The term “accredited investor” gets thrown around a lot in the financial world, but what does it actually mean?

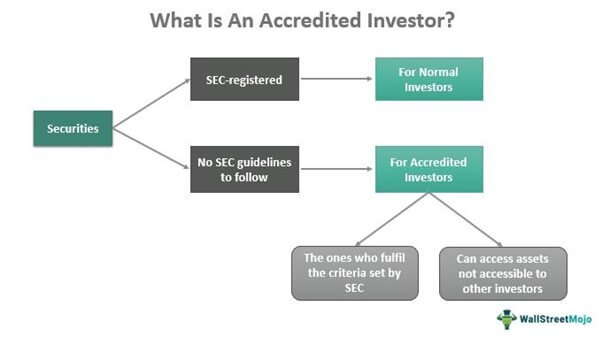

An accredited investor is an individual or institution that meets certain criteria set forth by the Securities and Exchange Commission (SEC). The requirements are designed to limit investments to those with the financial sophistication and capacity to sustain the risk of loss.

In order to be classified as an accredited investor, an individual must earn an annual income of $200,000 or more (or $300,000 combined with a spouse) for the past two years and have a reasonable expectation of earning the same amount in the current year.

What is an accredited investor?

An accredited investor is someone who meets certain criteria set forth by the U.S. Securities and Exchange Commission (SEC). The criteria are designed to identify investors who are financially sophisticated and have a reduced risk of fraud.

To be an accredited investor, an individual must earn an annual income of $200,000 or more (or $300,000 or more if filing jointly with a spouse), have a net worth of $1 million or more (excluding the value of one’s primary residence), or meet certain other criteria set forth by the SEC.

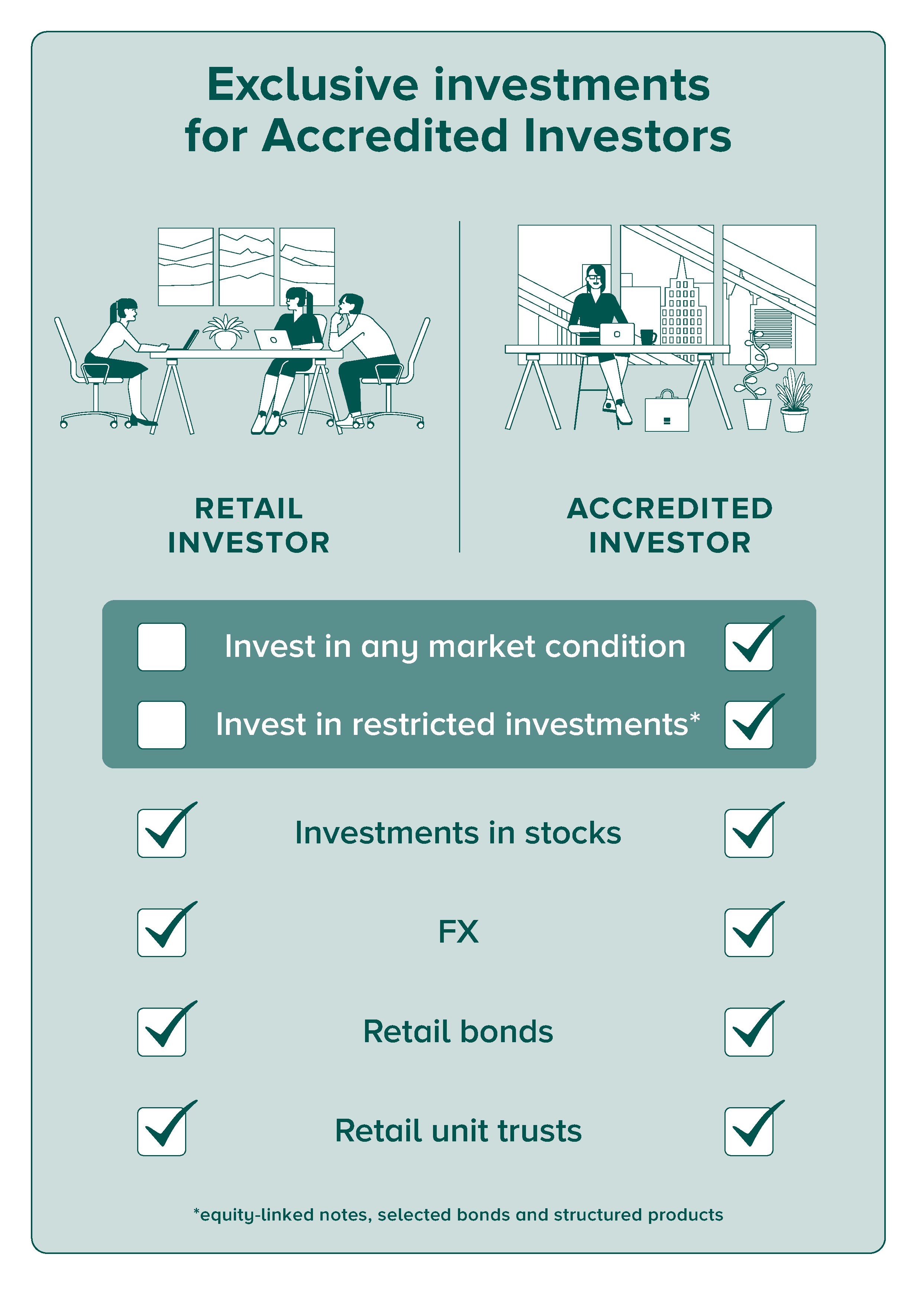

Investors who meet the accredited investor criteria are able to invest in certain types of securities that are not available to the general public. These include private placements, venture capital funds, and hedge funds. Accredited investors are also able to participate in initial public offerings (IPOs) of securities.

The SEC periodically reviews and updates the accredited investor criteria. For example, in 2016, the SEC raised the annual income threshold from $200,000 to $300,000 for individuals (or from $300,000 to $450,000 for couples filing jointly).

What does it take to be considered an accredited investor?

To be considered an accredited investor, an individual must earn an annual income of $200,000 or more, or have a net worth of $1 million or more.

Who qualifies as an accredited investor?

To qualify as an accredited investor, an individual must earn an annual income of more than $200,000 or have a net worth of more than $1 million.

An accredited investor is an individual who meets certain criteria set forth by the U.S. Securities and Exchange Commission (SEC). To qualify as an accredited investor, an individual must earn an annual income of more than $200,000 or have a net worth of more than $1 million.

The SEC defines an accredited investor as “a person who has earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects the same for the current year, OR has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence).”

How do you know if you are an accredited investor?

In order to be an accredited investor, you must meet one of the following criteria:

-Earn an annual income of $200,000 or more (or $300,000 or more for joint income) for the past two years and have the expectation to earn the same or more in the current year

-Have a net worth of over $1 million, either alone or together with a spouse

-Be a general partner, executive officer, or director of the company issuing the securities

-Be a business development company as defined in section 202(a)(22) of the Investment Advisers Act of 1940

-Be a registered broker-dealer

-Be an investment adviser registered with the SEC

-Be a bank, savings and loan association, insurance company, or registered investment company

-Have an equivalent status as determined by the SEC

Why should I invest in the stock market?

There are a number of reasons why you should invest in the stock market. One of the most important reasons is that it can help you to achieve your financial goals. By investing in the stock market, you will be able to grow your wealth over time.

Another reason to invest in the stock market is that it can provide you with a source of income. If you invest in stocks that pay dividends, you will be able to receive regular payments that can help to supplement your income.

Finally, investing in the stock market can also help to diversify your investment portfolio. By investing in a variety of different stocks, you will be able to reduce your overall risk and safeguard your finances against potential losses.

Should I invest in the stock market or another investment vehicle like real estate, or cash by investing my money into a CD instead of stocks?

When it comes to investing your money, there are a lot of different options to choose from. One of the most common questions people ask is whether they should invest in the stock market, or another investment vehicle like real estate or cash.

There is no easy answer to this question, as it depends on a variety of factors including your goals, risk tolerance, and time frame. However, one thing to keep in mind is that the stock market can be a volatile place, and there is no guarantee that you will make money by investing in stocks.

If you’re looking for a more stable investment, you may want to consider investing in a CD instead of stocks. CDs typically offer higher interest rates than savings accounts, and your principal is FDIC-insured up to $250,000.

Ultimately, the best way to decide whether to invest in stocks or another investment vehicle is to speak with a financial advisor and figure out what makes the most sense for your specific situation.

What Is Accredited Investor? – Accredited Investor Financial Definition

An accredited investor is an individual who meets certain criteria set forth by the U.S. Securities and Exchange Commission (SEC). These criteria are designed to identify investors who have the knowledge and experience to make informed investment decisions.

To be considered an accredited investor, an individual must have:

A net worth of $1 million or more

An income of $200,000 or more for each of the last two years ($300,000 if filing jointly with a spouse)

The expectation of earning the same or a higher income in the current year

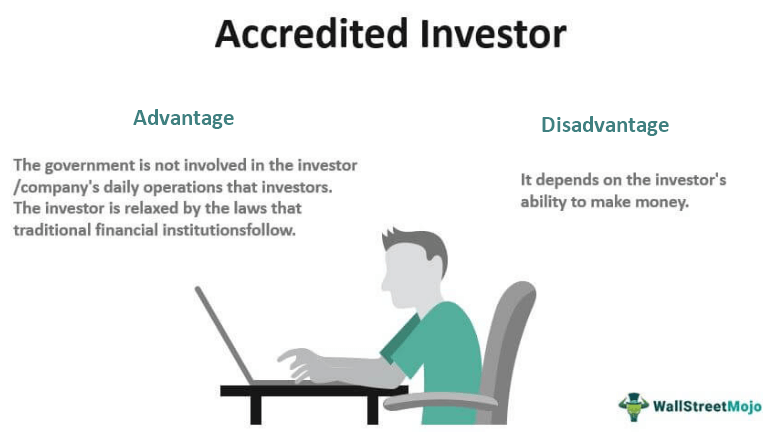

These criteria are designed to identify individuals who have the financial means and investment experience to handle the risks associated with investing in securities. The SEC believes that these investors are less likely to be harmed by fraudulent investment schemes.

In addition to meeting the financial criteria, accredited investors must also demonstrate that they have the requisite knowledge and experience to make informed investment decisions. The SEC has stated that individuals who meet this criterion generally have:

A college degree or higher education level; or, alternatively,