Accounts Receivable (AR) is an important financial metric that measures the value of money owed to a company by its customers. In other words, it is the money that a company has a right to receive because it has provided goods or services to its customers on credit.

An Accounts Receivable aging report is a snapshot of all the open invoices a company has at a certain point in time, and it shows how long each invoice has been outstanding. This information is important because it helps companies track their progress in collecting payments and manage their cash flow.

In this article, we will provide a detailed explanation of what accounts receivable is, how it is calculated, and why it matters for businesses. We will also discuss some best practices for managing accounts receivable and offer some tips for improving your own AR process.

What is Accounts Receivable (AR)?

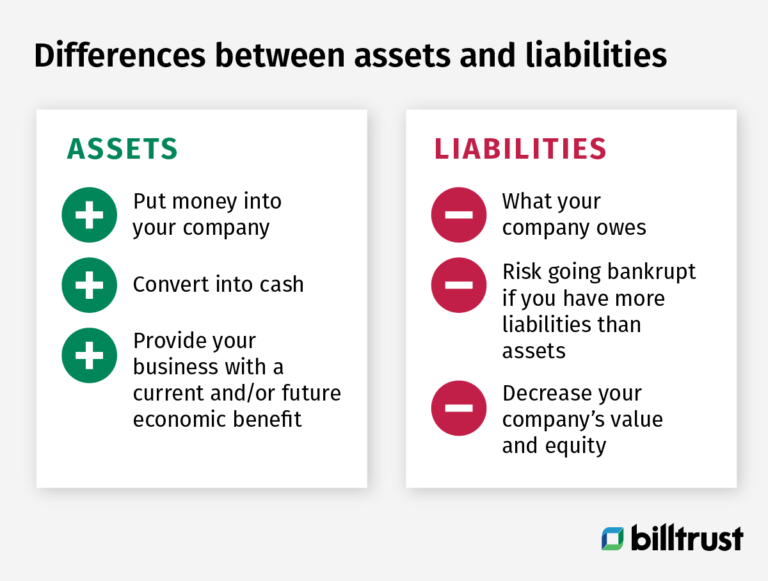

Accounts receivable (AR) is the amount of money owed to a company by its customers for goods or services that have been delivered or used but not yet paid for. Accounts receivable are classified as current assets on a company’s balance sheet, since they are typically due to be paid within one year.

Receivables management is the process of managing the accounts receivable portfolio, which includes tasks such as credit risk assessment, customer segmentation, invoicing, collections, and so on. The goal of receivables management is to optimize cash flow and minimize bad debt write-offs.

The accounts receivable turnover ratio (also known as the AR turnover ratio) is a financial metric that measures how quickly a company collects its accounts receivable. The formula for the AR turnover ratio is:

AR Turnover Ratio = Annual Sales ÷ Average Accounts Receivable

For example, if a company has $100,000 in sales and $10,000 in average accounts receivable, then its AR turnover ratio would be 10. This means that on average, the company collect its receivables 10 times per year.

What is AR’s Importance to a Company?

Accounts receivable is important to a company because it is an indication of the creditworthiness of the company. A high accounts receivable balance means that the company is selling on credit, which can be a good thing or a bad thing depending on the company’s financial situation. If the company is in good financial health, then selling on credit can be a good way to increase sales. However, if the company is in financial trouble, then selling on credit can be a risky move because the company may not be able to collect on the receivables.

The Types of Accounts Receivable

There are several types of accounts receivable, which can be classified by the type of customer or by the type of transaction.

1. Trade Accounts Receivable

This is the most common type of accounts receivable and is created when a company sells goods or services on credit to another business. The account is typically due within 30 days and is recorded on the balance sheet as an asset.

2. Non-Trade Accounts Receivable

Non-trade accounts receivable include amounts owed by individuals or other entities that are not businesses, such as governments or agencies. These receivables may take longer to collect and are often unsecured, meaning they have no collateral backing them up. As a result, they typically carry a higher risk of default.

3. Service Revenues Receivable

This type of receivable arises from service contracts, such as for maintenance or repairs. The payments are typically made in installments, over the term of the contract, and may be secured by the equipment being serviced.

4. Installment Accounts Receivable

An installment account receivable occurs when a company sells goods or services on credit and allows the customer to make payments over time, rather than all at once. The account is recorded on the balance sheet as an asset, similar to trade accounts receivable, but the payments may span several months or years.

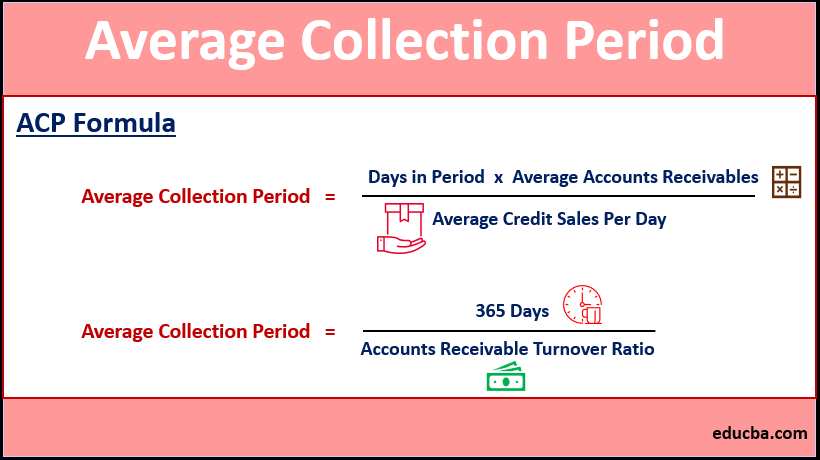

How to Determine the Length of Your Accounts Receivable Collection Period

A company’s accounts receivable collection period is the average number of days it takes the company to collect payment on its credit sales. To calculate a company’s accounts receivable collection period, divide the number of days in a year (365) by the company’s receivables turnover ratio.

For example, if a company’s receivables turnover ratio is 10, its accounts receivable collection period would be 365/10, or 36.5 days. This means that, on average, it takes the company 36.5 days to collect payment on its credit sales.

A company can have a high or low receivables turnover ratio, depending on its business model and credit policies. For example, companies that sell products with a long shelf life (such as automobiles) usually have a longer receivables collection period than companies that sell perishable goods (such as food).

A company can also have a high or low receivables turnover ratio depending on how lenient it is with its credit terms. Companies that offer their customers generous credit terms (such as 60 days) will usually have a longer receivables collection period than companies that require their customers to pay within a shorter time frame (such as 30 days).

The length of a company’s accounts receivable collection period can have a significant impact on its cash flow and financial health. A longer receivables collection period means that the company has to wait longer to receive payment for its goods or services

The Importance of Managing Your Accounts Receivable

Accounts receivable (AR) is the portion of a company’s sales that have not yet been paid for. It is important to manage accounts receivable carefully, because it can have a major impact on a company’s cash flow.

Accounts receivable management includes activities such as credit control, invoicing, and collections. These activities are important in order to ensure that customers pay their invoices on time and that the company does not lose money due to late or unpaid invoices.

There are several methods that companies use to finance their accounts receivable, such as factoring, invoice financing, and lines of credit. Each of these methods has its own advantages and disadvantages, so it is important to choose the right one for your company.

Credit control is an important part of accounts receivable management. It involves setting credit limits for customers and monitoring their payment history. This helps to prevent bad debts and ensures that customers pay their invoices on time.

Invoicing is another important part of accounts receivable management. It involves sending invoices to customers and following up on them if they are not paid on time. It is important to send accurate and timely invoices in order to avoid disputes.

Collections is the process of chasing up customers who have not paid their invoices. This can be done by phone, email, or post. It is important to be polite but firm when collecting payments, as aggressive tactics may

What Is Accounts Receivable (AR)? – Accounts Receivable (AR) Financial Definition

Accounts Receivable (AR) is an important financial metric that measures the value of outstanding customer invoices that have not yet been paid. This metric is used by businesses to track and manage their receivables, and by investors to assess a company’s financial health and creditworthiness.

AR can be a helpful metric for businesses to track because it provides insight into how much money is owed to them by customers. This information can be used to make strategic decisions about collections, budgeting, and cash flow. For example, if a business knows that its AR is high, it may decide to focus on increasing collections efforts in order to improve its cash flow.

Investors often look at a company’s AR when considering whether to invest in it. A high level of accounts receivable may indicate that a company is having difficulty collecting payments from its customers, which could lead to financial problems down the road.