What is accredited in business valuation (ABV)? This designation is earned by financial professionals who have completed specific coursework and examinations in business valuation. The ABV credential is granted by the American Institute of Certified Public Accountants (AICPA).

What is the Accredited In Business Valuation?

The American Institute of Certified Public Accountants (AICPA) offers the Accredited in Business Valuation (ABV) credential to CPAs who specialize in business valuation. The ABV designation is the most recognized business valuation credential in the world.

To receive the ABV credential, CPAs must pass a comprehensive exam administered by the AICPA. The exam covers a wide range of topics related to business valuation, including accounting, finance, economics, statistics, and valuation methodology.

ABV-credentialed CPAs are required to complete continuing education on business valuation topics every year. The credential is valid for five years and can be renewed by passing an updated version of the ABV exam.

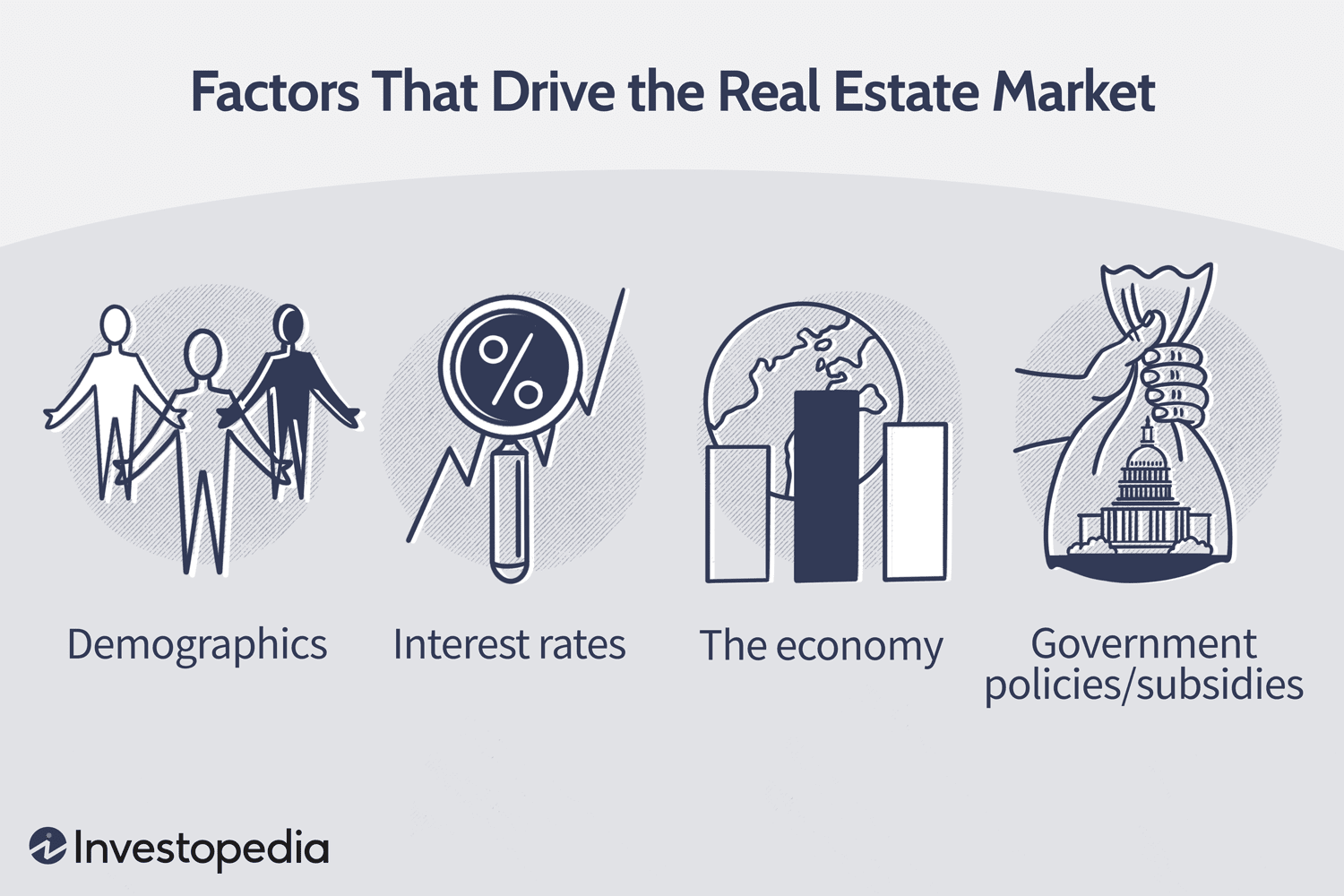

Does the ABV Affect the Property Market?

No, the ABV does not affect the property market. The American Business Valuation Association is a non-profit organization that provides education and accreditation to professional business appraisers. The ABV credential is recognized by the US Small Business Administration, the US Internal Revenue Service, and many state governments.

What are the Benefits of an ABV?

An ABV designation is the highest credential that a business valuation professional can earn. The ABV credential is granted by the American Institute of Certified Public Accountants (AICPA). To earn the credential, a business valuation professional must pass a rigorous examination, have at least three years of experience in the field, and agree to adhere to the AICPA’s code of professional conduct.

The benefits of holding an ABV credential include:

– Demonstrating to clients and employers that you have the knowledge and skills necessary to perform accurate business valuations

– Enhancing your career prospects and earning potential

– Giving you access to exclusive resources and networking opportunities

What are the Limitations of an ABV?

There are a few key limitations to bear in mind when considering an ABV:

– Firstly, it is important to remember that an ABV is only as good as the information that goes into it. If the financial information used to calculate the value of a business is inaccurate or incomplete, then the resultant valuation will also be inaccurate.

– Secondly, the valuation methodologies used in an ABV can be complex and may not be suited to all types of businesses. As such, it is important to seek professional advice to ensure that the valuation methodology chosen is appropriate for the business being valued.

– Finally, it should be noted that an ABV is only one tool that can be used to value a business. Other factors, such as market conditions and the unique circumstances of the business being valued, will also need to be taken into account in order to arrive at a comprehensive and accurate valuation.

How to Get an ABV?

There are a few steps that need to be completed in order to become an ABV. First, one must have a four-year degree from an accredited college or university. Next, two years of professional experience must be gained in business valuation, financial analysis, or another field related to business valuation. After completing these requirements, individuals must pass a comprehensive exam administered by the AICPA. Finally, individuals must agree to abide by the AICPA’s Code of Professional Conduct.

What Is Accredited In Business Valuation (ABV)? – Accredited In Business Valuation (ABV) Financial Definition

The ABV credential is the only globally recognized designation for business valuation professionals. The credential is granted by the American Institute of Certified Public Accountants (AICPA) to CPAs who have demonstrated knowledge and experience in business valuation. To earn the credential, CPAs must pass a comprehensive exam, meet experience requirements, and agree to adhere to the AICPA Code of Professional Conduct.

The ABV credential is highly regarded by businesses and investors alike, as it provides assurance that the CPA has the necessary skills and experience to provide accurate valuation services. Businesses often require an ABV-credentialed CPA when they are looking to buy or sell a business, raise capital, or resolve shareholder disputes. Investors also frequently request that business valuations be performed by an ABV-credentialed CPA when making investment decisions.