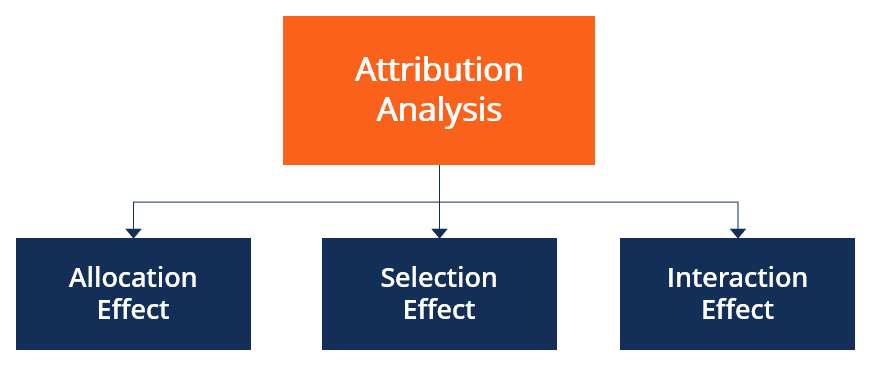

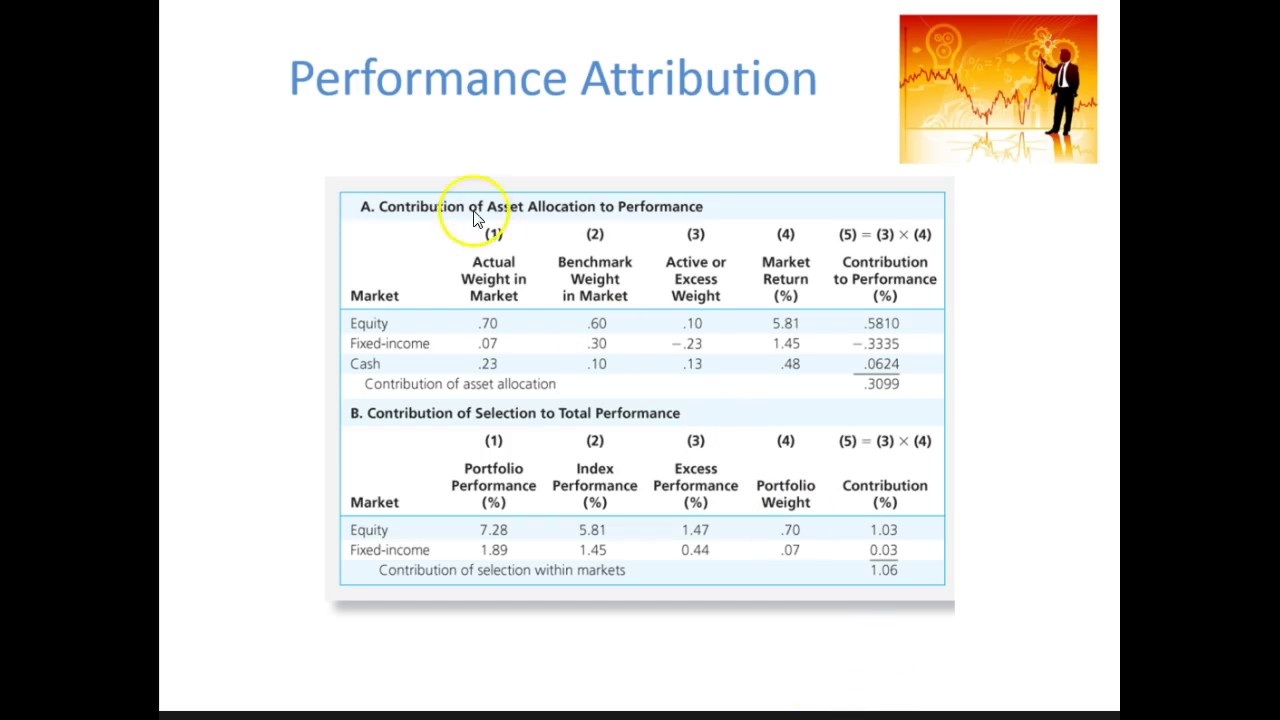

Attribution Analysis is an increasingly popular tool used by financial professionals to gain insight into the performance of a portfolio. By providing an analytical breakdown of the sources of returns, it helps investors understand the impact of their investment decisions on the overall performance of their portfolios. This article will discuss in detail what Attribution Analysis is, how it works and its various applications in the financial industry.

Understanding the Basics of Attribution Analysis

Attribution analysis is a great tool for understanding how different marketing channels and campaigns are performing. It helps marketers to see which campaigns are most profitable and which ones need improvement. By breaking down results into individual campaigns, marketers can identify which channels are driving the most conversions and revenue. This allows them to cut back on marketing spend on underperforming campaigns and allocate more budget to successful ones. Attribution analysis also helps marketers identify which marketing strategies are most effective and which strategies need more attention. With this data, marketers can adjust their strategies to get the most bang for their buck. Attribution analysis is a powerful tool for any marketer looking to maximize their ROI and get the most out of their marketing budget.

The Benefits of Attribution Analysis

Attribution analysis is a great tool to have in your financial toolbox. It can help you identify key drivers of success in your investments, and it can help you make informed decisions about where to allocate capital and resources. Attribution analysis is also a great way to spot trends and detect potential opportunities in the market. It can be used to analyze the performance of a portfolio, or to compare the performance of various investments or strategies. The benefits of attribution analysis are numerous, but here are a few key benefits: it can help you identify the most profitable investments, it can provide valuable insight into the behavior of the markets, and it can help you make better decisions about where to allocate resources. With attribution analysis, you can gain an understanding of how your investments are performing and how they compare to other investments. This can be an invaluable tool for any investor.

How Attribution Analysis Helps Avoid Plagiarism

Attribution analysis helps you avoid plagiarism by giving you the ability to analyze the sources of information in a piece of writing. It allows you to determine where the ideas and content in your work originated, so you can give proper credit to the original authors. It also allows you to easily recognize when someone has plagiarized your work. By using attribution analysis, you can ensure that you are giving credit where credit is due, while also preventing others from taking credit for your work. With attribution analysis, you can be sure that your work is protected and that others are not taking credit for your ideas.

New Technologies in Attribution Analysis

Attribution analysis is becoming more and more advanced as technology progresses. New technologies are allowing for more comprehensive and accurate attribution analysis, and can provide insights into the entire customer journey. This can include analyzing customer behavior, website and app interactions, and even media consumption. With this information, marketers can more effectively target campaigns and increase ROI. New technologies also allow for a more granular level of analysis, so marketers can identify the most effective channels, campaigns, and even specific ads that are driving the most revenue. By using these new technologies, marketers can make sure they’re getting the most out of their marketing efforts and can create a more personalized experience for their customers.

Best Practices for Using Attribution Analysis

Using attribution analysis is a great way to get a better understanding of your marketing efforts. It allows you to identify which channels are performing best, so that you can allocate your budget accordingly. Best practices for using attribution analysis include setting clear goals, tracking user behavior across all channels, and understanding the different types of attribution models. It’s also important to identify the most effective channels for your business and optimize them for the best results. Additionally, you should use attribution analysis to continually tweak and refine your strategies, so that you can maximize your return on investment. With the right tools and strategies, you can get the most out of your marketing efforts and make sure that you’re staying ahead of the competition.