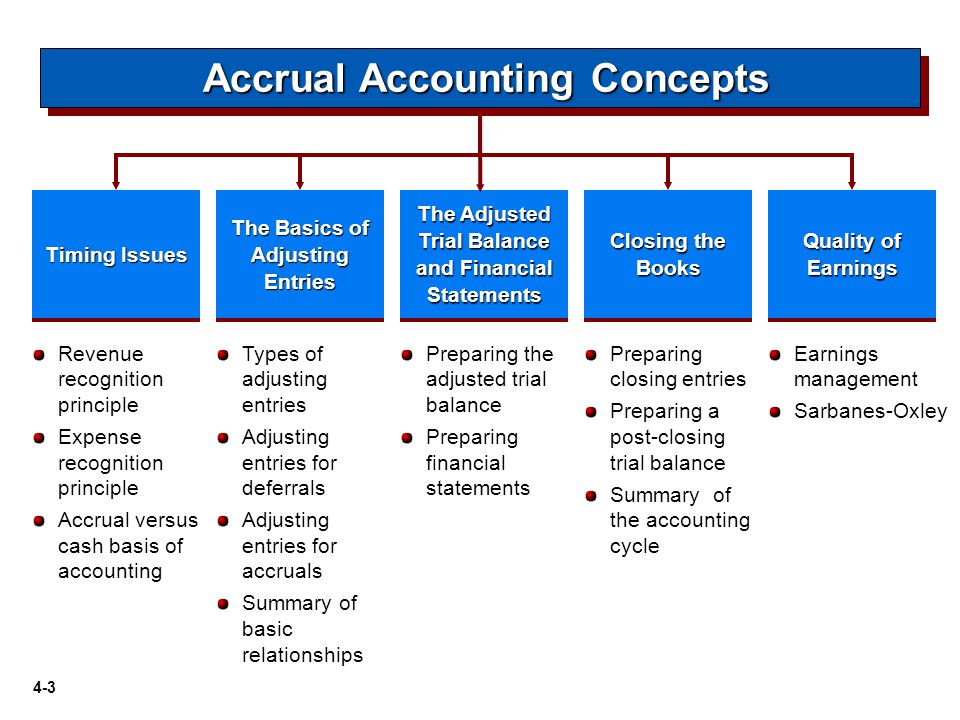

In accounting, accrual refers to the recording of revenue and expenses that have been incurred, but have not yet been paid. In other words, it’s the recognition of economic activity that has taken place, but has not yet been reflected in the financial statements.

The accrual method of accounting is in contrast to the cash basis method, which only records transactions when cash is exchanged.

There are two main types of accruals: receivables and payables. Receivables are amounts that are owed to the company, while payables are amounts that the company owes to others.

While the accrual method provides a more accurate picture of a company’s financial activity, it can also be more complex and difficult to track. For this reason, small businesses may choose to use the cash basis method instead.

What is an Accrual?

An accrual is an accounting term that refers to the recognition of revenue or expenses that have been incurred but not yet received or paid. In other words, it is the process of recording revenue or expenses when they are earned or incurred, regardless of when the money is actually received or paid.

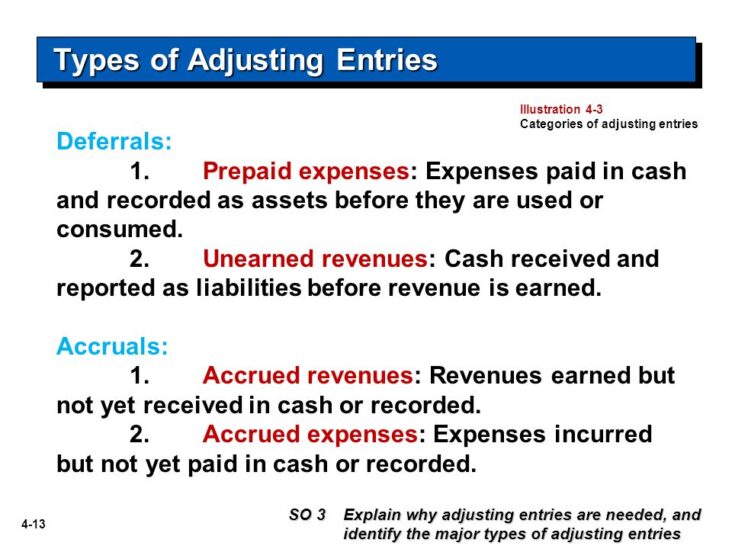

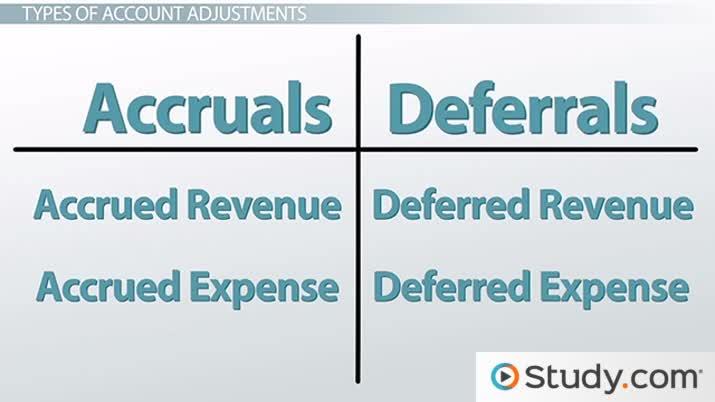

There are two main types of accruals: accruals for revenue and accruals for expenses.

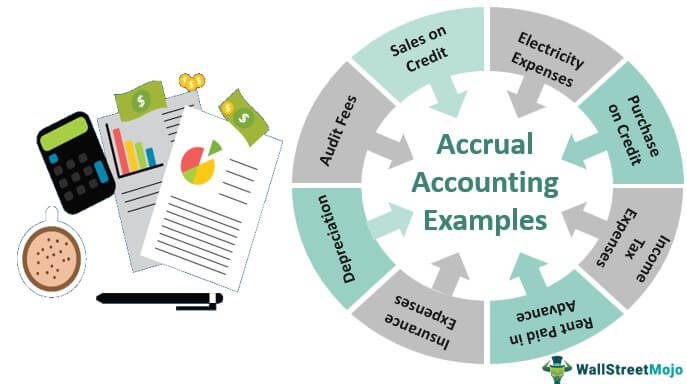

Accruals for revenue refer to the recognition of revenue that has been earned but not yet received. For example, if a company sells a product on credit, the revenue from that sale will be recognized as soon as the product is shipped, even though the payment may not be received until later.

Accruals for expenses refer to the recognition of expenses that have been incurred but not yet paid. For example, if a company pays its employees every two weeks, the salaries expense will be recognized in the period in which it is earned, even though the cash may not be paid out until the following period.

The use of accruals allows companies to more accurately reflect their financial position and performance by matching revenues and expenses to the periods in which they are earned and incurred.

Types of Accruals

There are two main types of accruals: accounting and tax.

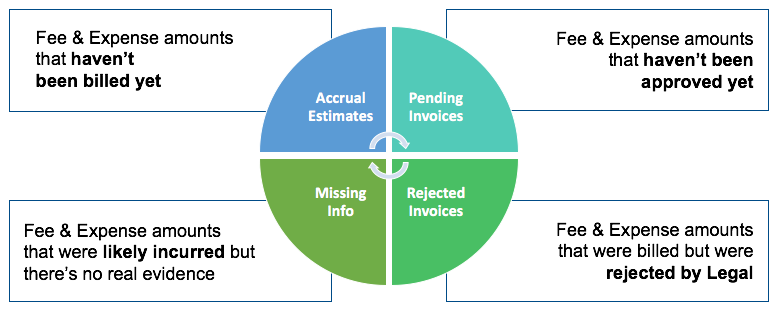

Accounting accruals are used to record expenses and revenues that have been incurred but not yet recorded in the financial statements. For example, if a company pays its employees on the last day of the month, but the work was performed in the previous month, the company would record an accrual for the wages earned in the previous month.

Tax accruals are used to defer taxes that have been incurred but not yet paid. For example, if a company pays property taxes on December 31st, but the taxes are not due until January 1st of the following year, the company would record an accrual for the taxes owed.

How To Calculate an Accrued Value

To calculate an accrued value, you’ll first need to determine the periodic interest rate. This is the interest rate that applies to the loan or investment for a specific period of time. To find the periodic interest rate, divide the annual interest rate by the number of periods in a year.

Next, calculate the number of days that have elapsed since the last payment was made. To do this, count the number of days from the last payment date until today’s date.

Finally, multiply the periodic interest rate by the number of days that have elapsed since the last payment was made. This will give you the accrued value for your loan or investment.

Differences Between Gross and Net Accrued Values

When it comes to bookkeeping, there are two types of accrued values: gross and net. Gross accrued value is the total amount of money that a company has earned but has not yet been paid. This can be calculated by adding up all the invoices that a company has issued but has not yet received payment for. Net accrued value, on the other hand, is the total amount of money that a company has earned minus any taxes or other deductions that may be owed. This can be calculated by taking the gross accrued value and subtracting any taxes or other deductions that are owed.

Resources

There are a number of resources available to help you understand accruals and how they work. Here are a few of the most helpful:

Accrue: Definition, How It Works, and 2 Main Types of Accruals Financial Definition – This blog article provides a clear and concise definition of accruals, as well as explaining how they work and highlighting the two main types.

The Accounting Coach – This website offers a range of articles on accruals and other accounting topics, making it a great resource for both beginners and more experienced users.

Investopedia – This finance-focused website has a range of articles on accruals, including one that outlines the different types of accrual arrangements.

What Is Accrue: Definition, How It Works, and 2 Main Types of Accruals? – Accrue: Definition, How It Works, and 2 Main Types of Accruals Financial Definition

In finance, the term “accrue” refers to the accumulation of something of value over time. In accounting, accruals are entries made in the books to record revenue or expense that has been incurred but not yet received or paid. Accruals are important because they allow businesses to keep track of their financial obligations and ensure that they are reported in the correct period.

There are two main types of accruals: accrued expenses and accrued revenues. Accrued expenses are incurred when a business pays for goods or services before they receive them. For example, if a company orders office supplies on credit, the cost of those supplies is an accrued expense. The company will not receive the invoice for the supplies until after they have been used, but the expense is incurred at the time of purchase. Accrued revenues are earned when a business provides goods or services but does not receive payment until after the work is done. For example, if a company provides consulting services and sends invoices to clients 30 days after the work is completed, the revenue from those services is considered accrued.

Accruals are important because they help businesses to match expenses with revenues and better understand their financial obligations. Without accruals, businesses would only be able to record transactions when payment was received or made, which could lead to mismatches between income and expenses. For example, if a company only recorded transactions when payment was received, it would appear that the company had more income in one quarter than