Advanced Internal Rating-Based (AIRB) is an innovative risk management tool used by financial institutions to assess and manage the credit risk of their loan portfolios. By assigning a credit score to each loan, the AIRB tool helps financial institutions better understand their risk exposures and plan accordingly. This article provides an in-depth look at the AIRB tool and explains how it works, its benefits, and how it can be used to effectively manage risk.

Explaining the Basics of Advanced Internal Rating-Based (AIRB)

Advanced Internal Rating-Based (AIRB) is a financial risk assessment tool used by banks and other financial institutions to measure the creditworthiness of potential borrowers. It uses a combination of internal and external data to generate a score that assesses the likelihood that a borrower will default on a loan. Banks use this score to determine how much to lend and at what interest rate to charge on a loan. AIRB also helps banks understand the risks they face and set appropriate lending levels. It is important for financial institutions to use AIRB when evaluating borrowers in order to protect their investments and minimize their losses. AIRB can also be used to improve the overall efficiency of the lending process and help banks make informed decisions about who to lend to.

Understanding the Different Components of AIRB

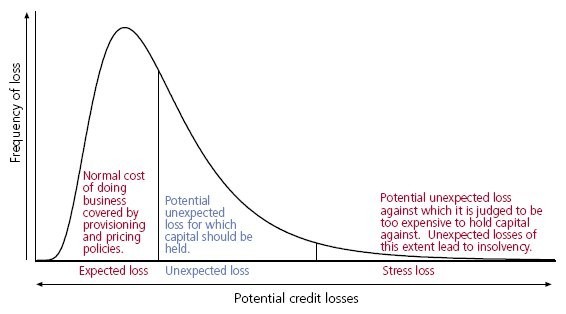

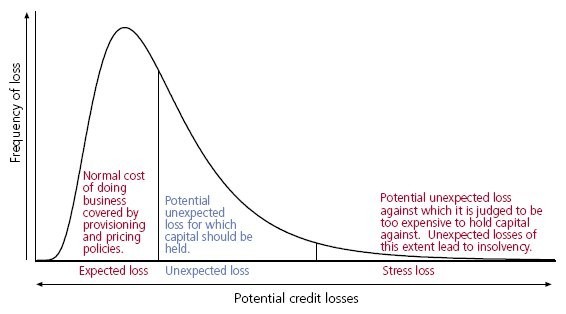

Understanding the different components of AIRB is key to understanding how it works. AIRB is an advanced internal assessment system that evaluates credit risk for financial institutions. It is designed to be used as an internal rating system that provides a consistent, objective, and comprehensive method to measure credit risk. The components of AIRB include credit risk measurement, credit risk estimation, and credit risk monitoring. Credit risk measurement involves the use of internal and external data sources to evaluate the creditworthiness of potential borrowers. Credit risk estimation involves the use of statistical models to estimate the probability of default. Finally, credit risk monitoring involves the tracking of credit risk over time to ensure that the creditworthiness of borrowers is maintained. With these components, AIRB provides a comprehensive assessment of credit risk and helps financial institutions make informed decisions about their portfolios.

Assessing the Benefits of AIRB for Financial Institutions

The Advanced Internal Rating-Based (AIRB) approach is a great way for financial institutions to assess the credit risk of their borrowers. With AIRB, institutions can more accurately measure and quantify the risk of a loan, allowing them to make better decisions when lending out money. The AIRB approach also helps financial institutions better manage their portfolios and better understand their exposure to credit risk. As a result, institutions can be more confident that their loans are safer and that their capital is better protected. Implementing AIRB can help institutions maximize their profitability and better manage their credit risk. All in all, AIRB offers a great way for financial institutions to manage their credit risk and maximize their profits.

Analyzing the Challenges of Implementing AIRB

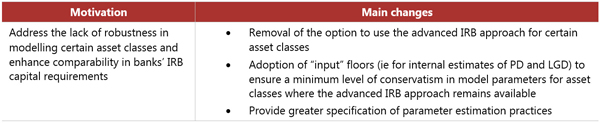

Implementing the Advanced Internal Rating-Based (AIRB) system can be a daunting task for many banks and financial institutions. Not only must they understand the intricacies of the system, but they must also invest time and money into getting it up and running. The AIRB system is based on a sophisticated risk-based approach to assigning credit ratings, which requires banks to have a deep understanding of the risk-based approach as well as the ability to accurately assess the risks associated with a particular loan or other financial instrument. Additionally, banks must have the right personnel and information systems to be able to properly implement the system. While the AIRB system may be complex and require a significant amount of effort, it is a necessary step for banks and financial institutions to ensure that they are making sound, informed decisions.

Examining the Impact of AIRB on Financial Regulation

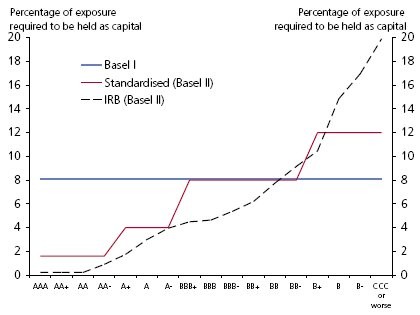

The Advanced Internal Rating-Based (AIRB) is an important regulatory measure that has been put in place to ensure financial stability in the banking sector. It is a risk-based approach to capital adequacy calculations, which requires banks to use their own internal models to assess the risks in their portfolios. This system has been put in place by the Basel Committee on Banking Supervision, and it is designed to ensure that banks maintain sufficient capital to protect themselves against potential losses. The AIRB has had a significant impact on financial regulation and has forced banks to become more disciplined in their risk management practices. It also has increased the transparency of risk management practices and has made it easier for regulators to monitor and assess banks’ risk profiles. The AIRB is an important tool for financial regulation and has been instrumental in helping to create a more stable financial system.