Administrative Expenses are a key component of any business’ financial strategy and can be a great way to maximize efficiency and profitability. Administrative expenses are the costs incurred in the day-to-day running of a business, such as salaries, office supplies, and other overhead costs. Understanding the different types of administrative expenses and how they impact a business’ bottom line is essential for financial success. In this article, we’ll explore what administrative expenses are, how they are classified, and how to manage them effectively.

What Are the Different Types of Administrative Expenses?

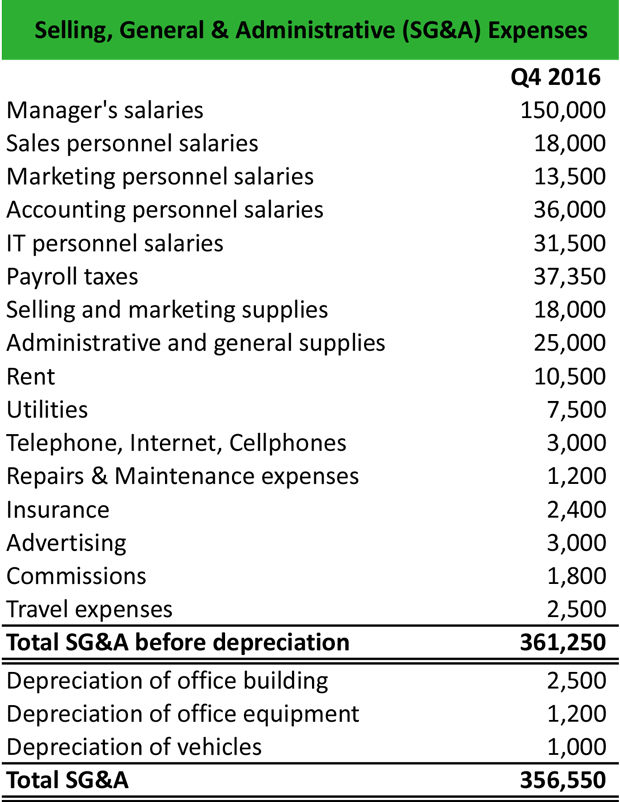

Administrative expenses are the costs of running a business and can include a wide range of things. From salaries and rent to office supplies and advertising, these costs can quickly add up. But, understanding the different types of administrative expenses can help you better manage your budget and ensure your business is running efficiently. Common types of administrative expenses are office and facility costs, human resources costs, communications costs, professional fees, and marketing costs. Office and facility costs include rent, utilities, furniture, and equipment. Human resources costs include salaries, benefits, training, and recruitment. Communications costs include phone, internet, and mail services. Professional fees include accounting, legal, and consulting services. Lastly, marketing costs include advertising, promotions, and public relations. By understanding the different types of administrative expenses, you can create a more accurate budget and make sure your business is running as efficiently as possible.

What Are the Benefits of Tracking Administrative Expenses?

Tracking administrative expenses is a great way to stay on top of your business finances. Doing so can help you keep your costs down and ensure that you’re spending only on necessary items. Tracking your administrative expenses can also help you to identify any areas where you may be able to save money. By understanding exactly where your money is being spent, you can more easily identify any inefficiencies or areas where cuts can be made. Additionally, tracking your administrative expenses can help you to create more accurate budgeting plans so that you can better manage your finances. With better visibility into your spending, you can make more informed decisions about how to allocate your resources. Ultimately, tracking your administrative expenses can help you to understand your financial situation and make smart decisions that will help your business succeed.

How Can Organizations Reduce Administrative Expenses?

Organizations can save money on administrative expenses in a few different ways. One of the most obvious methods is to cut back on the number of staff that handle administrative tasks. By streamlining the process and minimizing the number of people involved, organizations can reduce payroll costs and administrative costs. Additionally, organizations can take advantage of digital solutions to automate administrative tasks. By using technology to automate mundane tasks, organizations can save time and money. Finally, organizations should consider outsourcing their administrative tasks to a third party. This can be a great way to reduce costs and free up resources that can be used for other tasks. With careful planning and foresight, organizations can drastically reduce their administrative expenses and improve their bottom line.

What Are the Common Accounting Practices for Administrative Expenses?

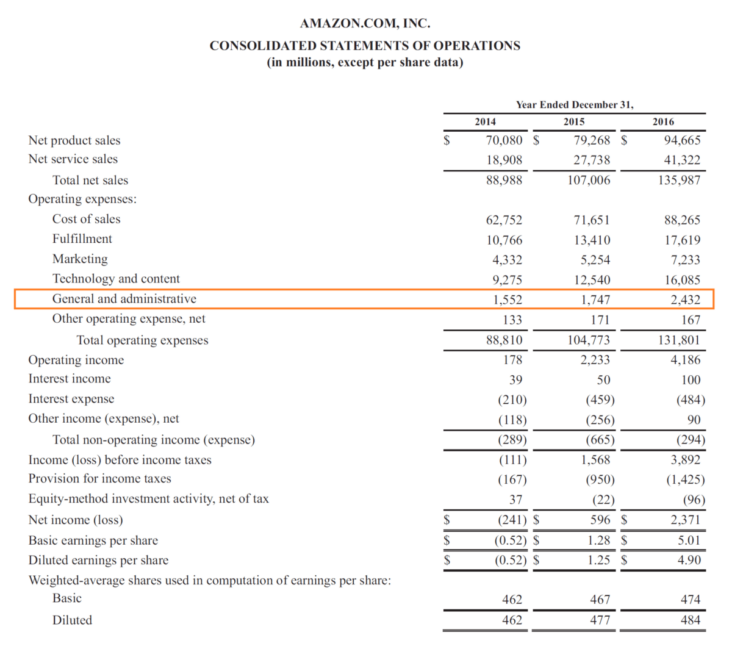

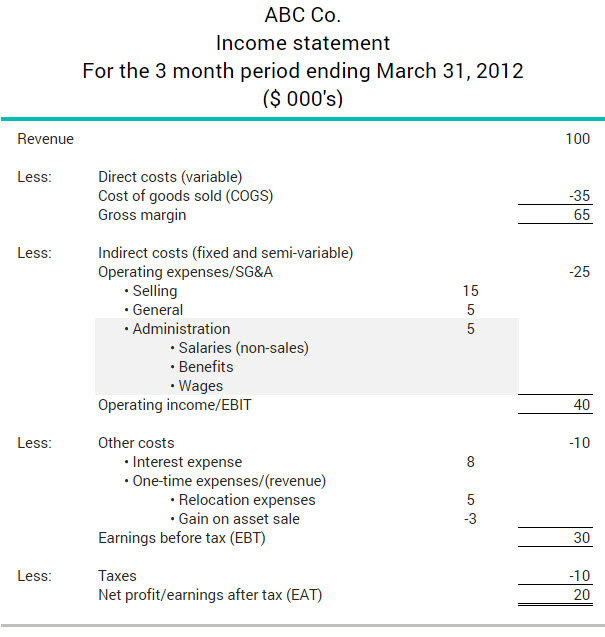

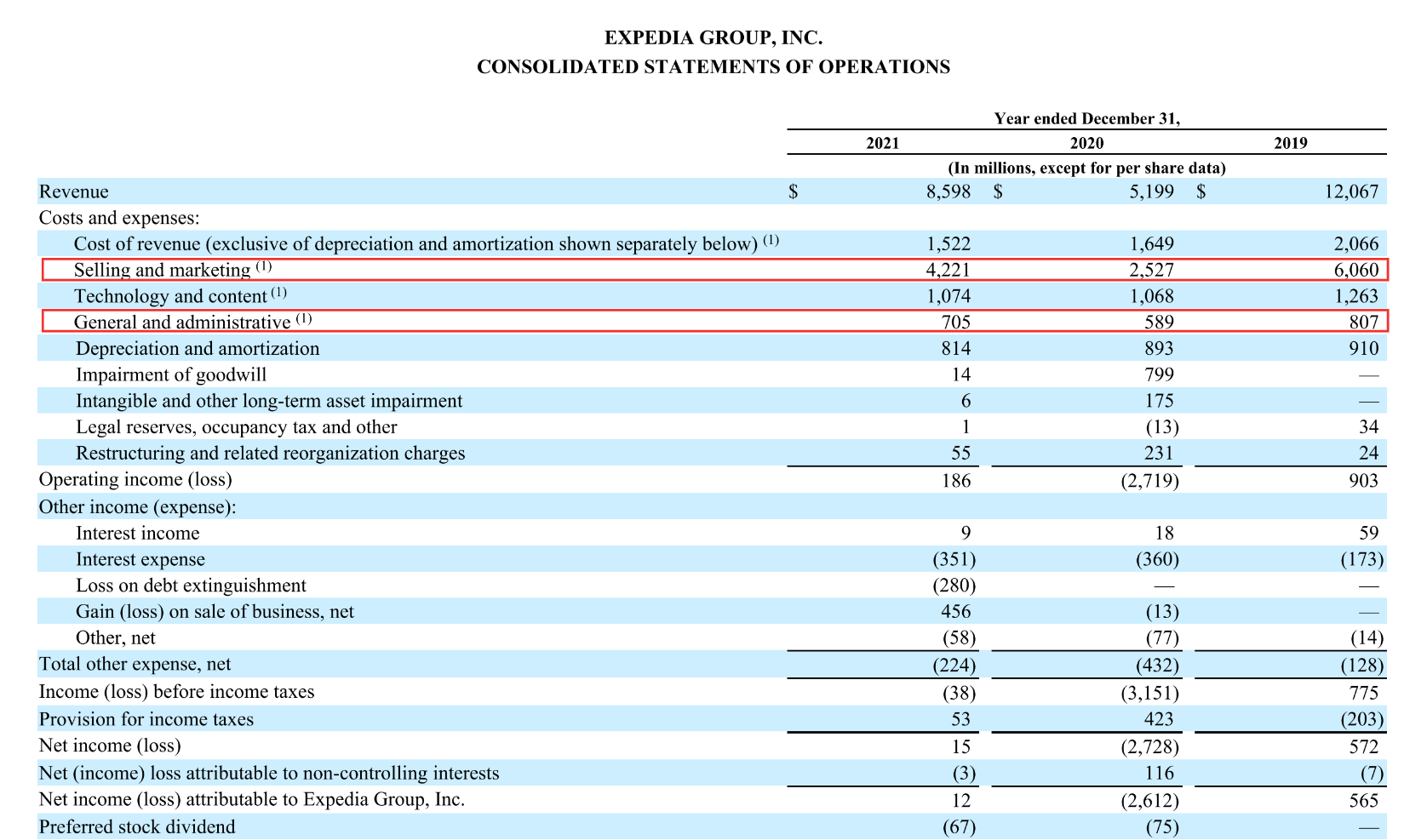

When it comes to accounting for administrative expenses, there are a few common practices that businesses should be aware of. First, businesses should ensure that all administrative expenses are properly categorized and recorded in the correct financial statements. This includes properly tracking any overhead costs associated with running the business. Additionally, businesses should strive to keep administrative expenses as low as possible, focusing on streamlining costs and minimizing waste. Finally, businesses should keep a close eye on their administrative expenses and track their spending against their budget. This can help to ensure that administrative expenses are kept under control and that the business is not overspending on these costs. By following these common accounting practices, businesses can ensure that their administrative expenses are properly managed and controlled.

What Are the Best Practices for Managing Administrative Expenses?

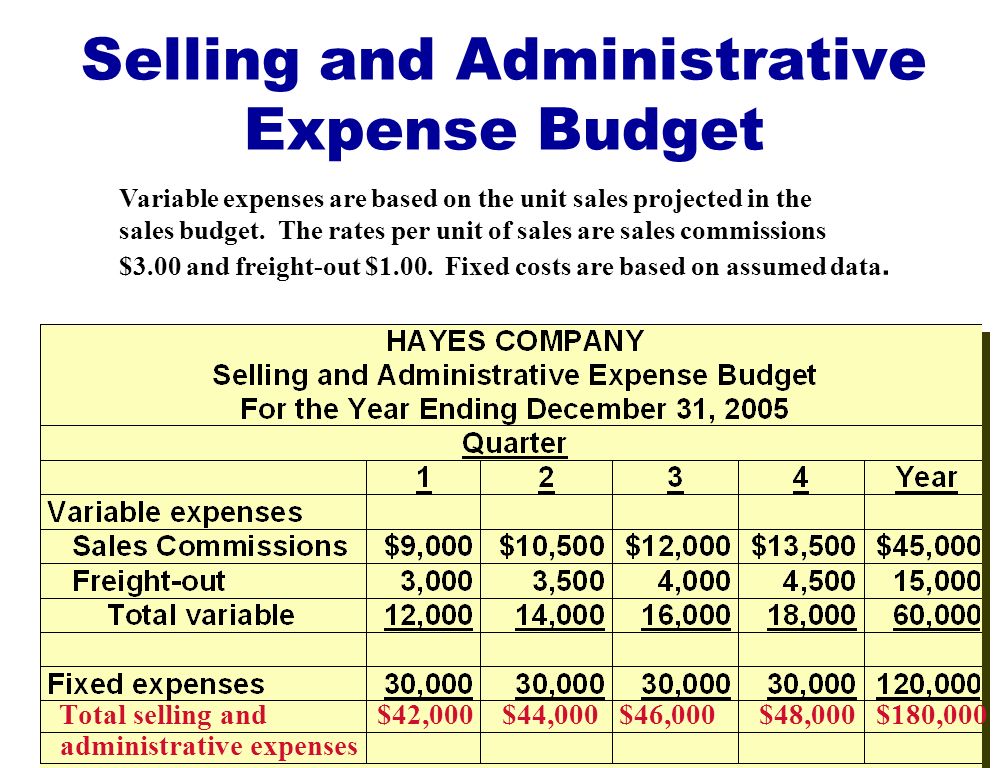

When it comes to managing administrative expenses, it’s important to have best practices in place to ensure that your business is running efficiently and staying within budget. One of the best ways to manage administrative expenses is to create a budget and stick to it. Make sure to account for all necessary expenses and try to avoid any unnecessary or luxury expenses. Another great way to keep administrative expenses in check is to track spending. Make sure to review all bills and receipts and try to find areas where you can save money. Additionally, it’s a good idea to create a system to stay organized and make sure all records are up to date and accurate. Finally, it’s important to think ahead when it comes to administrative expenses and plan for upcoming expenses. This will help you to reduce any surprises and stay on top of all of your expenses. Following these best practices for managing administrative expenses can help you keep control of your finances and ensure that your business continues to run smoothly.