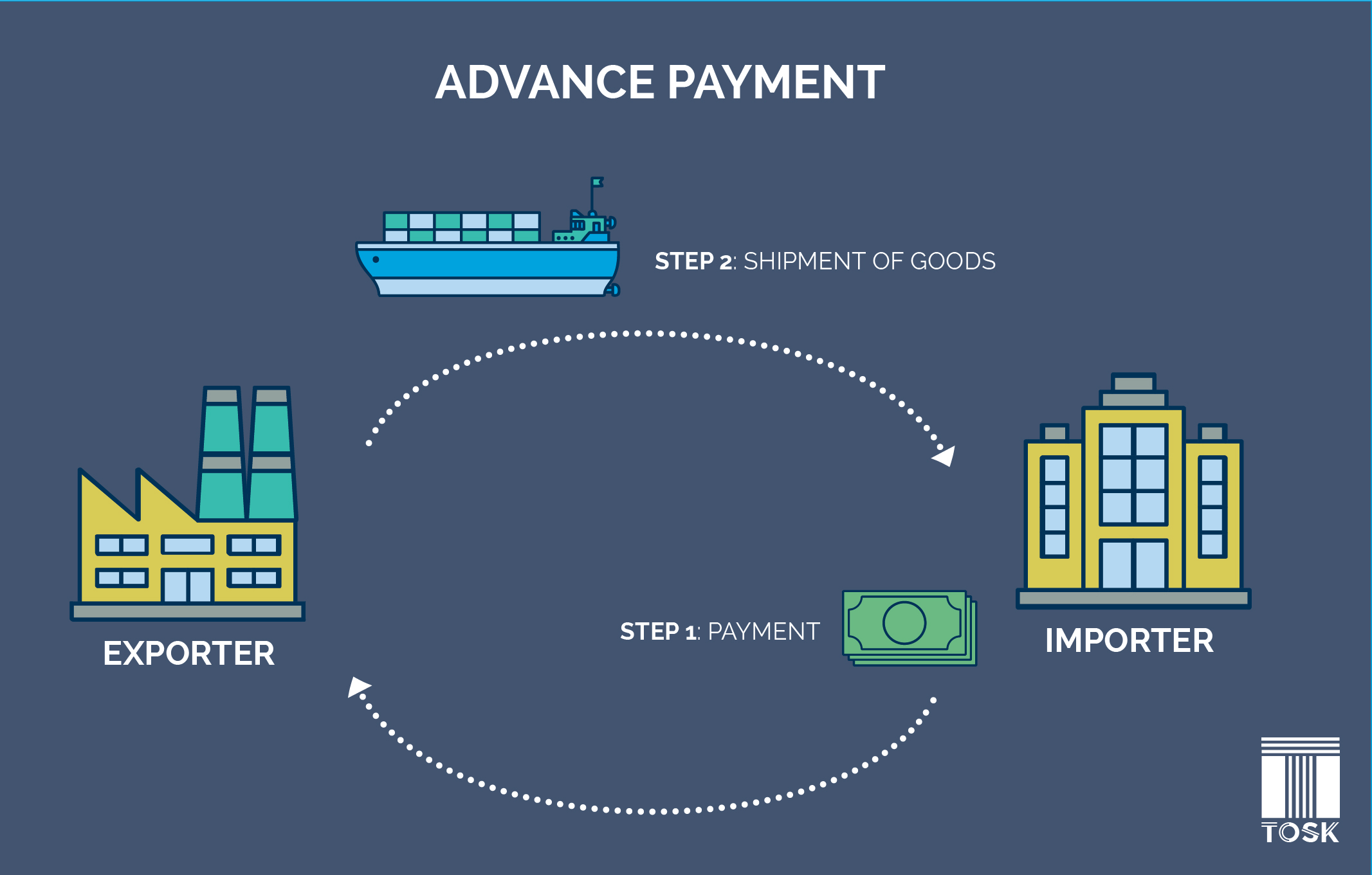

Advance Payment is a financial concept that refers to paying an amount of money before the goods or services are received. It is a particularly important concept for businesses that require pre-payment to guarantee services or goods. It can also be beneficial for customers who want to ensure that the goods or services they need will be available when they need them. Understanding how Advance Payment works and the potential associated risks can help you make informed decisions about when and how to use it for your business or personal needs.

What are the Benefits of Advance Payment?

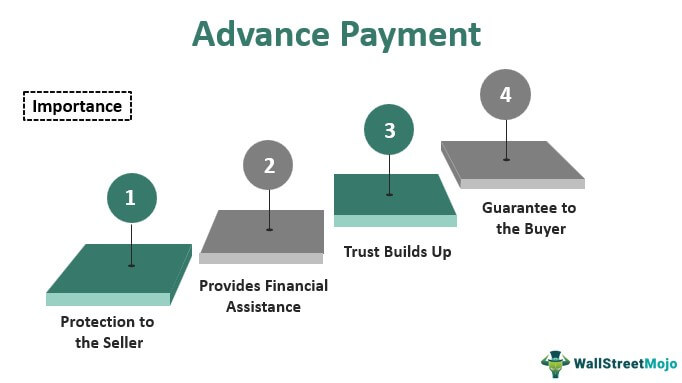

Advance payments come with a ton of benefits, especially for small businesses. First, they offer convenience and peace of mind. By paying upfront, you don’t have to worry about keeping track of invoices and payments, and you can rest assured knowing that your purchases will be taken care of. Second, making advance payments can save you money. You can often get discounts for paying a certain amount in advance, so you can save big by taking advantage of these offers. Third, advance payments can help you stay organized. With an upfront payment, you know exactly how much you’re spending and when, and you can plan your budget accordingly. Lastly, paying in advance can help you build a strong relationship with vendors and suppliers, as they’ll be more likely to work with you knowing that you’re reliable and willing to commit to a payment plan. All in all, advance payments are great for small business owners who want to get the most bang for their buck and stay organized.

How to Manage an Advance Payment?

Managing an advance payment can be a tricky process, especially when you’re dealing with a large sum of money. It’s important to keep track of all the details involved, including the payment plan and any fees or interest. The key to managing an advance payment is to make sure you understand the terms and conditions before agreeing to anything. Make sure you have a clear understanding of any fees or interest and what you’re agreeing to pay back. You should also keep track of your payments and make sure you’re on schedule. It’s important to be proactive in managing an advance payment to avoid any unnecessary fees and to make sure you’re getting the most out of the agreement. Finally, make sure you communicate with the lender regularly so that both parties are aware of any changes or issues that might arise. With the right approach, managing an advance payment can be a smooth process.

What Are the Risks of an Advance Payment?

Making an advance payment can be a great way to secure a service or product, but there are some risks involved. One of the biggest risks is that you might not get what you paid for. If the service or product is not delivered, then you could be out the money you paid in advance. Another risk is that the seller may keep your advance payment and go out of business, leaving you with nothing to show for your money. Finally, if you are not sure how the seller will use your money, you may be putting yourself at risk of fraud. To minimize the risks of an advance payment, make sure to check reviews and ratings, ask for proof of delivery, and only make payments using a secure payment method.

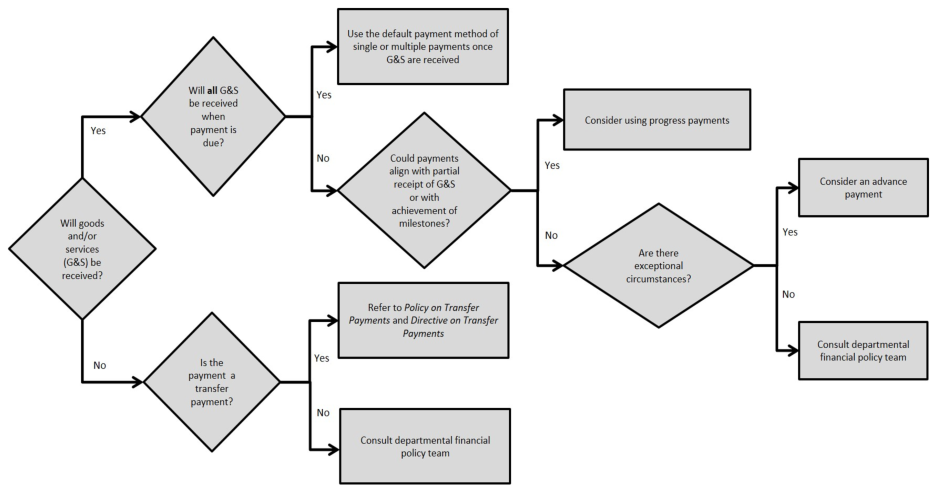

What Are the Alternatives to Advance Payment?

Advance payments can be a great way to secure a product or service, but there are other options available. Alternatives to advance payments include paying in installments, using a prepaid card, requesting a credit line, or using a payment gateway. Paying in installments is a great option if you need to spread out the cost of a product or service over a period of time. Prepaid cards are also a popular alternative and can be used to pay for goods or services in advance without having to worry about late fees. Requesting a credit line may also be an option, but keep in mind that this could come with a hefty interest rate. Finally, payment gateways are a great way to securely pay for goods and services online without having to worry about fraudulent activity. Regardless of which option you choose, make sure you are aware of the terms and conditions of the agreement before committing to any payment.

How to Ensure Compliance with Advance Payment Guidelines?

Making sure you stay compliant with advance payment guidelines is essential for any business. To ensure you are following the rules, you need to make sure you have proper documentation for every advance payment you make. You should also make sure to keep track of all payments you have made and how much you have paid out. This will help you stay on top of any discrepancies or errors in the system. Additionally, you should also be aware of any laws or regulations that might affect your advance payment policies. Understanding the legal requirements can help you avoid any potential penalties or fines. Finally, if you ever have any doubts or questions, make sure to contact a professional financial advisor or accountant who can help you make sure you are staying within the parameters of the guidelines.