Adjusted Funds From Operations (AFFO) is an important financial metric used to assess a company’s financial performance. It is a non-GAAP measure used to assess cash flow and profitability, and is often used by investors to help them make more informed decisions about stocks and other investments. AFFO gives investors insight into how well a company is able to generate and manage cash flow, and to make more informed decisions about their investments. This article will explain what AFFO is, why it is important, and how investors can use it to make more informed decisions.

What is Adjusted Funds From Operations (AFFO)?

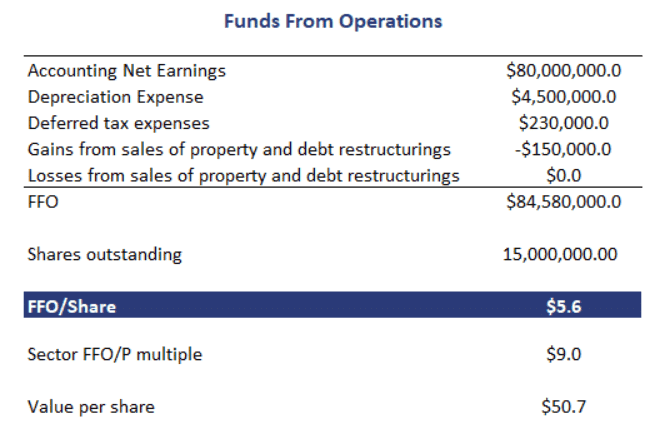

Adjusted funds from operations, or AFFO, is a financial measure used to evaluate the performance of real estate investment trusts (REITs). AFFO takes into account a company’s operating expenses and capital expenditures, making it a more accurate indicator of true cash flow than other measures. By taking into account a company’s capital expenditures, AFFO provides investors with an indication of how much money is actually available to distribute to shareholders. AFFO is an important metric for REIT investors because it provides an indication of how well a REIT is performing and how much money they will receive in dividends. Understanding AFFO is key to making informed investment decisions in the REIT sector.

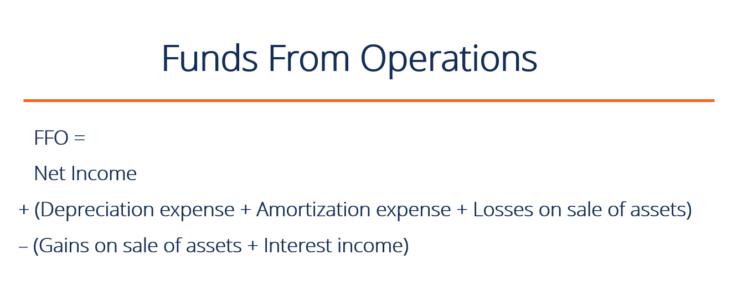

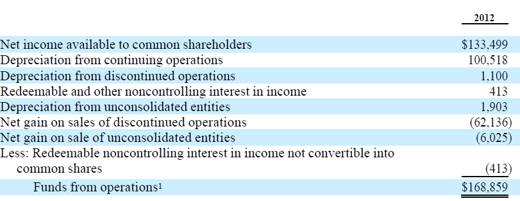

How Does AFFO Differ From Funds From Operations (FFO)?

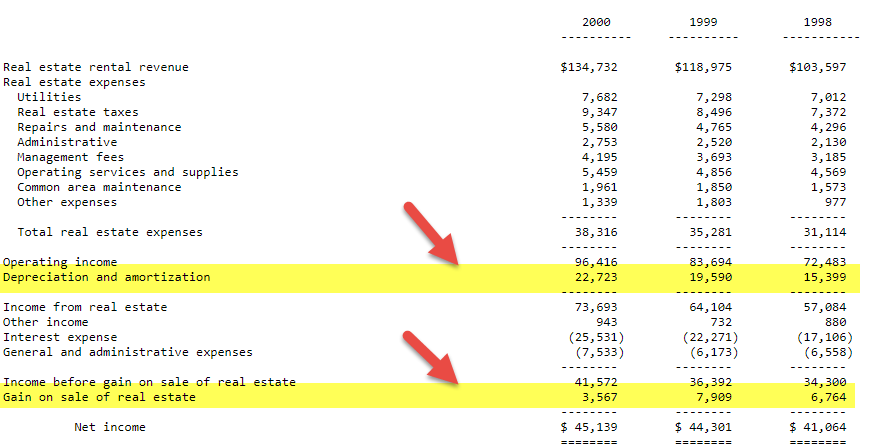

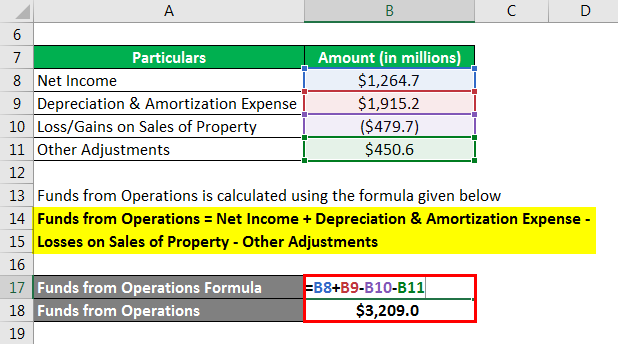

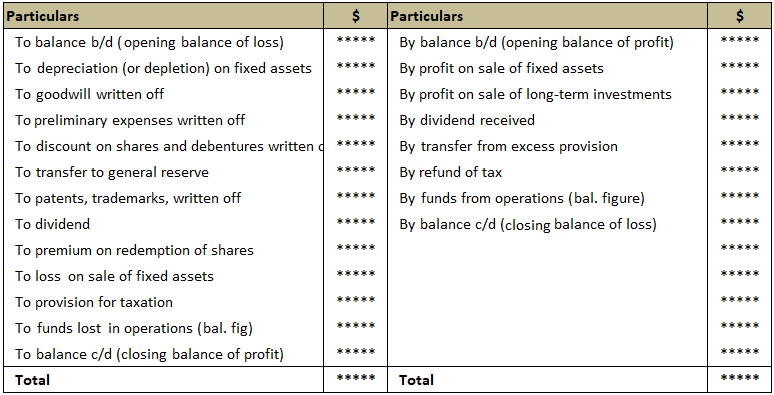

.When it comes to understanding the difference between Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO), it’s important to know that AFFO takes FFO one step further by making adjustments to account for non-cash expenses that are not related to core operations. AFFO takes into account things like tenant improvements, leasing commissions, and depreciation, among other factors, which FFO does not. This gives investors a more accurate picture of the company’s operational performance, as it takes into account money that might not show up in FFO. AFFO is a useful metric for investors to look at when assessing the financial health of a company, as it provides more detailed insight into the company’s actual cash flow.

What Are The Benefits of AFFO?

AFFO is a great metric for investors to look at when determining the profitability and stability of a company. AFFO is a more precise measure of cash flow than traditional earnings because it accounts for non-cash expenses and capital expenditures. This means that investors can get a clearer picture of how much money a company is actually generating. The benefits of AFFO include its ability to provide a more accurate measurement of a company’s financial health and performance, allowing investors to make more informed decisions. AFFO also provides investors with better insight into the company’s future cash flow prospects and a better understanding of the company’s ability to generate free cash flow. Furthermore, AFFO is a good indicator of a company’s capacity to pay dividends and reduce debt. All of these benefits make AFFO an important tool for investors to keep an eye on.

What Are The Challenges of AFFO?

Calculating AFFO can be tricky, as there are many different interpretations of what qualifies as cash flow and what is considered a non-cash expense. The lack of a standardized measure of AFFO means that investors can’t always be sure they’re getting an accurate picture of a company’s cash flow. Additionally, certain types of non-cash expenses, such as depreciation, may not be fully represented by AFFO calculations, making it difficult to compare one company to another. Finally, AFFO doesn’t always reflect the true economic value of a company, since it doesn’t take into account any potential future cash flows. For these reasons, investors should always take the time to analyze a company’s full financial statements before making any investment decisions.

How Can Investors Use AFFO To Evaluate Real Estate Investment Performance?

Investing in real estate can be a great way to build wealth, but you need to understand how to evaluate the performance of your investment. Adjusted Funds From Operations (AFFO) is a key metric that investors can use to evaluate how well their real estate investments are performing. AFFO takes into account the operating expenses associated with an investment and adjusts for non-cash expenses and other factors that can distort the actual performance of the property. By using AFFO, investors can get an accurate picture of how their investment is performing and make decisions about whether to continue investing or move on. AFFO can also be used to compare the performance of different properties and make decisions about which ones to invest in. With the right understanding of AFFO and some careful analysis, investors can make sure their real estate investments are performing as expected and make smart decisions about their investments.