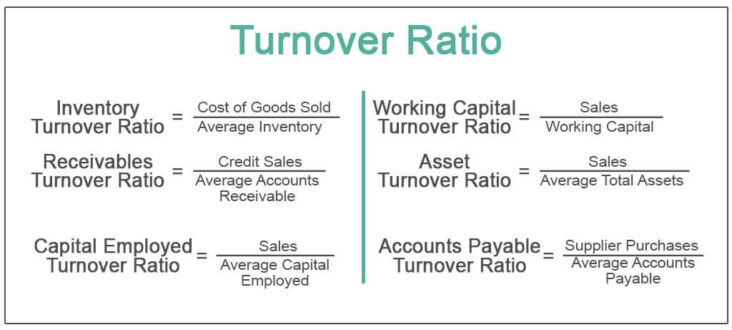

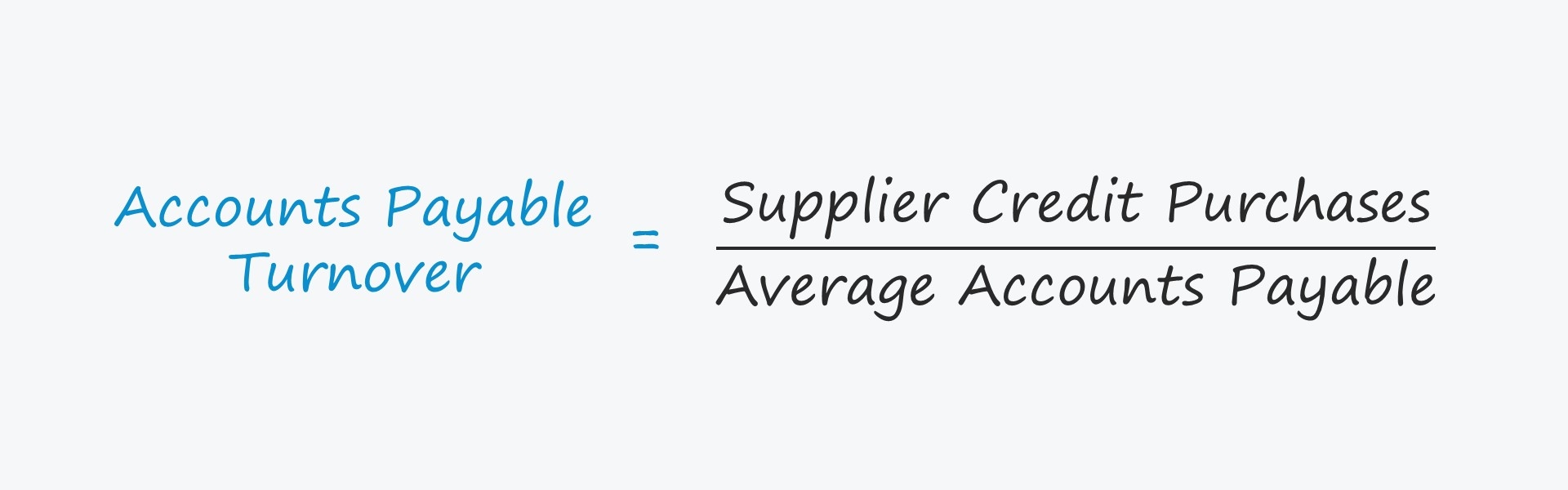

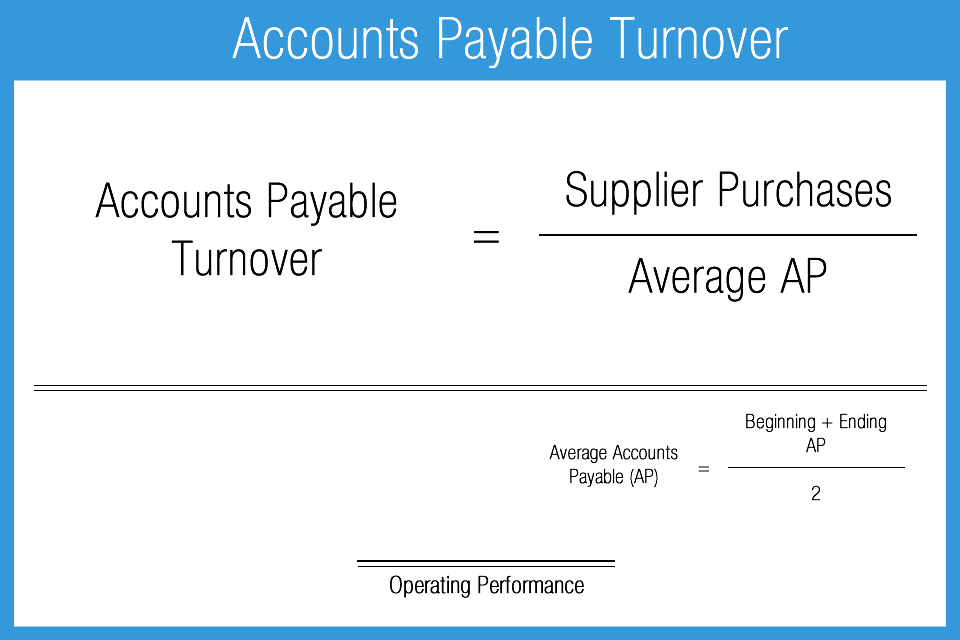

Accounts payable turnover ratio is a financial metric used to measure a company’s efficiency in paying its suppliers. The accounts payable turnover ratio is calculated by dividing the total amount of credit purchases by the average accounts payable balance.

A high accounts payable turnover ratio indicates that a company is paying its suppliers promptly and is not taking advantage of supplier credit terms. A low accounts payable turnover ratio may indicate that a company is taking too long to pay its suppliers, which could result in late payment penalties or difficulty obtaining credit in the future.

What is Accounts Payable Turnover Ratio?

The accounts payable turnover ratio is a financial metric used to measure a company’s efficiency in using its accounts payable. The ratio is calculated by dividing the total value of a company’s accounts payable by the average value of its accounts payable over a specific period of time, typically one year.

The higher the accounts payable turnover ratio, the more efficient a company is in using its accounts payable. A high ratio indicates that a company is quickly paying off its suppliers and is not carrying a large amount of Accounts Payable on its balance sheet. A low ratio indicates that a company is taking longer to pay off its suppliers and is carrying a larger Accounts Payable balance.

The accounts payable turnover ratio is an important metric for both creditors and investors to assess a company’s financial health. Creditors use the ratio to help determine whether a company will be able to make timely payments on its outstanding debts. Investors use the ratio to help assess a company’s overall profitability and cash flow generation.

The Purpose of Accounts Payable Turnover Ratio

Accounts payable turnover ratio is a financial metric used to measure a company’s efficiency in managing its accounts payable. The ratio is calculated by dividing the total value of accounts payable by the average value of accounts payable outstanding during the period.

The purpose of accounts payable turnover ratio is to assess a company’s ability to manage its accounts payable and to timely pay its creditors. A high ratio indicates that a company is efficient in managing its accounts payable and has a good working relationship with its creditors. A low ratio indicates that a company may have difficulty meeting its financial obligations in a timely manner.

How to Calculate Accounts Payable Turnover Ratio

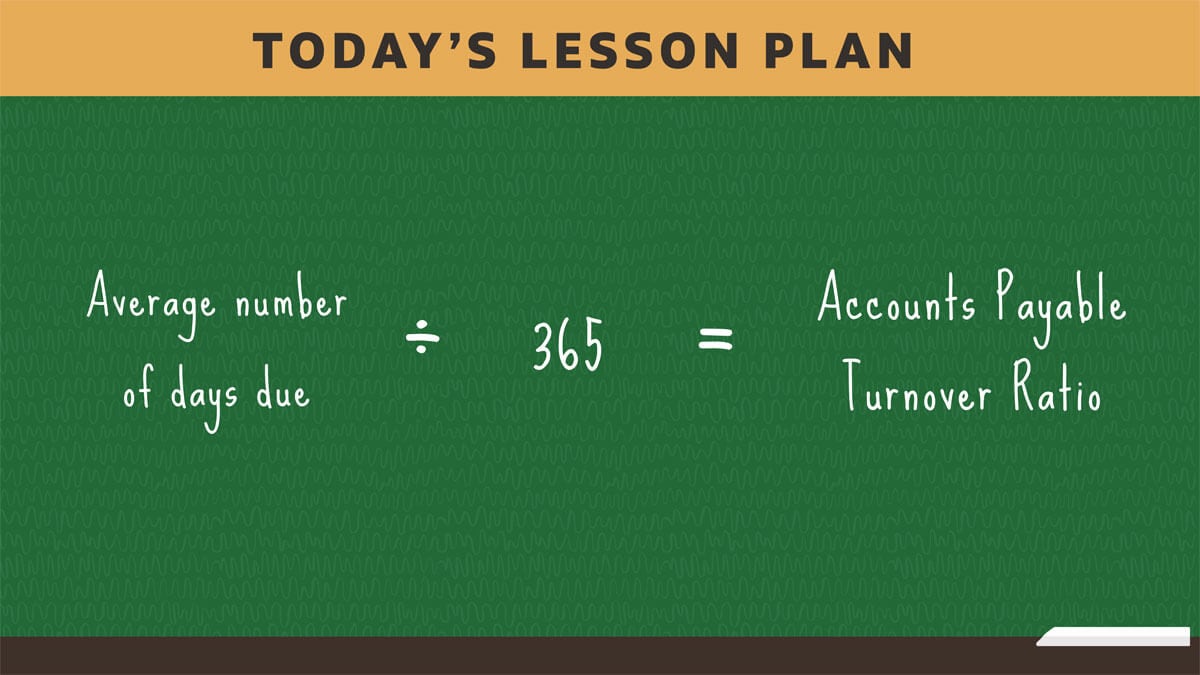

Accounts payable turnover ratio is a financial metric used to measure a company’s efficiency in managing its accounts payable. Accounts payable turnover ratio is calculated by dividing the total number of days in a period by the number of days it takes to pay off accounts payable.

The formula for accounts payable turnover ratio is:

Accounts Payable Turnover Ratio = Total Number of Days in Period / Number of Days to Pay Off Accounts Payable

For example, if a company has accounts payable totaling $100,000 and it takes the company 30 days on average to pay off its accounts payable, the company’s accounts payable turnover ratio would be:

Accounts Payable Turnover Ratio = 30 / 100,000

= 0.0003

A high accounts payable turnover ratio indicates that a company is efficient in managing its accounts payable and is able to quickly pay off its debts. A low accounts payable turnover ratio indicates that a company is not as efficient in managing its accounts payable and may have difficulty paying off its debts.

How to Increase the Accounts Payable Turnover Ratio

Accounts payable turnover ratio is a measure of how many times a company pays its accounts payable during an accounting period. The higher the ratio, the better the company’s financial condition and liquidity. A company can increase its accounts payable turnover ratio by paying its bills more quickly or by negotiating longer payment terms with its suppliers.

Paying bills more quickly is the most obvious way to increase the accounts payable turnover ratio. Companies can do this by setting up an automated system to make payments as soon as invoices are received or by designating someone in the accounting department to check and pay invoices on a daily basis.

Another way to increase the accounts payable turnover ratio is to negotiate longer payment terms with suppliers. This gives the company more time to pay its bills and can improve its cash flow. However, it’s important to remember that extending payment terms can also put a strain on supplier relations if not managed properly.

What Is Accounts Payable Turnover Ratio? – Accounts Payable Turnover Ratio Financial Definition

The accounts payable turnover ratio is a financial metric used to measure a company’s efficiency in paying its suppliers. The ratio is calculated by dividing the total amount of accounts payable by the average amount of accounts payable.

A high accounts payable turnover ratio indicates that a company is paying its suppliers quickly and efficiently. A low accounts payable turnover ratio may indicate that a company is not paying its suppliers in a timely manner or that it is not using its cash efficiently.

The accounts payable turnover ratio is an important financial metric for companies to track as it can impact a company’s working capital and cash flow.