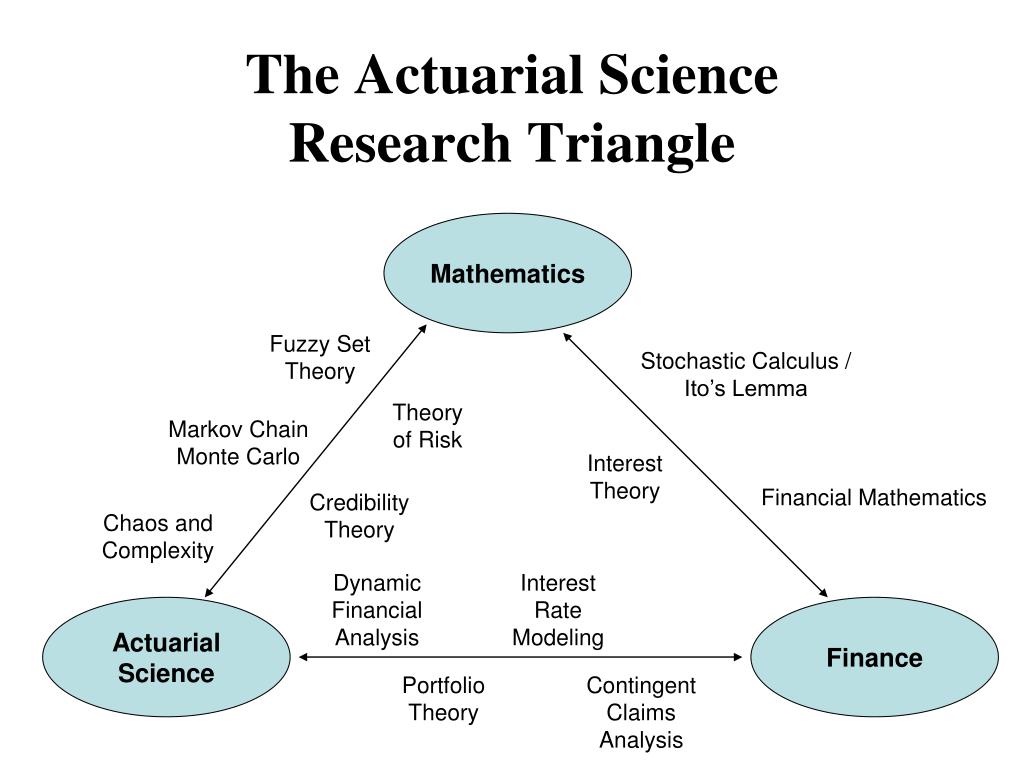

Actuarial Science is an exciting and rapidly-growing field of financial analysis that combines mathematics and statistics to help individuals and organizations make informed decisions. By taking into account the various risks associated with activities such as investments, pensions, and insurance, actuaries use their expertise to create solutions that help minimize financial losses. Actuaries utilize sophisticated techniques to analyze data and develop models that can be used to predict future trends, enabling them to make accurate predictions about the financial health of an organization or individual. With a comprehensive understanding of the financial markets, actuaries are able to provide invaluable advice to individuals, businesses, and government agencies.

Introduction to Actuarial Science: Definition and Overview

Actuarial science is a field that uses mathematics and statistics to assess risks and calculate the probability of certain events occurring. It’s used by insurance companies, banks, and other financial institutions to better understand the risks associated with certain investments or activities. Actuarial science is a complex field that requires in-depth knowledge of mathematics, statistics, and economics. It’s a great career choice for those who enjoy problem-solving and working with numbers. With a degree in actuarial science, you’ll be able to help companies assess risk and make sound decisions. Plus, you’ll have the opportunity to earn a steady paycheck and have job security. If you’re looking for an interesting and rewarding career, consider a degree in actuarial science. It’s a great way to use your mathematical and analytical skills to make a real difference.

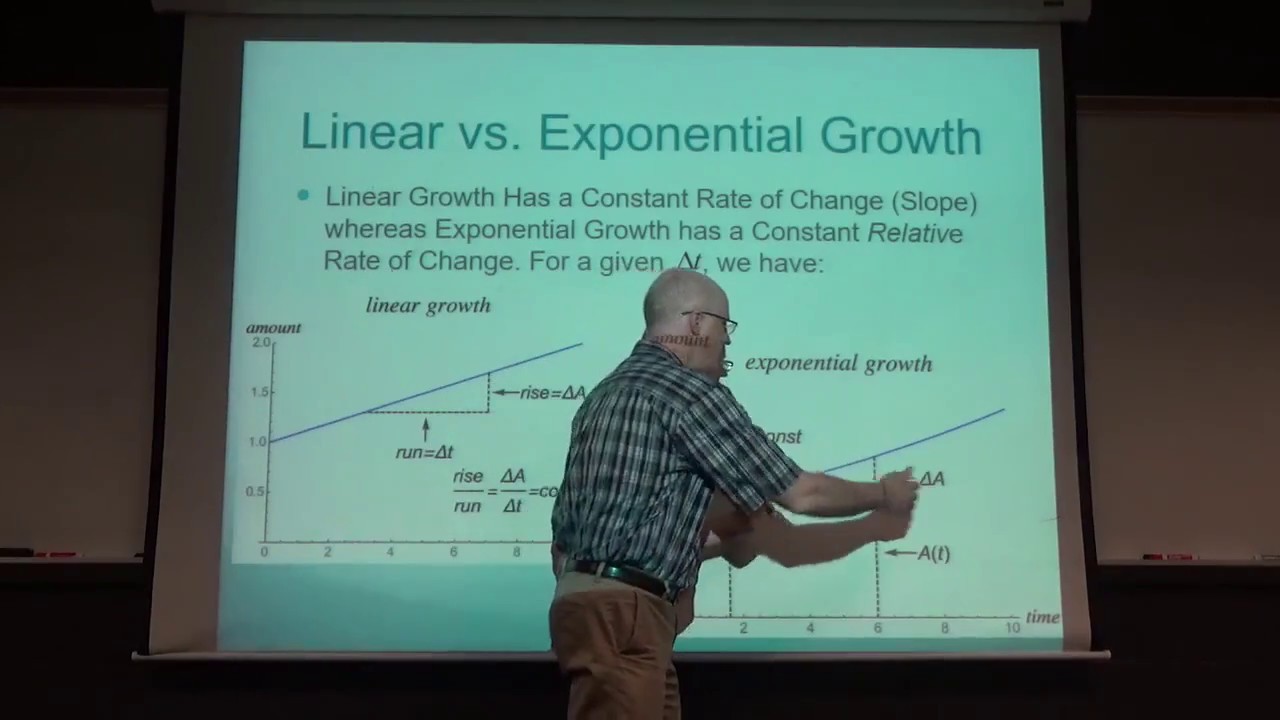

The Actuarial Process and Applications

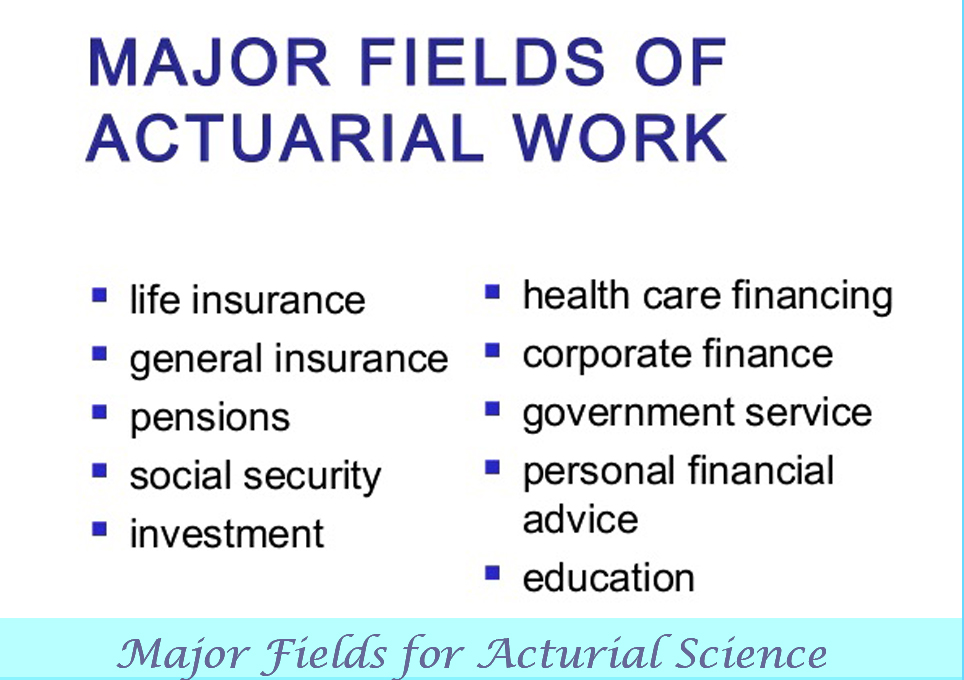

Actuarial science is a data-driven field that involves the assessment of financial risks and rewards of certain events. It utilizes mathematics, statistics, and financial knowledge to analyze and manage risk. The actuarial process includes analyzing risk and reward variables, modeling and pricing risks, and providing advice on how to best manage them. Actuarial science is used in a variety of industries including insurance, finance, banking, and healthcare. It can be used to to develop products, assess liabilities, and assess solvency. It is also used to predict and manage economic uncertainty by pricing and hedging financial instruments. In the insurance industry, actuarial science is used to assess and price insurance policies, design benefit packages, and evaluate claims. In the banking industry, actuarial science is used to assess credit risk and develop pricing models. In healthcare, actuarial science is used to analyze hospital costs and assess health risks. Actuarial science is a highly sought-after field and is becoming more and more popular as businesses continue to search for ways to minimize risk and maximize profits. With its growing popularity, more and more people are turning to actuarial science as a career path. This field provides a great opportunity for those who are interested in the intersection

Examining the Financial Risks Involved in Actuarial Science

.Examining the financial risks involved in actuarial science is essential for those who want to make a career out of it. It is a field that requires a great deal of knowledge and understanding of financial risks, as well as being able to accurately assess and mitigate them. Actuaries use their expertise in mathematics, statistics, and economics to evaluate the financial risks associated with a variety of situations, such as life insurance policies, investments, and pension plans. They also need to be knowledgeable in financial regulations and laws to ensure that their advice is in line with those regulations. By assessing and mitigating risks, actuaries are able to reduce the potential losses that a company or individual may incur and ensure that a sound financial plan is in place. Actuarial science is an important part of financial planning and is a great career choice for those looking to make a difference in the financial world.

The Benefits of Actuarial Science

Actuarial Science is an incredibly beneficial field to pursue if you’re looking for a career in finance. It applies mathematical and statistical techniques to assess and manage risk, enabling businesses and individuals to make informed decisions that help them protect their financial future. Actuarial Science helps to assess the probability of events, such as death, disability, illness, and retirement, and provides insight into the financial costs associated with such events. Additionally, it helps to model and predict the financial impact of various decisions, such as taking out an insurance policy or investing in a retirement plan. People who pursue careers in Actuarial Science are highly sought-after in the finance world, as they possess the skills necessary to accurately assess and manage risk. Actuarial Science also offers a great salary potential, with those in the field often earning high salaries and bonuses. Finally, the field of Actuarial Science is a great way to stay ahead of the curve in the ever-changing world of finance and technology.

How to Avoid Plagiarism in Actuarial Science Research and Writing

Writing a paper for an actuarial science class can be a daunting task. To make sure you get the grade you deserve, make sure you avoid plagiarism in your research and writing. Plagiarism is a serious offense and can result in penalties like failing grades and even expulsion from school. To avoid plagiarism, make sure to cite any sources you use in your paper and be sure to write your own words and phrases. If you’re not sure how to cite a source correctly, check with your professor or look up an online guide. Additionally, make sure you don’t copy large chunks of text from another source and pass it off as your own. If you need to include a quote, make sure to cite it properly and explain why you chose to include it. Finally, make sure you understand the concept of fair use and avoid using copyrighted material without permission. By following these simple steps, you can ensure your actuarial science research and writing is original and respectful of others’ intellectual property.