical expenses. It’s a great way to gain financial stability and peace of mind. It also allows business owners to focus on their core business operations and not have to worry about the financial ramifications of high medical costs. With this type of insurance, you can keep your business running smoothly and protect your bottom line.

When to Consider Aggregate Stop-Loss Insurance

When it comes to providing financial protection for your business, aggregate stop-loss insurance is a great option to consider. It’s an insurance policy that helps to cover the costs of medical claims made against your business. Through this type of policy, you can set a maximum amount of money that your business will be responsible for paying out in the event of an unexpected medical claim. This way, you can ensure that your business is financially protected against any large medical bills that could be incurred. Aggregate stop-loss insurance is a great way to safeguard your business against unexpected medical costs, and can help to provide peace of mind when it comes to protecting your business from financial hardship.

Understanding the Financial Implications of Aggregate Stop-Loss Insurance

Aggregate stop-loss insurance is a type of insurance policy that helps protect businesses from unexpected financial losses. It’s designed to cover losses that exceed a predetermined threshold, providing a much-needed financial backstop for businesses. Understanding the financial implications of aggregate stop-loss insurance can be crucial for businesses, as it can help them manage their risk and protect their bottom line. For example, if a business has a large number of claims in a given year, aggregate stop-loss insurance can help mitigate the financial impact of those claims. Additionally, if a business has a particularly high-risk population, aggregate stop-loss insurance can provide an extra layer of protection to help keep the business financially secure. In short, aggregate stop-loss insurance can be an invaluable tool for businesses to help safeguard their financial health.

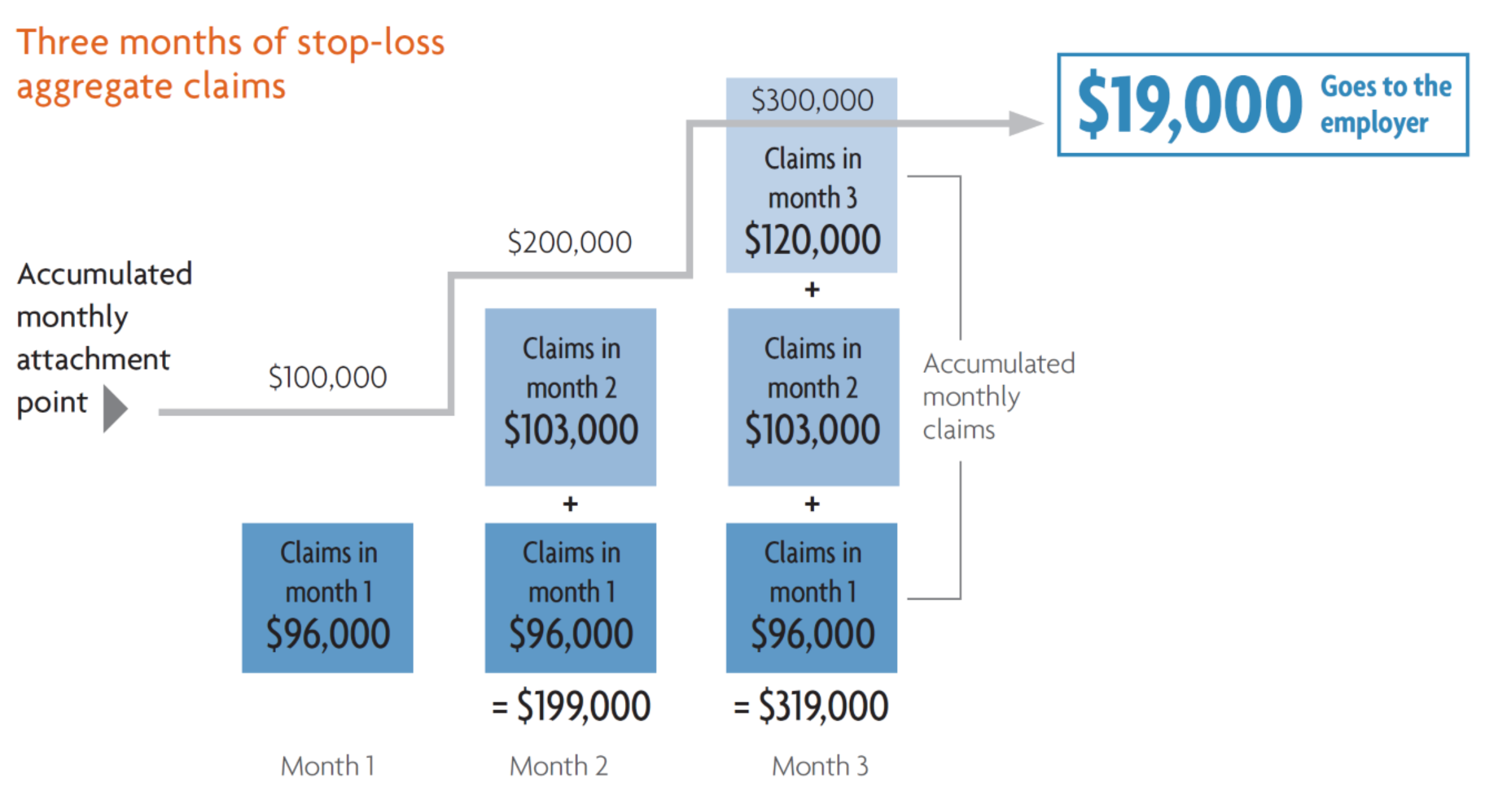

How to Calculate and File an Aggregate Stop-Loss Insurance Claim

Filing an aggregate stop-loss insurance claim can be complicated and time-consuming, but it’s important to make sure you get the coverage you need. Calculating the amount you need to file is key to making sure you get the right amount of coverage. When calculating the amount you need to file, consider your total annual risk, your deductible, and the coverage limits of your plan. Once you have an estimate of the amount you need, you can contact your insurance company to submit your claim. Be sure to keep all documentation of the claim process and any communication with the insurance company so you can easily track the status of your claim. Filing an aggregate stop-loss insurance claim doesn’t have to be a stressful process, but it’s important to make sure you’re properly covered.