Active Management is a strategy that involves actively selecting investments to achieve a desired outcome. This type of investment strategy requires a detailed analysis of the financial markets and involves taking calculated risk to maximize returns. It is a strategy used by portfolio managers to create a portfolio that meets their clients’ objectives and provides the greatest returns while minimizing risks. Active management is a form of investing that requires knowledge and experience in order to be successful, and it is important to understand the risks that can be associated with this type of financial strategy. This article will provide an overview of active management, discuss the risks that can be associated with this type of investing, and explain how it can help investors reach their financial goals.

Overview of Active Management

Active management is a type of financial strategy where a portfolio manager actively chooses which assets to invest in and when to make changes. This type of strategy involves research, analysis, and frequent monitoring of the financial markets and individual investments. The goal is to outperform the market returns by selecting stocks, bonds, and other securities that have the potential for higher returns than the market. Active management relies on the manager’s ability to make informed decisions about when to buy and sell investments, as well as the ability to predict changes in the markets. Active managers must be able to identify and capitalize on opportunities quickly, as well as take on more risk than passive investors. This type of strategy can be beneficial for investors who are looking for higher returns, but also comes with a higher level of risk.

Benefits of Active Management

Active management is a great way to maximize your financial returns. It can help you make the most of your investments while minimizing risk. With active management, you have a dedicated team of professionals analyzing markets and finding opportunities to increase your portfolio’s performance. This can help you achieve greater returns than you could with passive investing strategies. Additionally, active management can provide you with more control over your investments, allowing you to tailor your portfolio to meet your specific needs. With active management, you can take advantage of timely market insights, reduce risk, and capture more potential gains.

Strategies Used in Active Management

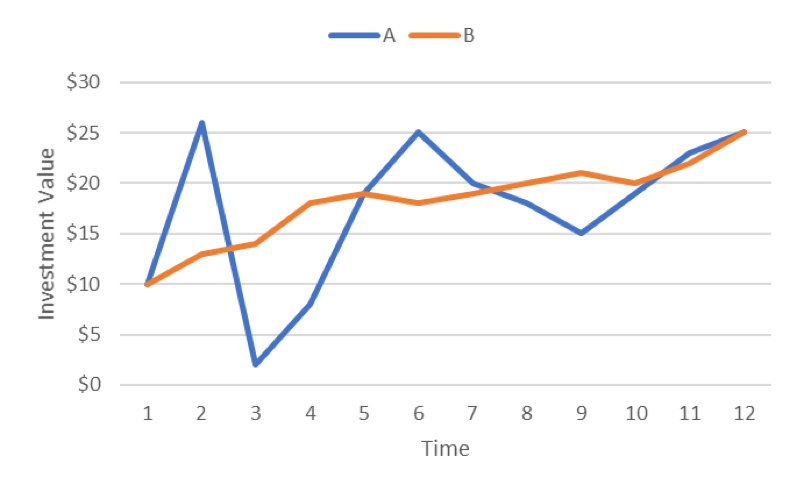

Active management is a strategy that involves making specific investments and taking specific steps to try and outperform the market. It involves actively monitoring and managing investments in order to maximize returns. Active management strategies can include taking a more aggressive approach to investing, investing in stocks and other securities, and trying to identify undervalued or overlooked stocks. It also involves making decisions based on market conditions and taking advantage of short-term opportunities. Active management is a great way to try and maximize returns while minimizing risks. With the right strategy and discipline, active management can be a great way to increase returns over the long-term.

Challenges of Active Management

Active Management can be a great tool to help you better understand and manage your investments, but it can come with some challenges. One of the most important challenges of Active Management is that it requires a significant amount of time and dedication from an investor. It requires an understanding of the markets, the ability to research, analyze, and make decisions quickly and accurately, and the ability to implement those decisions in a timely manner. Additionally, the cost of Active Management can be high, as it often involves trading fees and other related costs. Finally, the performance of Active Management can be difficult to track and predict accurately, as market conditions can change quickly. While Active Management can be a great tool to help you maximize returns on your investments, it is important to consider all of the challenges before you decide to pursue this type of investment strategy.

Tips for Successful Active Management

If you want to be successful with active management, it’s important to keep a few tips in mind. First, you need to understand the markets you’re investing in, as well as the available strategies and objectives. Knowing what you’re investing in and how you plan to achieve your goals is essential for successful active management. Additionally, you should also take the time to research potential investments, and always be willing to make changes when necessary. Additionally, diversifying your portfolio is another key to successful active management, as this helps limit risk while ensuring a solid return on investment. Finally, staying informed on current market trends and news is essential, as this will help you make informed decisions. Being smart and proactive with your investments is the best way to ensure the success of your active management strategy.